Ripple Price Forecast: XRP at crossroads on mixed signals, Fed optimism

- XRP remains above $3.00, underpinned by growing optimism for a Federal Reserve interest rate cut.

- XRP exchange outflows surge, backing short-term bullish potential, but rising exchange reserves signal potential selling pressure.

- The 50-period EMA provides short-term support on the 4-hour chart above the crucial $3.00 level.

Ripple (XRP) trades above the crucial $3.00 level on Wednesday as the broader cryptocurrency market awaits the United States (US) interest rate decision. A favorable outcome for crypto markets would mean a 25-basis-point rate cut by the Federal Reserve (Fed), which could support XRP’s bullish potential and potentially lead it toward its record high of $3.66, reached on July 18.

Assessing XRP’s short-term bullish potential

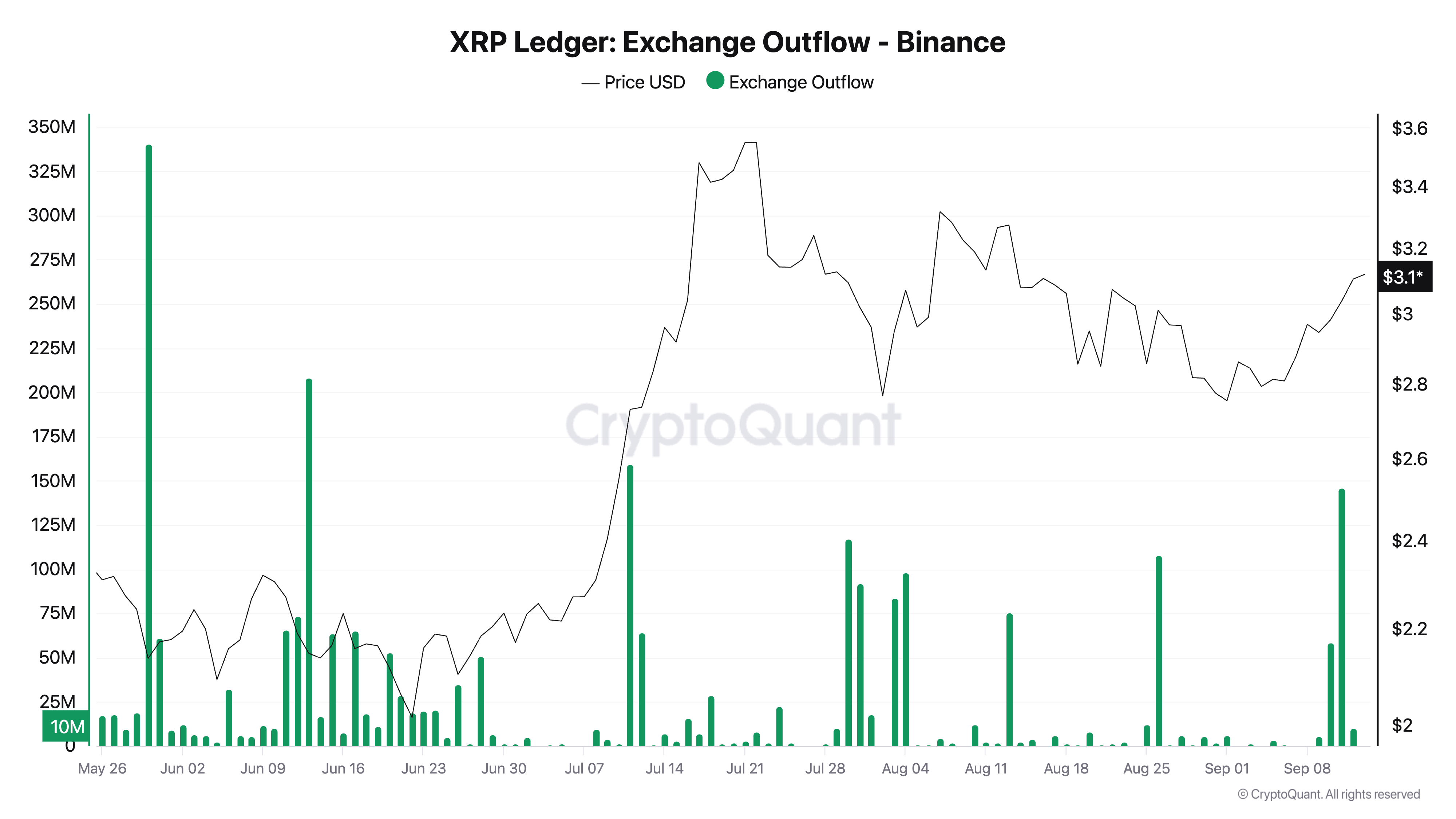

Some on-chain metrics, such as Exchange Outflows (Binance), support the bullish case for the cross-border money remittance token. According to CryptoQuant data, holders are aggressively withdrawing XRP from Binance, opting for self-custody of their assets.

Approximately 146.3 million XRP was drawn from the exchange on September 11, compared to subdued outflows since August 27. This represents a bullish trend, reflecting investor confidence in the ecosystem and XRP’s potential to sustain a recovery toward its all-time high.

XRP Exchange Outflows - Binance | Source: CryptoQuant

Still, traders must temper their bullish expectations following a sudden increase in the Exchange Reserve metric (Binance). According to CryptoQuant data, the balance of XRP on exchanges averaged at 3.6 billion coins on September 12, compared to 2.9 billion coins on August 31.

