Ethereum Price Forecast: ETH tests 100-day EMA as Fusaka launches on Hoodi testnet

Ethereum price today: $3,940

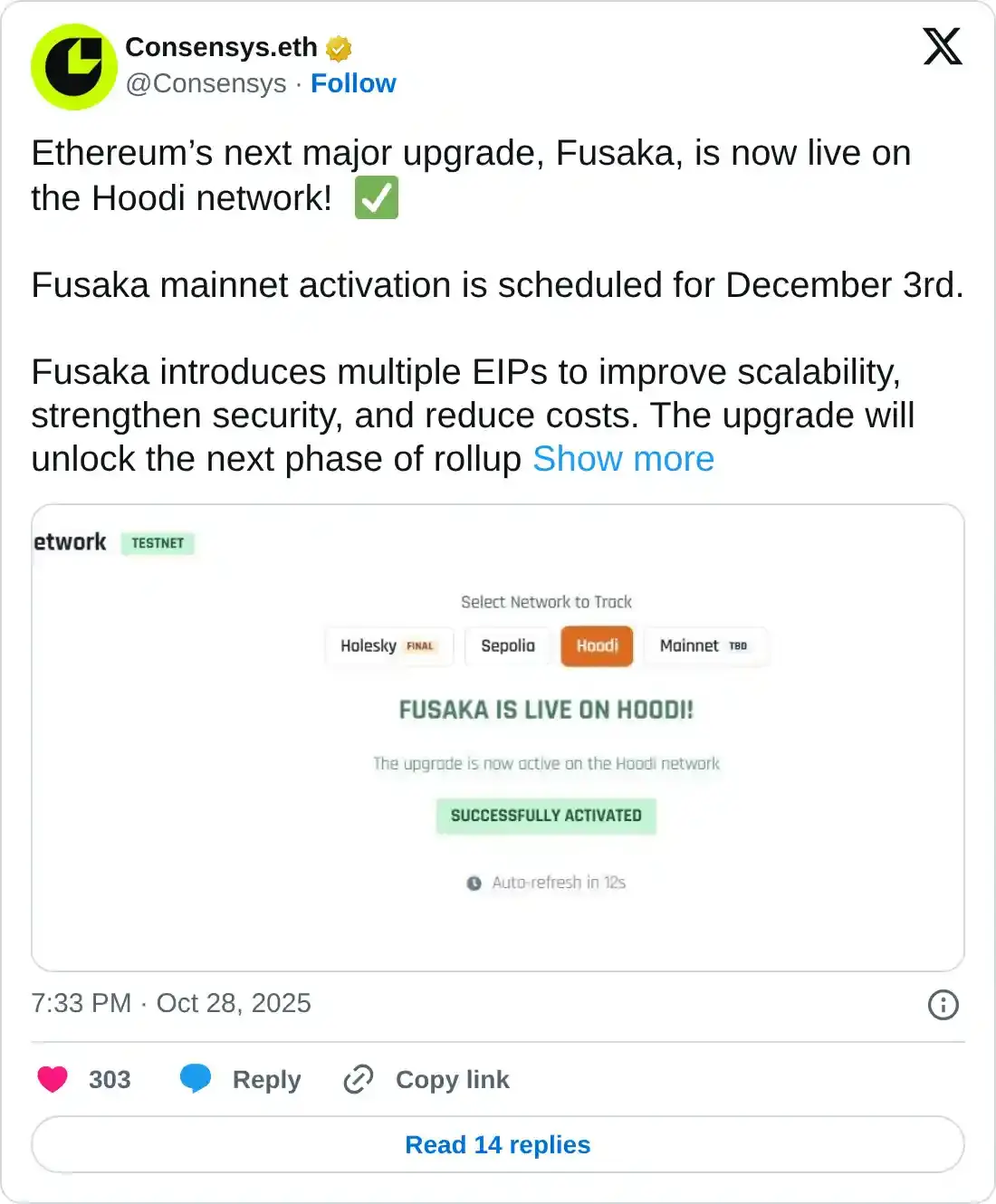

- Ethereum Fusaka upgrade successfully debuted on the Hoodi testnet without any hiccups.

- With Hoodi finalized, developers are tentatively planning to push Fusaka to the Ethereum mainnet on December 3.

- ETH faces pressure at the 100-day EMA after declining below $4,100.

Ethereum's (ETH) upcoming network upgrade, Fusaka, has gone live on the Hoodi testnet, with mainnet launch the next step.

Ethereum Fusaka upgrade set for mainnet after launching on Hoodi testnet

Ethereum's Fusaka upgrade, slated to bring increased scalability and security improvements, successfully debuted on Hoodi on Tuesday, the third and final testnet before mainnet launch.

Testnets are environments where developers validate network upgrades or changes before deploying them on the main blockchain network.

In October, Fusaka launched on three testnets — Holesky, Sepolia, and Hoodi — without any hiccups so far. Hoodi, which replaced Holesky, is primarily for testing infrastructure, validator and staking functionality.

