Major meme coins Dogecoin, Shiba Inu slide as Turbo surges 250% in a month

- Meme coins Dogecoin and Shiba Inu slide, reflecting broader bearish sentiment in the crypto market ahead of the Fed decision on Wednesday.

- Turbo’s price surges over 250% in the last 30 days, reclaiming the 50-day, 100-day and 200-day EMAs as support.

- Turbo shows signs of a potential breakout toward $0.01 amid surging investor confidence.

Cryptocurrency prices are broadly stagnating on Tuesday, ahead of the Federal Reserve (Fed) meeting on the decision on interest rates on Wednesday. Leading meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) face sticky overhead pressure, making recovery elusive, while downside risks emerge. However, Turbo, a relatively smaller meme token, outperformed major assets, increasing over 12% on the day to trade at $0.006 at the time of writing.

Investors await FOMC decision on interest rates

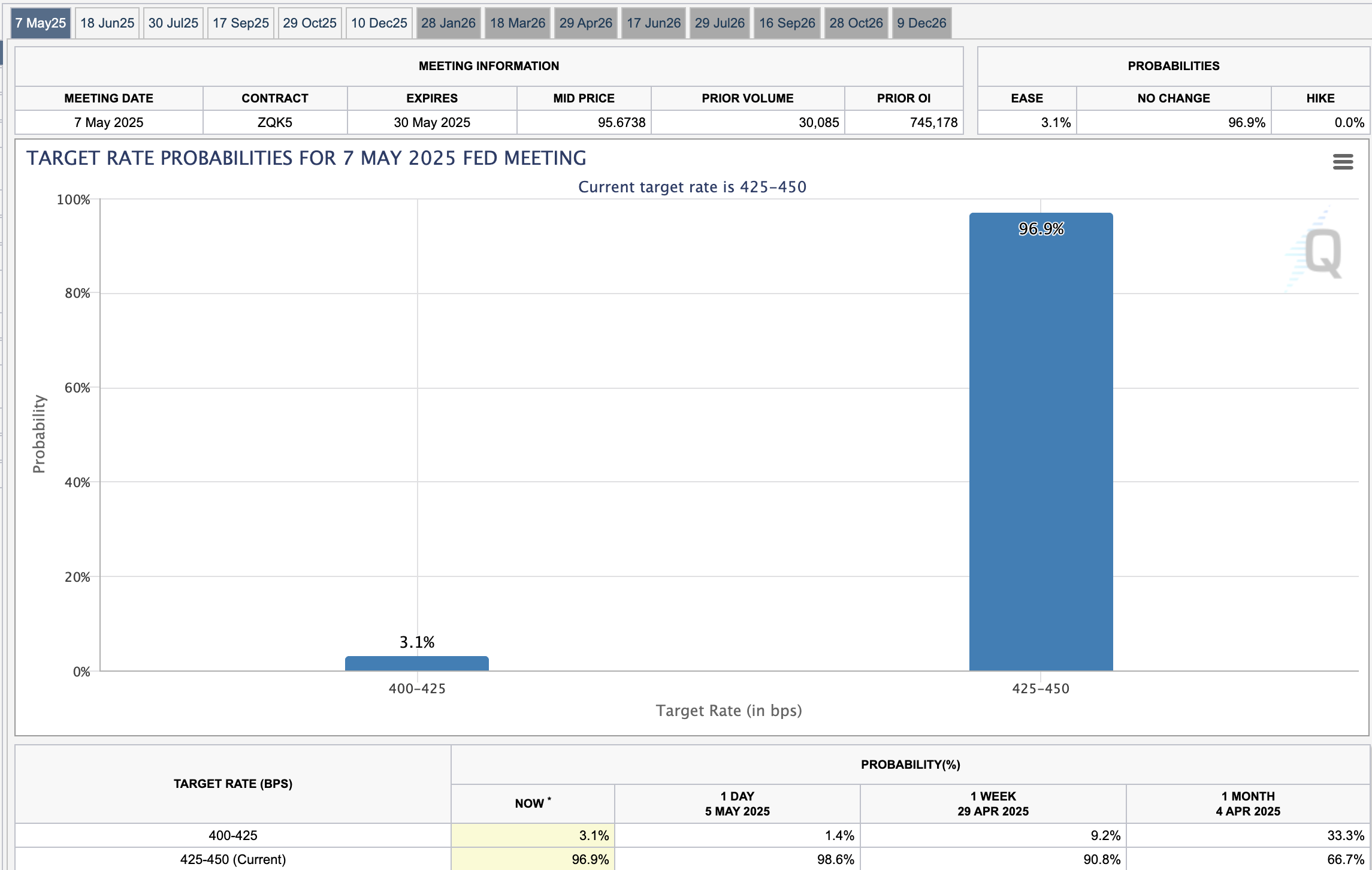

The Federal Open Market Committee (FOMC) meeting on Wednesday is expected to leave interest rates unchanged. The CME Group’s FedWatch tool shows a 96.9% probability of interest rates remaining unchanged in the 4.25%-4.50% range.

Investors are likely to focus on the Fed Chair Jerome Powell’s remarks, which could give insight into the policy and where markets could go next.

FedWatch Tool | Source: CME Group

Dogecoin and Shiba Inu’s uptrend falter

The meme coins sector has generally been down 1.3% over the past 24 hours and has been drawn down by 8.6% in a week. Crypto’s top meme coin, Dogecoin, hovers at $0.16, down over 2% on the day.

Dogecoin snapped out of the uptrend from its April low at $0.13, after encountering resistance at $0.19 on April 26. A subsequent drop under the ascending trendline emphasized the bearish momentum. With DOGE sitting below the 4-hour 50, 100 and 200 Exponential Moving Averages (EMAs), the short-term outlook likely remains largely bearish.

DOGE/USDT 4-hour chart

The Relative Strength Index (RSI) sharp drop toward the oversold region amplifies bearish momentum. However, if the RSI recovers, Dogecoin could be more attractive to traders willing to buy the dip.

On the other hand, Shiba Inu’s 4-hour chart showcases a bearish landscape, emphasized by a sloping RSI indicator likely to reach the oversold region in upcoming sessions.

Larger than expected declines may invalidate the potential bull flag pattern and accelerate losses, targeting the short-term support area at $0.000012, $0.000011 and the April 7 low at $0.000010, where buyers might step in to collect liquidity.

The RSI is not offering the bulls much hope as it slides toward oversold territory, confirming the bearish momentum.

This steep decline in RSI highlights the intense selling pressure SHIB is facing, and without a significant catalyst, a recovery seems unlikely in the near term.

SHIB/USDT 4-hour chart

However, if the RSI dips below 30 and starts to curl upward, it could signal a potential bounce, something bulls will be watching closely towards the weekend.

Turbo surges 250% in a month

Turbo has outperformed most major meme coins, surpassing 250% gains in a month, from the April 7 low of $0.0013 to exchange hands at $0.0060 at the time of writing.

The meme coin’s bullish outlook appears strong, holding above the 50-day, 100-day and 200-day EMAs. After rejection from overbought levels at 84.66 and dropping into the neutral region, the RSI indicator is back above 70, hinting at a strong bullish momentum.

TURBO/USDT daily chart

The meme coin faces resistance at around $0.0065, marked in red on the chart above. If broken, confirming increasing demand for Turbo, a price hike towards $0.01 will likely follow.

However, traders must appreciate Turbo’s prevailing overbought conditions, which could result in a larger pullback than expected if investors take profit, contributing to sell-side pressure. The 200-day EMA at $0.0057, the 100-day EMA at $0.0038 and the 50-day EMA at $0.0035 are tentative support levels.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.