JPMorgan to roll out Bitcoin, Ethereum-backed loans for institutional clients by year-end

- JPMorgan is planning to allow institutions access to Bitcoin and Ethereum collateralized loans before the end of the year.

- The product will serve clients globally with the investment bank outsourcing digital custody services.

- JPMorgan’s CEO, Jamie Dimon, who once dismissed Bitcoin as a “hyped up fraud,” has recently softened his stance.

JPMorgan Chase is reportedly planning to offer Bitcoin (BTC) and Ethereum (ETH) backed loans, targeting institutional clients by the end of the year in what is seen as a paradigm shift in the bank’s policy.

JPMorgan taps Wall Street’s crypto rush

According to a Bloomberg report, the loan product will accept both Bitcoin and Ethereum as collateral assets. People familiar with the matter, who were not named, said that JPMorgan will contract a third-party custodian to safeguard the assets.

JPMorgan began accepting crypto ETFs as collateral for loans in June, with limited access for BlackRock’s clients. The investment bank also considers crypto ETF holdings as net worth and liquid assets during assessments.

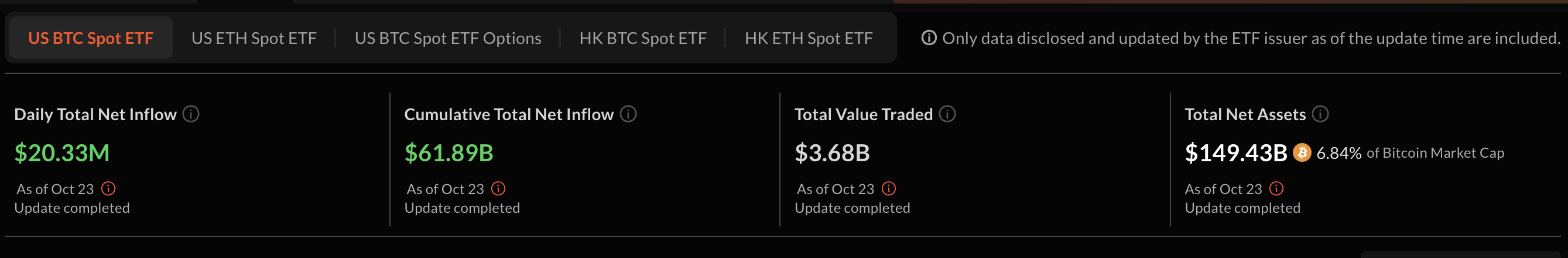

Since the approval of Bitcoin ETFs in January 2024, Wall Street has warmed up to the crypto industry as institutions seek alternative investment vehicles. In less than two years, BTC spot ETFs have accumulated nearly $62 billion in net inflows and $149 billion in net assets, according to SoSoValue.

Bitcoin ETF stats | Source: SoSoValue

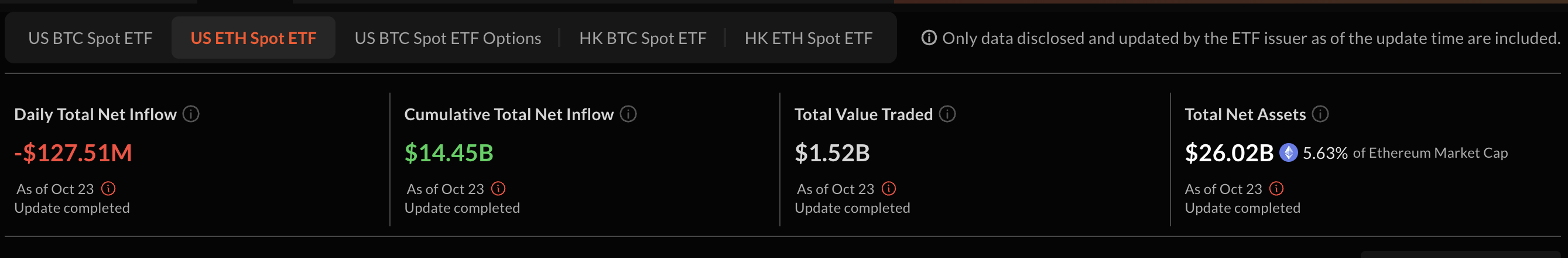

Ethereum spot ETFs experienced their biggest growth rate this year, with inflows averaging $14.45 billion on Friday and total net assets of $26 billion. Nine ETFs operate in the United States (US).

Ethereum ETF stats | Source: SoSoValue

JPMorgan’s interest in Bitcoin and the crypto market has taken a different turn in recent months, as the traditional financial sector has begun integrating the asset class amid positive regulatory shifts.

For JPMorgan, the move to embrace digital assets is symbolic, given that the CEO, Jamie Dimon, had earlier dismissed Bitcoin as a “hyped-up fraud.” Dimon once called Bitcoin a “pet rock,” suggesting it had no intrinsic value.

The CEO has lately softened his stance toward Bitcoin, with JPMorgan paying attention to client needs.

“I don’t think we should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin, go at it,” Dimon stated at JPMorgan’s investor conference in May.

According to Bloomberg, JPMorgan also plans to allow clients to access prominent cryptocurrencies like Bitcoin and Ethereum on its E*Trade retail platform in 2026.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.