Crypto Today: Bitcoin, Ethereum, XRP build momentum amid stable retail demand

- Bitcoin extends its recovery above $111,000 backed by stable retail demand.

- Ethereum bulls battle to break the 100-day EMA resistance amid persistent ETF outflows.

- XRP rebounds as its technical picture improves, supported by a MACD buy signal.

Bitcoin (BTC) trends higher for the second day, trading above $111,000 at the time of writing on Friday. The steady price increase from a weekly low of $106,666 mirrors a gradual sentiment growth across the cryptocurrency market.

Altcoins, including Ethereum (ETH) and Ripple (XRP), are signaling a modest bullish trend ahead of the weekend, supported by stable retail demand. Ethereum is holding above $3,900, while XRP is trading around $2.45 at the time of writing.

Data spotlight: Bitcoin bulls build on retail demand

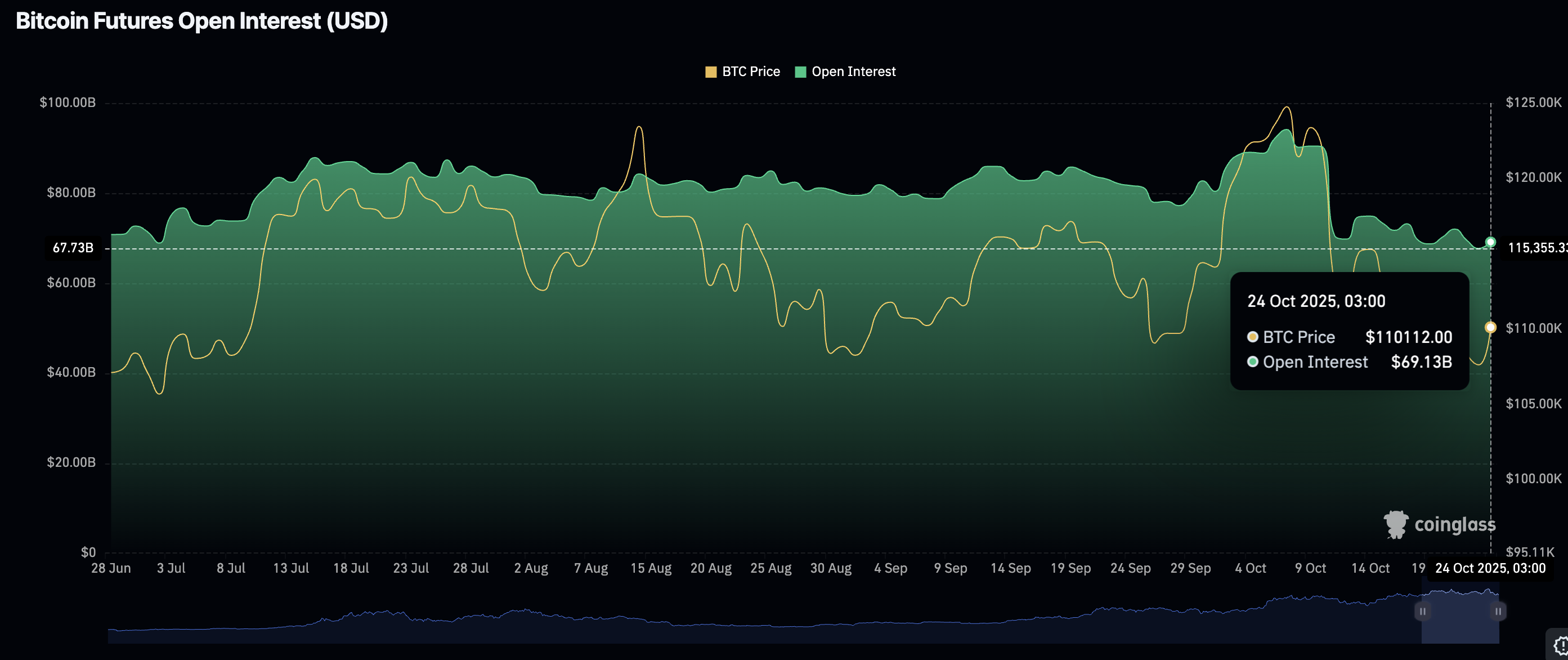

The Bitcoin derivatives market has stabilized over the last two weeks, following the largest deleveraging event on October 10, which liquidated $19 billion in crypto assets. BTC's futures Open Interest (OI) averages at $69 billion, down from approximately $90 billion on October 10. This also marks a slight improvement in futures demand from a low of $67.70 billion posted on Thursday, underpinning stable retail demand.

OI refers to the notional value of outstanding futures contracts; hence, a steady increase is key to sustaining a recovery in Bitcoin's price. It shows that traders are increasing risk exposure, anticipating stability and short-term price increases.

