Crypto Today: Bitcoin, Ethereum, XRP rebound slightly as technicals signal bullish shift

- Bitcoin steadies above $68,000, rising by 1% despite ETF outflows.

- Ethereum is testing a breakout above $2,000, supported by renewed institutional interest.

- XRP trades near the upper end of the range at $1.50 amid positive signals from the MACD and MFI indicators.

The cryptocurrency market is showing signs of a gradual recovery, with Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all edging higher at the time of writing on Wednesday after the price declines seen a day earlier.

CoinGecko data shows the total cryptomarket capitalization is steady above $2.4 trillion as the Crypto King aims for a breakout above the $70,000 psychological level. Ethereum has returned above $2,000 and is testing its breakout strength amid a renewed institutional interest.

Meanwhile, XRP tries to breach the resistance at $1.50 as part of a larger breakout scope aiming at Sunday’s high at $1.67.

Bitcoin, Ethereum, XRP see modest gains amid mixed ETF flows

Bitcoin showcases potential for a bullish shift as it edges up above $68,000. The modest price uptick is supported by an improving technical structure, with support provided by the lower end of the range around $65,115, tested last Thursday.

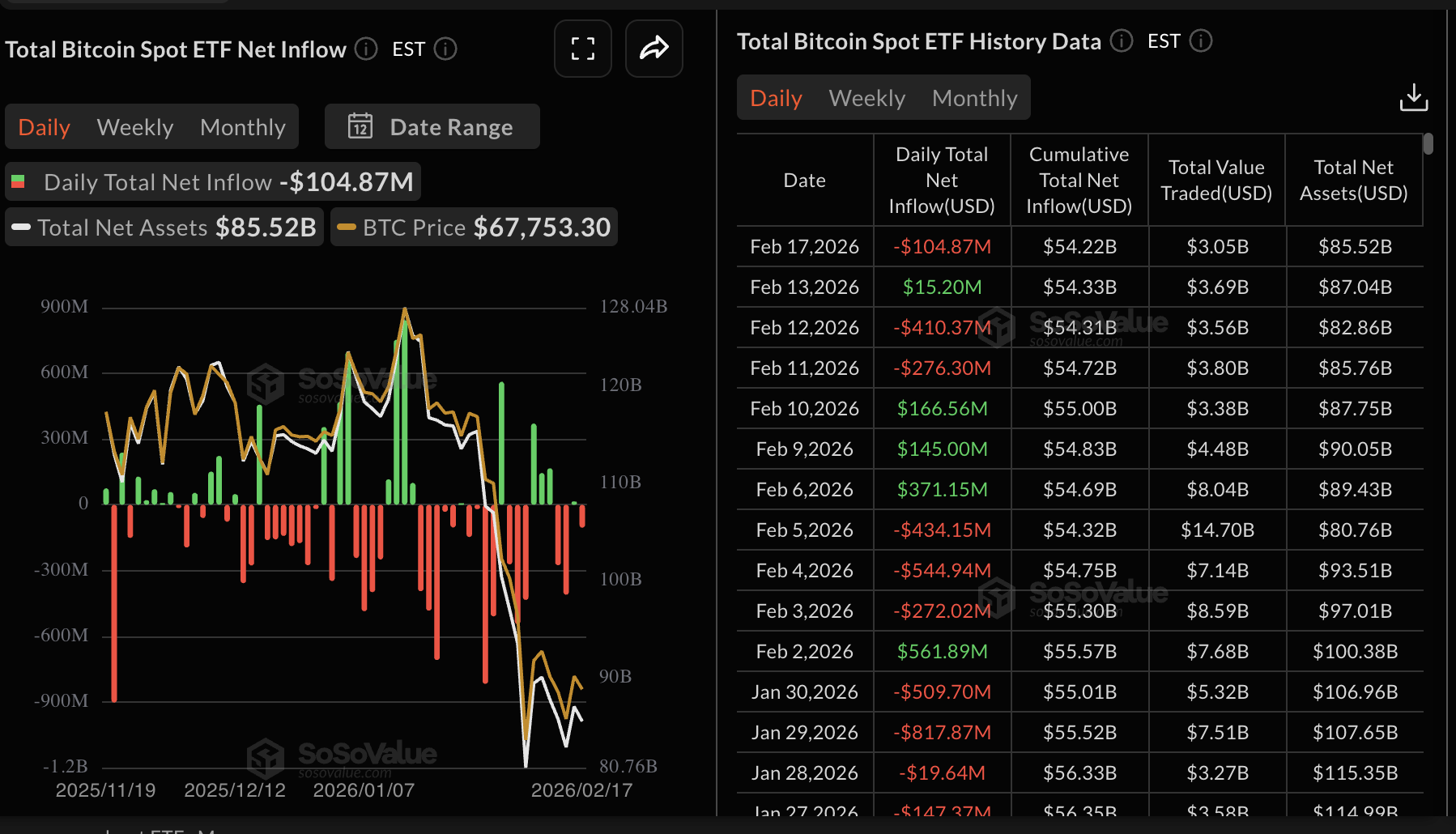

At the same time, Bitcoin spot Exchange-Traded Funds (ETFs) paint a grim picture, as reflected by approximately $105 million in outflows recorded on Tuesday. Cumulative inflows currently stand at $54.22 billion, with net assets under management at $85.52 billion.

Zooming out, total net assets reached a record $170 billion in October and have gradually declined to current levels as risk appetite has faded. Such a persistent decline negatively affects sentiment, making it difficult for Bitcoin to sustain an uptrend.

