6 Best Gold CFD Trading Platform Australia: ASIC-Regulated Brokers Reviewed (2026 Guide)

Australia’s gold market continues to attract both beginner and seasoned traders looking to gain exposure to XAU/USD price movements without owning physical gold. Gold CFD trading — a popular way to speculate on gold prices via contract for difference products — allows investors to enter and exit positions quickly, apply leverage, and take advantage of both rising and falling markets.

However, not all brokers are created equal. Traders seeking the best gold CFD trading platform in Australia should prioritise ASIC-regulated brokers that offer transparent pricing, robust risk controls, competitive spreads, and reliable account funding options such as AUD deposits via PayID.

In this article, we review the 6 best gold CFD trading platforms available in Australia in 2026, with detailed insights into each broker’s features, strengths, weaknesses, and overall suitability for different types of traders.

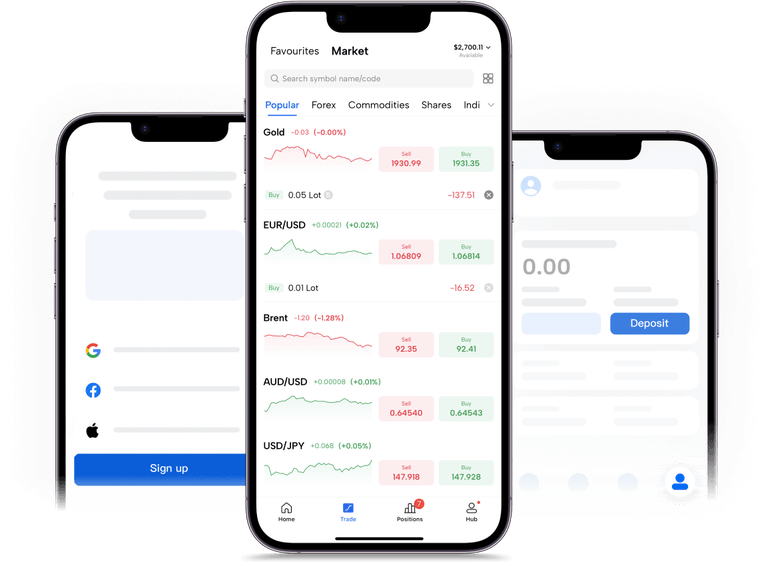

1. Mitrade

Mitrade is a well-established Australian CFD broker that has gained traction among both new and experienced traders thanks to its user-friendly interface, transparent pricing, and strong regulatory oversight.

Overview

Regulation: ASIC-regulated (AFSL 398528)

Product offering: Gold CFDs, forex, indices, commodities, stocks, ETFs, crypto

Platforms: Web, iOS & Android mobile app

Key Features

Competitive gold spreads averaging 0.12–0.18 USD per ounce during peak market hours

Low overnight swap rates on long/short positions

Built-in risk management tools such as stop-loss and trailing stop

Fast trade execution (typically 40–60ms) with minimal slippage

Education hub with market analysis and tutorial resources

Pros

✅ Beginner-friendly platform with intuitive design

✅ Transparent pricing and fee structure

✅ Fast PayID and POLi AUD deposits

✅ Same-day withdrawals to Australian banks without fees

✅ Strong focus on trader education

Cons

❌ Advanced charting and analysis tools are less extensive than MT4/MT5 platforms

❌ Limited asset classes compared to some larger global brokers

Trade XAU/USD with Tight Spreads

2. Pepperstone

Pepperstone is one of Australia’s most popular forex and CFD providers, widely respected for its execution quality, deep liquidity, and institutional-grade pricing, making it especially appealing for active gold traders.

Overview

Regulation: ASIC-regulated (AFSL 414530)

Platforms: MT4, MT5, cTrader, TradingView

Leverage: Up to 1:20 (retail), higher for professional clients

Key Features

Razor account gold spreads often as low as 0.08–0.15 USD per ounce

Transparent $3.50 round-turn commission per lot

Low slippage and fast execution (<25ms via Equinix servers)

Diverse platform support including TradingView integration

Pros

✅ Extremely tight spreads ideal for scalping and short-term strategies

✅ Multiple advanced trading platforms

✅ 24/7 support and robust liquidity

✅ Competitive overnight financing rates

Cons

❌ Commission structure may be less attractive for very small account sizes

❌ Platform complexity might overwhelm total beginners

3. IC Markets

IC Markets is recognised globally as a true ECN broker offering raw spreads, deep market liquidity, and high-performance execution — qualities that make it a favourite among algo, scalping, and professional traders.

Overview

Regulation: ASIC-licensed (AFSL 335692)

Platforms: MT4, MT5, cTrader, TradingView

Key Features

Raw gold spreads typically in the range of 0.10–0.16 USD

$3.50 per lot round-turn commission on raw accounts

Execution speeds often under 40ms

Flexible platform choice and advanced charting

Pros

✅ ECN pricing ensures some of the tightest available gold spreads

✅ Robust enough for high-frequency strategies

✅ Supports expert advisors (EAs) and automated trading

✅ Global presence with strong regulatory oversight

Cons

❌ Commission costs can add up for frequent traders

❌ Advanced tools require learning curve

4. Vantage

Vantage offers a comprehensive CFD trading environment, and its pricing structure is particularly suitable for gold traders who hold positions overnight or engage in longer-term speculative trading.