Bitcoin Futures Open Interest | Source: CoinGlass

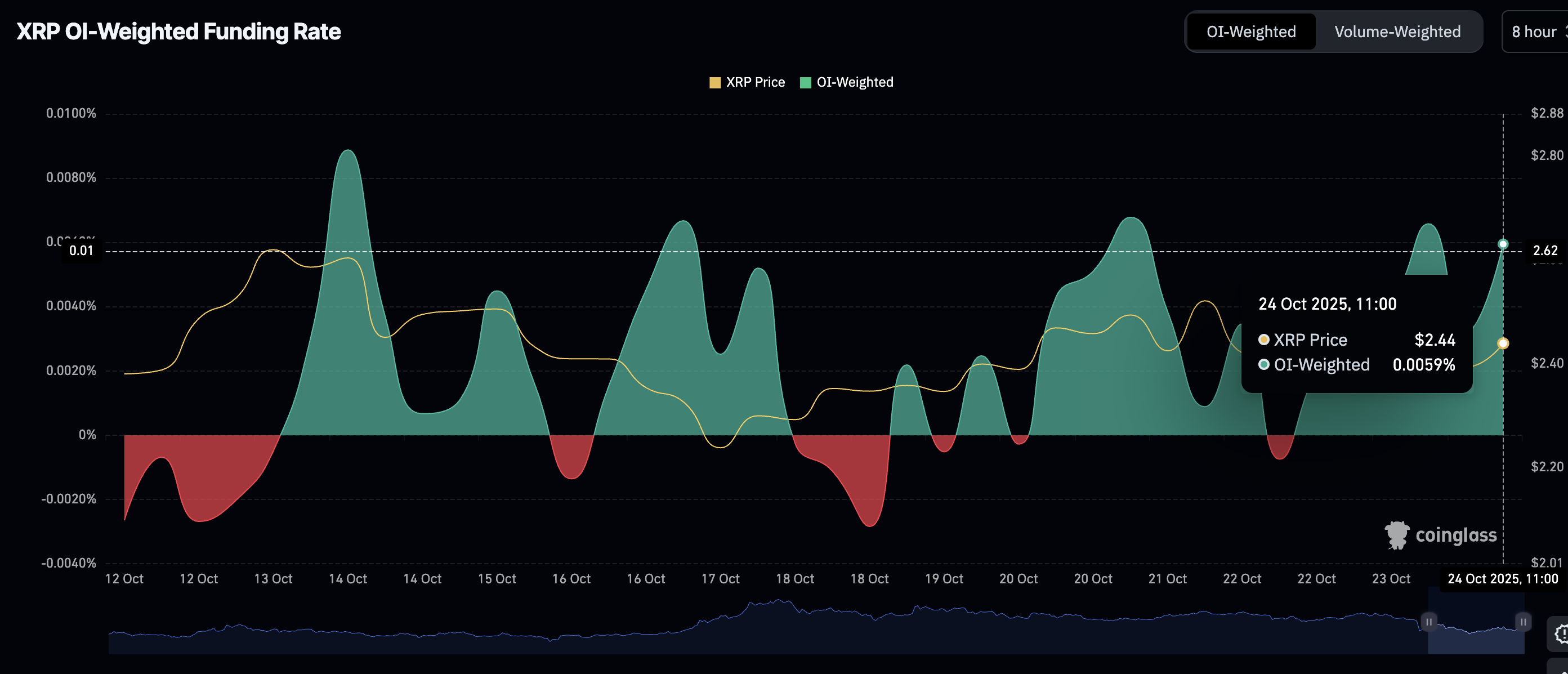

XRP, on the other hand, has seen a sharp rebound in the OI-weighted funding rate to 0.0059% on Friday from 0.0032% on Wednesday. The OI weighted funding rate tracks the level of trader interest in XRP. A sustained increase signals that traders are confident about rejoining the market, piling into long positions, which strengthens the token's short-term bullish picture.

