Avalanche Price Forecast: AVAX bulls hold firm despite broader market weakness

- Avalanche price extends gains on Tuesday, building on Monday’s sharp recovery.

- On-chain and derivatives data paint a bullish picture as AVAX’s TVL is climbing and open interest is nearing record highs.

- Institutional demand strengthens, as AGRI reveals plans to establish an AVAX treasury reserve.

Avalanche (AVAX) shows signs of resilience, trading above $34 at the time of writing on Tuesday after a sharp recovery the previous day. On-chain and derivatives data further support the bullish outlook, with rising Total Value Locked (TVL) and Open Interest (OI). Additionally, growing institutional demand suggests potential for further upside despite the recent market correction.

On-chain and derivatives data continue to strengthen AVAX’s outlook

Avalanche price climbs above $34 during the Asian trading session on Tuesday, extending its sharp recovery from Monday. AVAX is showing resilience despite broader market weakness, with Bitcoin (BTC) slipping below $112,000 and Ethereum (ETH) dropping toward the $4,000 mark as the week begins.

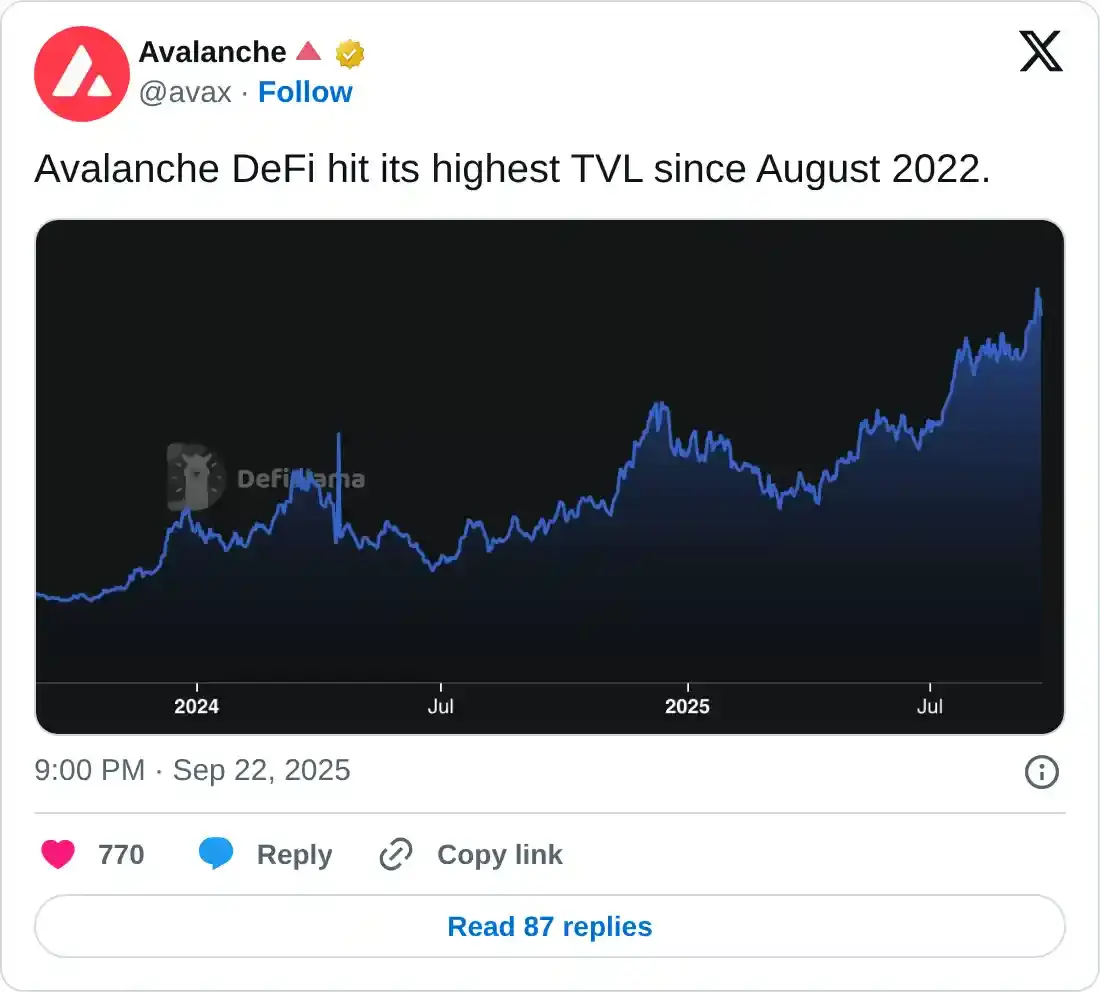

On-chain data indicate that the Avalanche Total Value Locked (TVL) has reached its highest level since August 2022. Rising TVL indicates growing activity and interest within AVAX’s ecosystem, suggesting that more users are depositing or utilizing assets within AVAX-based protocols.

On the derivatives side, the Avalanche’s futures’ Open Interest (OI) at exchanges stands at $1.79 billion on Tuesday, nearing its record highs. Rising OI represents new or additional money entering the market and new buying, which could fuel the current AVAX price rally.

Avalanche open interest chart. Source: Coinglass

Avalanche treasury reserves

Institutional demand for Avalanche also strengthens as the week begins. On Monday, AgriFORCE Growing Systems announced plans to rebrand as AVAX One, becoming the first Nasdaq-listed company dedicated to holding the Layer-1 token.

“The goal of the Company’s capital raising strategy is to own more than $700 million worth of AVAX tokens, making it a foundational partner in the growing ecosystem,” said AgriFORCE in the press release.

The company seeks to raise $550 million from a private investment in public equity (PIPE) deal worth $300 million, combined with an additional near-term funding of up to $250 million.

The news boosted the AVAX price on Monday, fueling a sharp recovery from its recent dip and closing above $33.80. Moreover, in the long term, the development is bullish for the Avalanche ecosystem, as it reduces the circulating supply, increases demand, and supports higher prices. Meanwhile, growing institutional interest further strengthens its credibility and adoption.

Avalanche Price Forecast: AVAX bulls aiming for $39 mark

Avalanche price broke above the ascending channel pattern on Thursday but faced a pullback over the next three days. At the start of the week on Monday, AVAX corrected sharply during the first half but recovered sharply after retesting the $30 psychological support during the second half of the day, closing above $33.80. At the time of writing on Tuesday, it continues to trade higher at around $34.45.

If AVAX continues its upward momentum, it could extend the rally toward the technical target of the channel pattern at $39.61, based on the distance between the channel range from the breakout point.

The Relative Strength Index (RSI) on the daily chart reads 71, indicating that it is above its overbought levels and pointing upward, which suggests strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also displayed a bullish crossover in mid-September, which remains in effect and supports the bullish view.

AVAX/USDT daily chart

However, if AVAX faces a correction, it could extend the decline to retest its key support at $30.