With Hoodi finalized, developers are tentatively planning to push Fusaka to the Ethereum mainnet on December 3 before expanding the network's blob capacity on later dates.

Fusaka features 12 Ethereum Improvement Proposals (EIPs), including EIP-7594, or PeerDAS, which will enable validators to verify Layer 2 transactions using only a small portion of the rollup data.

"The upgrade [Fusaka] will unlock the next phase of rollup scaling and pave the way for parallel execution," noted crypto infrastructure provider Consensys, in an X post on Tuesday.

Fusaka comes after the Pectra upgrade, which brought features such as staking efficiency, smart wallet functionality, and blob expansion to the mainnet in May. After Fusaka, developers are looking to further improve efficiency and scalability through the Glamsterdam upgrade slated for 2026.

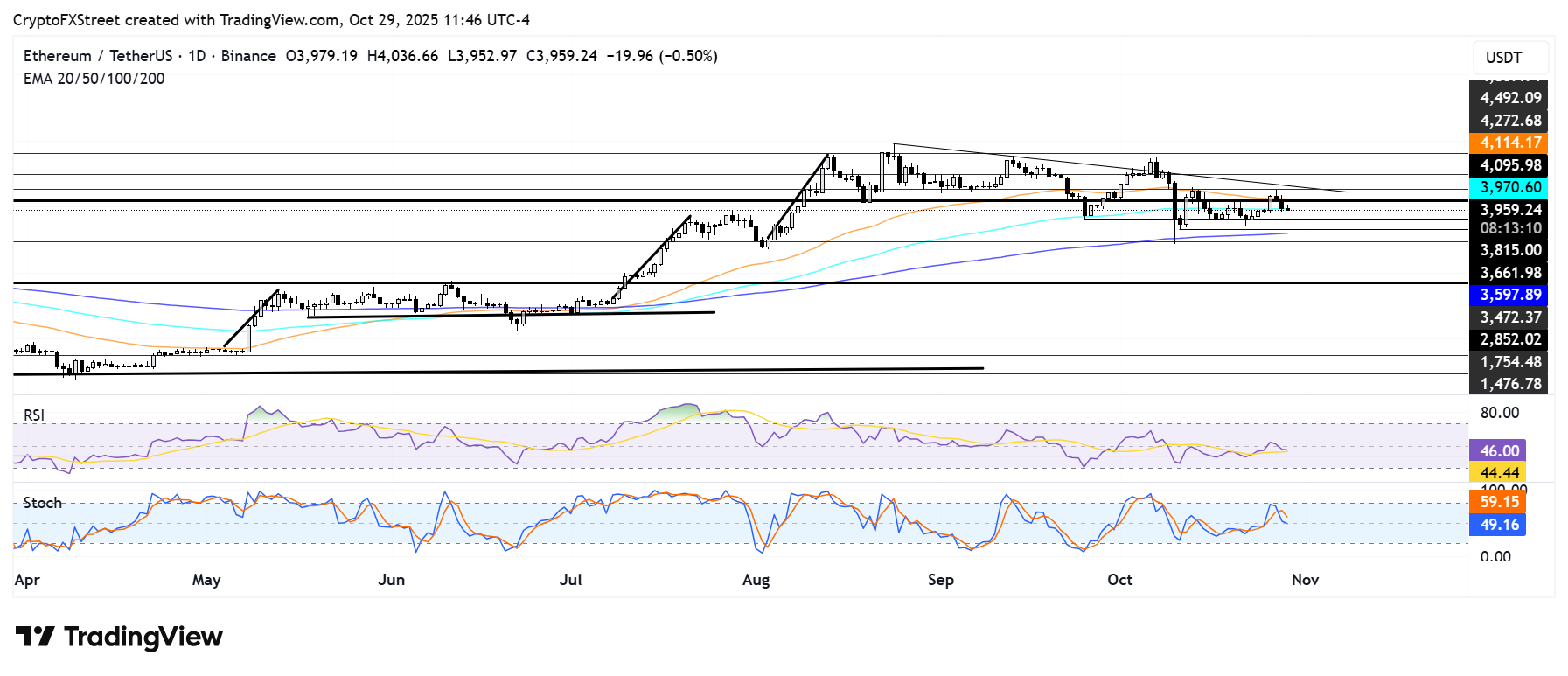

Ethereum Price Forecast: ETH traders battle at the 100-day EMA

Ethereum saw $142.5 million in liquidations over the past 24 hours, with long liquidations accounting for $103.3 million, according to Coinglass data.

ETH faces pressure at the 100-day Exponential Moving Average (EMA) as bulls and bears battle near the level. The top altcoin could find support near $3,800 if bears prevail. Meanwhile, if the 50-day EMA crosses below the 100-day EMA, a further decline toward $3,470 — just below the 200-day EMA — could be in the picture.

ETH/USDT daily chart

On the upside, ETH has to overcome a key descending trendline resistance and move above $4,500 to resume a rally toward its all-time high.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downwards and testing their neutral levels. A firm decline below could accelerate the bearish momentum.