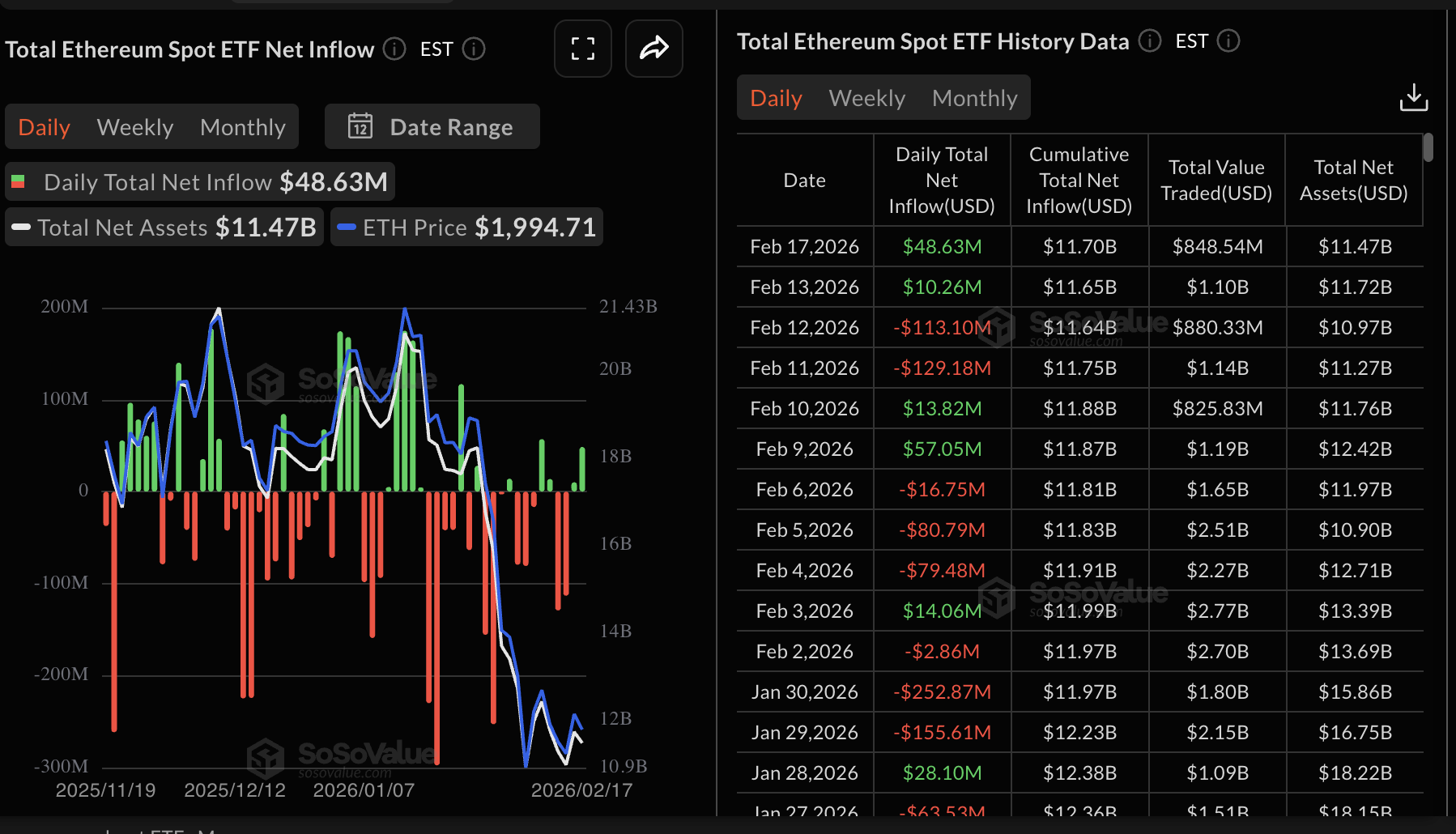

Ethereum, on the other hand, recorded inflows of approximately $49 million on Tuesday, outpacing both Bitcoin and XRP. The cumulative inflow now stands at $11.7 billion, with net assets under management at $11.47 billion. The total net assets soared to an all-time high of $25.71 billion in August, suggesting that interest in ETH ETFs has also dropped significantly.