XRP OI Weighted Funding Rate | Source: CoinGlass

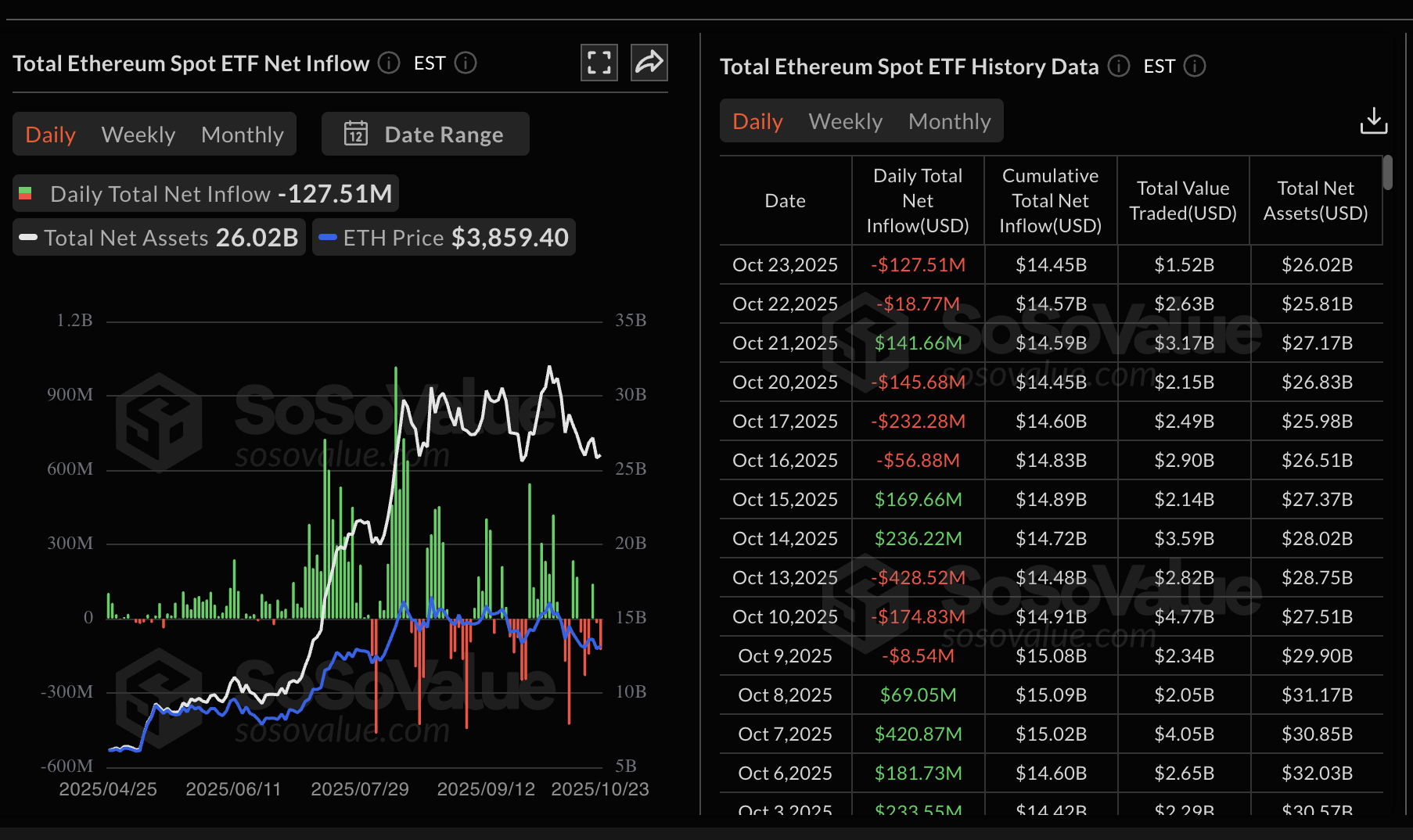

As for Ethereum, institutional interest remains significantly suppressed, as evidenced by the $128 million in outflows from Exchange Traded Funds (ETFs) on Thursday. None of the nine US-based ETH ETFs saw inflows, with Fidelity's FETH posting $77 million in outflows, followed by BlackRock's ETHA with $23 million.

Apart from Tuesday's net inflow of $142 million, Ethereum ETFs have experienced steady outflows every business day since October 16, underscoring the lack of conviction in the asset's short-term recovery.

Ethereum ETF stats | Source: SoSoValue

Chart of the day: Bitcoin extends recovery

Bitcoin is stretching its up leg above $111,000 at the time of writing, as risk appetite slowly returns in the cryptocurrency market. The Relative Strength Index (RSI) bullish crossover and position at 47 on the daily chart indicate that the bullish momentum is poised to increase.

Traders should also watch for a potential buy signal from the Moving Average Convergence Divergence (MACD) indicator in the same daily range, which would encourage investors to increase risk exposure and contribute to buying pressure. A buy signal occurs when the blue MACD line crosses and closes above the red signal line, as the indicator generally trends higher.

Bulls are targeting a daily close above the 100-day Exponential Moving Average (EMA) at $112,675 and the 50-day EMA at $113,352 to ascertain the bullish momentum heading into the weekend.

BTC/USDT daily chart

Still, investors should be cautiously optimistic, particularly amid the ongoing trade standoff between the United States (US) and China. Profit-taking could cut the uptrend short, leading to a reversal below $110,000. The 200-day EMA at $108,113 is in line to absorb selling pressure if decline accelerates.