Overview

Regulation: ASIC (AFSL 428901), FCA, CIMA, VFSC

Platforms: MT4, MT5, ProTrader

Key Features

Raw ECN account spreads on gold around 0.15–0.22 USD

$3 round-trip commission

Minimal slippage and reliable execution

Same-day PayID AUD deposits

Pros

✅ Competitive swap rates make it attractive for multi-day trades

✅ Wide range of markets beyond gold

✅ 24/7 customer support

Cons

❌ Spread ranges slightly wider than razor account brokers

❌ Commission can be noticeable for smaller positions

5. Fusion Markets

Founded in Melbourne, Fusion Markets has built its reputation around cost-effective CFD trading with transparent pricing and minimal mark-ups.

Overview

Regulation: ASIC (AFSL 385620)

Platforms: MT4, MT5, cTrader

Key Features

Zero account spreads in the 0.10–0.17 USD range (plus $2.25 commission)

True ECN order execution model

Efficient PayID funding and fast withdrawals

Competitive overnight swaps

Pros

✅ One of the lowest total cost structures for gold CFD trading

✅ Reliable execution and minimal slippage

✅ Good fit for scalpers and intraday traders

Cons

❌ Smaller research and educational resources

❌ Fewer additional asset classes compared to larger brokers

6. Eightcap

Eightcap, headquartered in Melbourne, combines competitive pricing with flexible platform support, particularly for traders who rely on TradingView charts and signals.

Overview

Regulation: ASIC (AFSL 391441), FCA, CySEC, SCB

Platforms: MT4, MT5, TradingView

Key Features

Raw Spread account offers 0.12–0.20 USD spreads, plus $3.50 commission

TradingView integration for seamless charting and execution

Instant PayID deposits and same-day AUD withdrawals

Pros

✅ Strong platform options for technical analysis

✅ Balanced pricing and execution quality

✅ 24/7 support

Cons

❌ Slightly wider spreads than razor ECN brokers

❌ Commission rates make it less ideal for micro accounts

Comparison of the Best Gold CFD Trading Platforms in Australia

“Trade gold CFDs with an ASIC-regulated broker. Fast AUD funding via PayID. ”

Why Trade Gold via CFDs Instead of Physical Gold?

1. Exposure to Gold Prices Without Storage or Ownership Costs

Trading gold via CFDs allows investors to participate in gold price movements without owning the physical metal. There is no need to worry about storage, insurance, transportation, or security costs, which can significantly reduce overall investment efficiency when dealing with physical gold. CFDs offer a cleaner and more cost-effective way to access the gold market.

2. Ability to Trade Both Rising and Falling Markets

One of the key advantages of gold CFDs is the flexibility to profit in different market conditions. Unlike physical gold, which generally benefits only from rising prices, CFDs allow traders to take both long and short positions. This means traders can potentially benefit from gold price declines during periods of strengthening US dollar, rising interest rates, or reduced geopolitical risk.

3. Lower Capital Requirements Compared to Physical Gold

Buying physical gold often requires a relatively high upfront investment, especially when purchasing bullion or gold bars. With gold CFDs, traders can access the market with a much smaller amount of capital. This lower entry barrier makes gold trading more accessible to retail investors in Australia, while still offering meaningful market exposure.

4. Use of Leverage to Improve Capital Efficiency

Gold CFD trading in Australia is regulated by ASIC, which allows retail traders to use leverage within strict limits. Leverage enables traders to control larger positions with less capital, improving capital efficiency. While leverage increases risk and must be managed carefully, it provides flexibility that physical gold ownership simply cannot offer.

5. High Liquidity and Fast Trade Execution

Gold (XAU/USD) is one of the most liquid instruments in global financial markets. CFD trading platforms typically provide tight spreads, deep liquidity, and fast execution, especially during major trading sessions. This makes gold CFDs suitable for active traders, short-term strategies, and those who react to macroeconomic events such as inflation data or central bank decisions.

6. Advanced Risk Management and Trading Tools

CFD platforms offer built-in risk management tools such as stop-loss orders, take-profit levels, and trailing stops. These tools allow traders to manage downside risk more precisely and automate parts of their trading strategy. Physical gold investment does not provide the same level of control, making CFDs more suitable for traders who value flexibility and disciplined risk management.

“Trade gold CFDs with an ASIC-regulated broker. Fast AUD funding via PayID. ”

Conclusion: Choosing the Right Gold Broker in Australia

All six brokers reviewed above are ASIC-regulated, offer reliable execution, and support AUD deposits, but each serves slightly different trader needs. Use this guide to match your goals — whether that’s low cost, fast execution, or advanced analytical tools — and start trading gold CFDs with confidence.

👉 Explore regulated gold CFD platforms and start trading today.

1. What is a gold CFD trading platform?

A gold CFD trading platform is an online brokerage interface that enables traders to speculate on the price movements of gold (XAU/USD) without owning physical gold. CFDs can be used to go long or short using leverage.

2. Are gold CFDs legal in Australia?

Yes. Gold CFD trading is legal in Australia when offered through ASIC-regulated brokers, which must comply with strict client fund protection and disclosure requirements.

3. What is the main difference between gold CFDs and physical gold?

The main difference is ownership. Physical gold involves owning and storing the metal, while gold CFDs allow traders to speculate on gold price movements without owning the asset. CFDs focus on price exposure and flexibility, whereas physical gold is typically held as a long-term store of value.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.