Holders deposit into exchanges when they intend to trade or sell crypto assets. The surge in exchange balances implies potential selling pressure. Therefore, traders must be cautious, despite the bullish potential, as gains could be quickly snuffed out by investors selling to realize profits.

-1758119360722-1758119360722.png)

XRP Exchange Reserves - Binance | Source: CryptoQuant

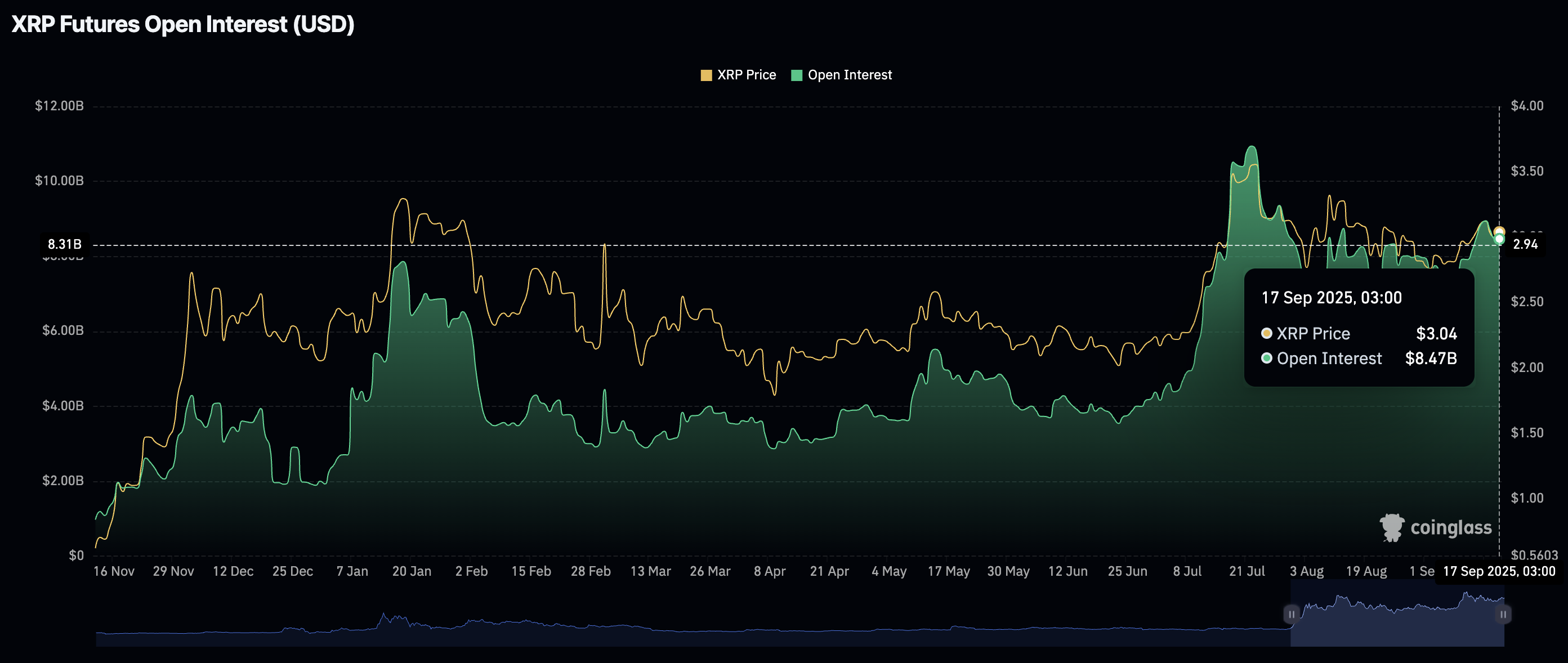

Meanwhile, retail demand for XRP remains relatively high, with the futures Open Interest (OI) averaging at $8.47 billion on Wednesday, up from $7.37 billion on September 7.

XRP Futures Open Interest | Source: CoinGlass

A steady OI, referring to the notional value of outstanding futures contracts, indicates that more traders are betting on short-term price increases in XRP. As risk-on sentiment improves, the path of least resistance remains upward, increasing the chances of the XRP price breaking out to its record high of $3.66.

Technical outlook: XRP holds a bullish structure, but downside risks persist

XRP remains above the $3.00 level, with the 50-period Exponential Moving Average (EMA) at $3.01, providing additional support. A minor reversal of the Relative Strength Index (RSI) to 49 on the 4-hour chart supports XRP’s short-term bullish potential.

A bullish reversal above the next key hurdle at $3.18, which was last tested on Saturday, would boost the chances of a bullish outcome toward the round-number supply area of $3.50 and the record high of $3.66.

XRP/USDT daily chart

Conversely, XRP is not out of the woods yet, and declines below $3.00 are still on the cards. With the Fed likely to cut interest rates by 25 bps, attention could shift to the Chair Jerome Powell’s remarks after the meeting.

Investors would be waiting to see the central bank’s outlook for the remainder of the year and whether further rate cuts are expected. In the event of a hawkish stance, which could dampen the macro outlook, traders should also prepare for a short-term correction, likely to bring the 100-day EMA at $2.98 and the 200-day EMA at $2.96 within reach.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.