Altcoins update: Ethereum, XRP edge higher

Ethereum is slowly gaining momentum toward the $4,000 mark while bulls battle resistance at the 100-day EMA at $3,964. This is the second day of steady recovery, as bulls work to regain control.

The RSI moves to 45, backing the short-term fading of bearish momentum. A sustained movement above the midline would reinforce the bullish grip, increasing the odds of a breakout past the $4,000 level.

The MACD indicator might confirm a buy signal in upcoming sessions if the blue line crosses above the red signal line. This signal calls on investors to increase risk exposure, thus building momentum.

Still, if traders book early profits, a correction could follow. Therefore, traders should not lose sight of key levels such as the $3,680 demand area and the 200-day EMA at $3,575, both of which will serve as support.

ETH/USDT daily chart

As for XRP, bulls are taking intraday control of the trend, propelling the price above $2.45 at the time of writing. The RSI at 43 and rising on the daily chart supports the short-term bullish momentum, with a breakout above the 200-day EMA at $2.61 in focus.

Meanwhile, the MACD indicator is confirming a buy signal, prompting traders to increase exposure in upcoming sessions.

XRP/USDT daily chart

Still, traders must be cautiously optimistic as sentiment remains shaky in the broader cryptocurrency market. Any signs of a weak technical outlook could lead to rushed profit-taking, increasing the odds of a reversal toward support at $2.40 and $2.18, tested over the past week.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.