Ethereum Price Forecast: ETH on-chain activity indicates mixed sentiment among investors

Ethereum price today: $1,760

- Ethereum's futures open interest increased by 700K ETH in the past 24 hours.

- The increase follows a drop in the ETH taker buy-sell ratio, indicating a rise in short positioning.

- Ethereum exchange outflows and sustained buying pressure in ETH ETFs show a divergence between futures and spot investors' sentiment.

- ETH declined 3% on Wednesday as traders remain indecisive in the short term.

Ethereum (ETH) is down 3% on Wednesday following mixed signals across the top altcoin’s on-chain metrics. While futures traders appeared to be positioning for a downside move, spot traders maintained a modest buying pressure.

Ethereum futures and spot investors display diverging sentiment

Ethereum futures open interest (OI) — the total amount of unsettled contracts in a derivatives market — increased by over 700K ETH on Wednesday, offsetting its drop since last Friday, per Coinglass data. However, the rising OI followed a slight price decline, with ETH seeing over a 3% loss on the day. This indicates that the new money entering the ETH futures market flowed toward short positions.

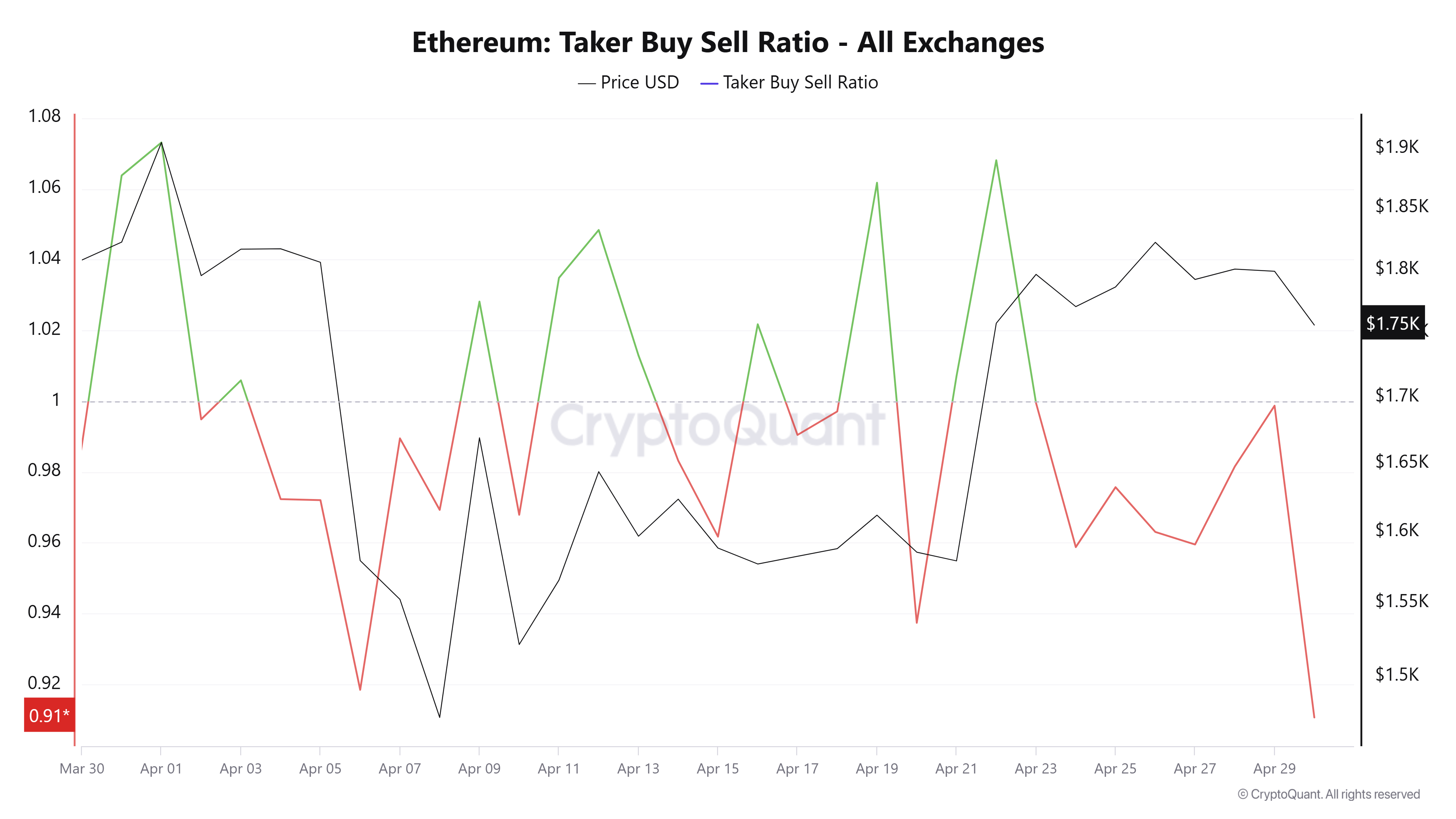

The Ethereum Taker Buy Sell Ratio confirms the rise in short positioning. This metric represents the takers' buy volume divided by sell volume in perpetual futures. A value above 1 indicates dominant bullish sentiment and vice versa when below 1.

The ratio dropped from 0.99 to 0.91 over the past 24 hours. ETH declined nearly 18% the last time the ratio saw a similar decrease. However, it's important to note that a deeper plunge in this ratio historically triggers a bullish reversal.

ETH Taker Buy Sell Ratio. Source: CryptoQuant

Despite the slight increase in ETH futures short positioning, spot traders have maintained a modest bullish sentiment, with six consecutive days of exchange net outflows. Rising exchange outflows indicate dominant buying pressure.

A similar trend is visible across US spot Ether ETFs, which posted $18.4 million in net inflows on Tuesday, per SoSoValue data. The products have now recorded four consecutive days of net inflows amounting to $250.17 million — the first time since February.

Crypto options platform Derive also noted an increase in bullish sentiment among ETH investors.

"A staggering 73% of all BTC options premiums are being used to buy calls, with ETH seeing an even higher percentage at 81.8%," wrote Sean Dawson, Derive's Head of Research. "The sentiment on Derive is extremely bullish, with calls outnumbering puts by 4x for ETH..."

However, unlike Derive investors, the wider crypto options market remains cautious, with investors' positioning indicating uncertainty.

"For ETH, the chance of it settling above $2,300 by May 30 remains at 9%, while the chance of it falling below $1,600 has dropped from 24% to 21% in the last 24 hours," added Dawson.

The mixed sentiment among ETH investors follows the Ethereum Foundation's official announcement of its new leadership structure and a restatement of its vision and principles.

Ethereum Price Forecast: ETH traders remain indecisive

Ethereum saw $72.46 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions is $60.95 million and $11.51 million, respectively.

ETH is consolidating within the $1,700 - $1,850 range as bulls failed to hold the $1,800 key level again.

ETH/USDT 4-hour chart

On the downside, ETH could bounce off the support of a slightly rising channel. A decline below this support places the $1,688 level and a key descending trendline as the next major support zone.

On the upside, ETH needs to break above and hold the upper boundary of the slightly rising channel as support to begin the next bullish move.

The 4-hour Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) show dominant bearish momentum in the short term, with the latter approaching the oversold region.