Warren Buffett Is Sending a Clear Warning As 2026 Approaches: 3 Things Investors Should Do

Key Points

Investors shouldn't panic, despite fears that the stock market could fall.

Buffett has built a big cash stockpile for Berkshire Hathaway, a wise move for other investors as well.

He continues to buy stocks selectively -- another prudent approach for all investors.

- These 10 stocks could mint the next wave of millionaires ›

You won't find Warren Buffett spreading doom and gloom. That isn't his style. Buffett has always been an optimist at heart, even during the most perilous days of the 2008 financial crisis.

However, Buffett is sending a clear warning as 2026 approaches. How? He has been a net seller of stocks for 12 consecutive quarters – the longest such streak ever since he took over Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B). This reflects an unprecedented negative outlook for Buffett as he prepares to step down as Berkshire's CEO at the end of the year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The "Oracle of Omaha" isn't publicly predicting what he thinks is about to happen with the stock market. He isn't telling investors specific steps to take, either. However, his actions speak volumes. Here are three things investors should do, based on what Buffett is doing himself.

Image source: The Motley Fool.

1. Don't panic

People often refer to Buffett's quote, "[W]e simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." There's a good case to be made that Buffett is fearful right now.

It can be tempting to equate the fear Buffett referenced with panic. But the legendary investor would never recommend panicking.

Sure, Buffett has sold numerous stocks in recent quarters. He wouldn't be a net seller of stocks if that were not the case. However, he hasn't dumped shares in a frenzy.

Do you want proof that Buffett isn't panicking? Simply look at Berkshire's portfolio. It still includes more than 40 stocks valued at over $300 billion. If Buffett were truly nervous about the future, Berkshire wouldn't have so much money tied up in the stock market.

Buffett has held onto positions for which he's most comfortable over the long term, including stalwarts such as American Express (NYSE: AXP) and Coca-Cola (NYSE: KO). That's a good strategy for other investors. Sell any stocks for which you have a lower conviction. Keep those you like the most. And, most importantly, remain calm.

2. Build cash

In the same letter to Berkshire Hathaway shareholders where Buffett provided his famous "be fearful" quote, he also wrote:

As this is written, little fear is visible in Wall Street. Instead, euphoria prevails-and why not? What could be more exhilarating than to participate in a bull market in which the rewards to owners of businesses become gloriously uncoupled from the plodding performances of the businesses themselves. Unfortunately, however, stocks can't outperform businesses indefinitely.

Those words were written in 1987 during a strong bull market, but they remain just as applicable today. The S&P 500 (SNPINDEX: ^GSPC) has skyrocketed to all-time highs. Many investors are fearful, but not in the way Buffett prescribed. They have FOMO -- the fear of missing out.

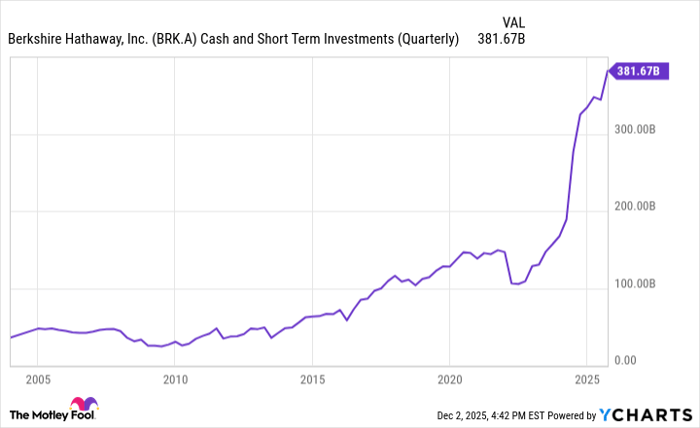

Buffett, though, understands that the boom will eventually come to a grinding halt. He wouldn't attempt to predict exactly when it will happen. However, he wants Berkshire to be prepared when it does. That's why he has amassed the largest cash stockpile in the company's history – around $382 billion.

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts

Building cash is a smart idea for retail investors, too. It puts you and me in a good position to invest in wonderful companies when prices become more attractive. And with short-term U.S. Treasuries yielding north of 3.5%, you'll still make at least a little money as you wait.

3. Buy selectively

When some hear that Buffett has been a net seller of stocks for 12 consecutive quarters, they might think he hasn't been buying any stocks at all. That's not the case. Buffett has bought some stocks. However, he is buying selectively.

This doesn't mean that Buffett has changed his criteria for investing in stocks because he's worried about the market or the economy. Instead, he remains consistent in applying the criteria he uses, regardless of what's happening externally.

To be specific, Buffett is only buying stocks for Berkshire's portfolio that have attractive valuations relative to their growth prospects. That's exactly what he has done for decades. This is a prudent approach for any investor. Establish your criteria for buying a stock. Make sure it's sound. Then stick to it, selling only when the stock no longer meets your initial investment thesis.

Buffett once used a baseball metaphor to make his point, "The stock market is a no-called-strike game. You don't have to swing at everything – you can wait for your pitch." No matter what's in store for the stock market, wait for your pitch and buy selectively.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 991%* — a market-crushing outperformance compared to 195% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of December 1, 2025

American Express is an advertising partner of Motley Fool Money. Keith Speights has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.