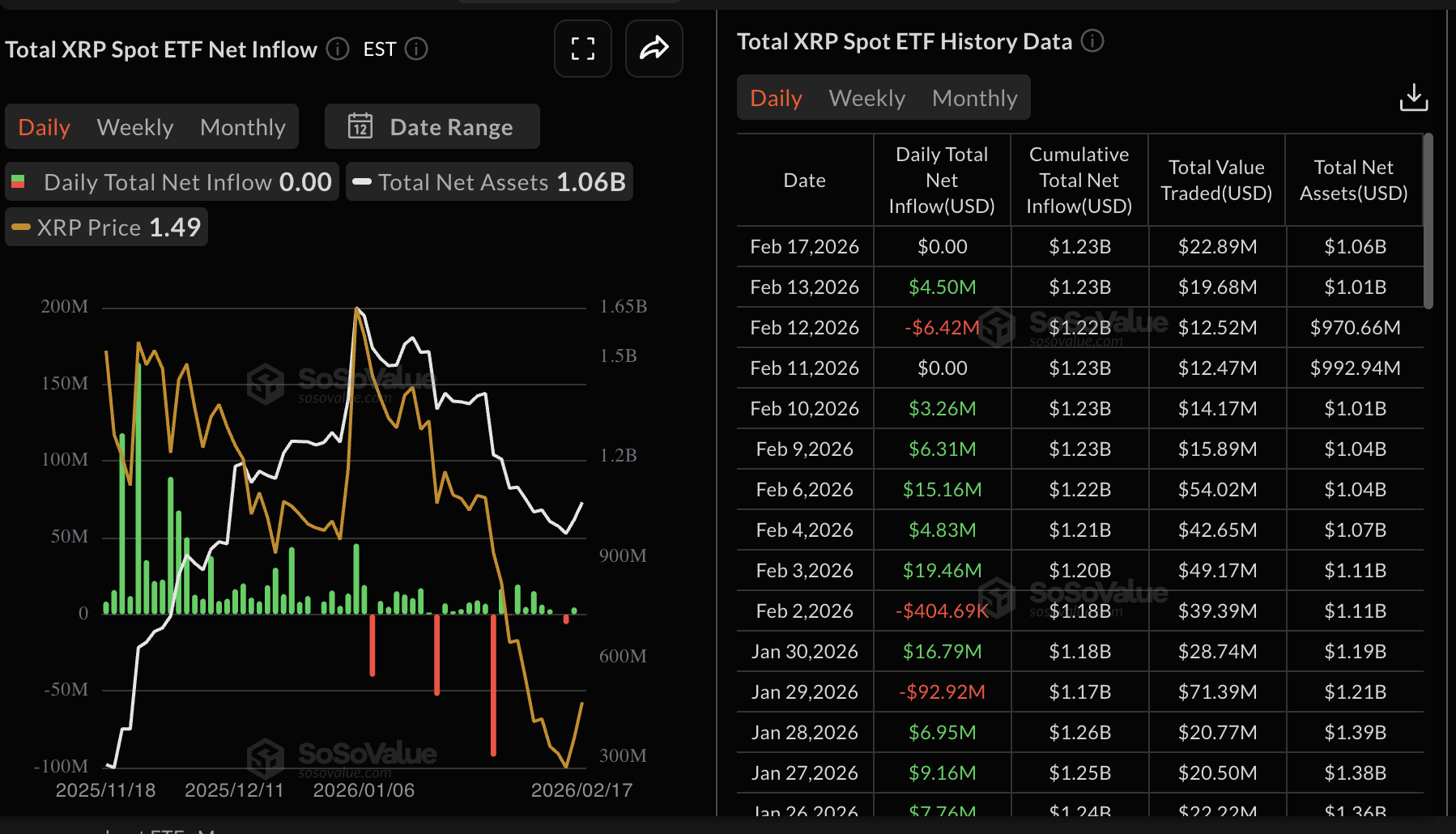

As for XRP spot ETFs, activity was muted on Tuesday, with no flows recorded, according to SoSoValue data. The cumulative inflow now stands at $1.23 billion, with net assets under management at $1.06 billion. As it did with BTC and ETH, total assets in XRP-related ETFs have also declined sharply after hitting a record high of $1.65 billion on January 5, suggesting that interest in US-listed XRP spot ETFs has gradually eased over the past weeks.

Chart of the day: Bitcoin stabilizes ahead of potential breakout

Bitcoin has regained support at $68,000 from the daily open of $67,504, in an attempt for a decisive break above $70,000.

The uptick is supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator, which is above its signal line on the daily chart, while the expanding green histogram bars prompt traders to increase their exposure.

At the same time, the Money Flow Index (MFI), an indicator that tracks the flow of money in and out of Bitcoin, is at 43 and rising toward the midline on the same chart. A continued uptrend would indicate steady risk appetite and increased momentum, supporting Bitcoin’s bullish thesis.

Altcoins technical outlook: Ethereum, XRP look poised for breakout

Ethereum is trading slightly above the previous day’s high of $2,025, supported by a strengthening technical outlook as observed on the daily chart.

The MACD indicator supports ETH’s intraday gains, sitting above the signal line on the same chart, while green histogram bars expand, encouraging investors to increase exposure. The MFI holds above 44, moving toward the midline.

A further increase above the midline would ascertain the bullish outlook and increase the odds of a breakout targeting the 50-day Exponential Moving Average (EMA), which appears to limit the upside at $2,538. The nearest breakout target sits around $2,174, which aligns with the high from February 5.

XRP rises alongside Bitcoin and Ethereum, up by over 1% intraday and trading around $1.49 at the time of writing on Wednesday. The path of least resistance appears to be upward, as confirmed by the MACD indicator holding above its signal line on the daily chart.

Bulls seem ready for a break above the short-term hurdle at $1.50, supported by the surge in the flow of money into XRP, as reflected by the MFI rising to 53. The 50-day EMA at $1.71 is a key target alongside the 100-day EMA at $1.92.

Still, both moving averages are sloping upward, suggesting the trend could remain bearish unless bulls push to break the hurdles at $1.71 and $1.92.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.