Gold plunges despite falling US yields and solid US jobs data

- Gold tumbles as strong jobless claims and NFP reinforce a steady-rate stance at the Federal Reserve.

- De-escalation hopes around Russia and Iran talks weigh on haven demand for bullion.

- Firm US Dollar and trimmed July cut bets offset falling US Treasury yields.

Gold price declines close to 2.7% on Thursday amid the lack of a clear catalyst, as US jobs data during the last couple of days was solid, despite of the number of Americans filing for unemployment benefits rose more than expected. At the time of writing, XAU/USD trades at $4,945 after reaching a daily high of $5,100.

XAU/USD sinks below $4,900 as easing geopolitical risks and steady Dollar tone spark sharp liquidation

Precious metals are collapsing during the day amid a lack of a clear catalyst, but there are factors emerging that can be driving price action. US equities are dropping amid potential further AI disruption, as a press release from Algorhythm Holdings (RIME) announced its SemiCab platform, now in live customer deployments, is enabling clients to scale freight volumes by 300-400% without hiring personnel.

In the meantime, a Bloomberg article revealed Russia’s intentions to return to the US Dollar settlement.

Data in the United States revealed that Initial Jobless Claims for the week ending February 7 exceeded forecasts of 222K, at 227K, but decreased compared to the previous print. The decline shows signs of strenght and it remains near the jobless claims 4-week average, standing at 219.5K.

On Wednesday, January’s Nonfarm Payrolls print was outstanding, nearly doubling estimates of 70K, with the economy adding 130K jobs, while the Unemployment Rate dipped from 4.4% to 4.3% beneath the Federal Reserve’s estimates.

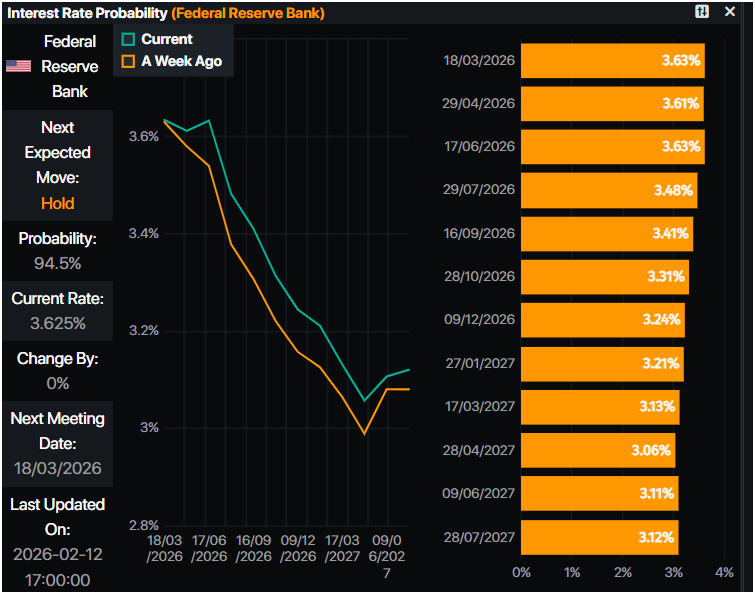

The stabilization of the labor market reinforced the Fed’s view to keep rates steady as depicted in the swaps market.

Money markets trimmed bets for an utmost sure rate cut in June, increasing the odds for a July reduction. Data from Prime Market Terminal shows 30 bps of easing for the July 29 meeting.

Recently, the Israeli Prime Minister Benjamin Netanyahu said that the conditions US President Donald Trump is setting on Iran, combined with their understanding that they made a mistake last time by not agreeing to a deal, could lead Tehran to accept terms that would make it possible to achieve a good deal, according to Axios.

A resumption of nuclear talks between the US and Iran, and a possible peace deal between Russia and Ukraine, would exert pressure on Gold prices due to the de-escalation of geopolitical risks.

US Dollar remains steady despite the drop of US Treasury yields

In the meantime, US Treasury yields are plunging sharply, usually a tailwind for Bullion. The US 10-year Treasury note plummets nearly seven basis points to 4.106%.

The US Dollar Index (DXY), which tracks the performance of the American Dollar against a basket of six major currencies, remains firm, up by 0.07% to 96.99.

What’s in the US economic schedule?

The docket will feature January’s Consumer Price Index (CPI) report, which is expected to come in softer than expected. Headline and core inflation figures are foreseen to dip from 2.7% to 2.5% YoY, and from 2.6% to 2.5%, each respectively.

If the data is aligned with estimates, Gold could extend its rally as Fed officials had stressed that if the disinfection process resumes, they might consider lowering rates.

XAU/USD Price Forecast: Gold retreats, tests 20-day Simple Moving Average at $4,940

Gold price remains upward biased, but Thursday’s price action is pushing the yellow metal to test lower prices. The Relative Strength Index (RSI) shows that buying momentum is fading and that sellers could be outweighing buyers, clearing the path for further losses.

If XAU/USD ends on a daily basis below $4,900, it opens the door for a pullback below $4,800. After this, the next support is the 50-day SMA at $4,602.

On the other hand, if Gold buyers reclaim $5,000, they could keep price action confined to the $5,000-$5,100 range for the rest of the week.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.