Gold treads water with US NFP and US-China trade talks in focus

- Gold ticks up as US-China trade talks ease market fears, limiting safe-haven demand.

- Eurozone Retail Sales and GDP data beat forecasts, but attention remains on Friday’s NFP employment report.

- Gold awaits a fresh catalyst for the next move as psychological support firms at $3,350.

Gold (XAU/USD) has fallen back into a narrow range of consolidation on Friday, trading around $3,363 at the time of writing and with Investors remaining on high alert ahead of the Nonfarm Payrolls (NFP) report release.

The NFP data is expected to show that 130,000 jobs were created in the US labour market in May, down from 177,000 in April and the Unemployment Rate is likely to remain unchanged at 4.2%.

If the US labour market shows clear signs of weakness, the Federal Reserve (Fed) may consider cutting interest rates in July, which could support demand for Gold as it has an inverse relationship with rates.

Trade and tariff developments continue to sway Gold prices

Friday’s focus remains on the ongoing trade discussions between the US and China, following the positive phone call between US President Donald Trump and Chinese President Xi Jinping on Thursday, where they agreed to restart high-level economic talks. The agenda includes resolving tariff disputes and improving relations, but there's skepticism among investors about how much progress will be made. This, coupled with the uncertainty around US-Mexico tariffs, could keep market sentiment cautious, supporting Gold prices.

If trade disputes intensify or fail to find a resolution, it could lead to an economic slowdown, weaker equity markets, and increased demand for safe-haven assets, such as Gold.

Gold daily digest: Trade talks, interest rates, and the economic outlook

- Economic data released from the Eurozone this morning shows that Gross Domestic Product (GDP) exceeded analyst forecasts for the first quarter on both a monthly and annual basis. GDP grew by 0.6% quarter-over-quarter (QoQ), exceeding estimates of 0.4%. Year-over-year (YoY) figures showed a 1.5% rise, also above estimates of 1.2%.

- Eurozone’s Retail Sales rose by 2.3% YoY, above the 1.4% estimate, while the monthly reading was in line with expectations of a 0.1% rise.

- On Thursday, the European Central Bank (ECB) cut its interest rate by 25 basis points (bps), a move that was already priced into the market. ECB President Christine Lagarde suggested that the rate-easing cycle may be nearing its end in the short term.

- According to the CME FedWatch Tool, market participants expect the Fed to leave interest rates unchanged within the current 4.25% to 4.50% range at the June 18 meeting. However, the release of NFPs may impact the prospects of whether the Fed will cut rates in July or September. The current probability of a 25 bps rate cut in July is 33.9% at the time of writing, with a 75% likelihood of interest rates being lower than current levels in September.

- The ADP Employment report, which was released on Wednesday, disappointed to the downside, with the private sector adding 37,000 jobs in May, below analyst expectations of a 115,000 increase.

- Thursday’s Jobless Claims data also provided signs of a slowdown in the strength of the US labour situation, with Initial Claims rising to 247,000 last week, above analyst estimates of a 235,000 rise.

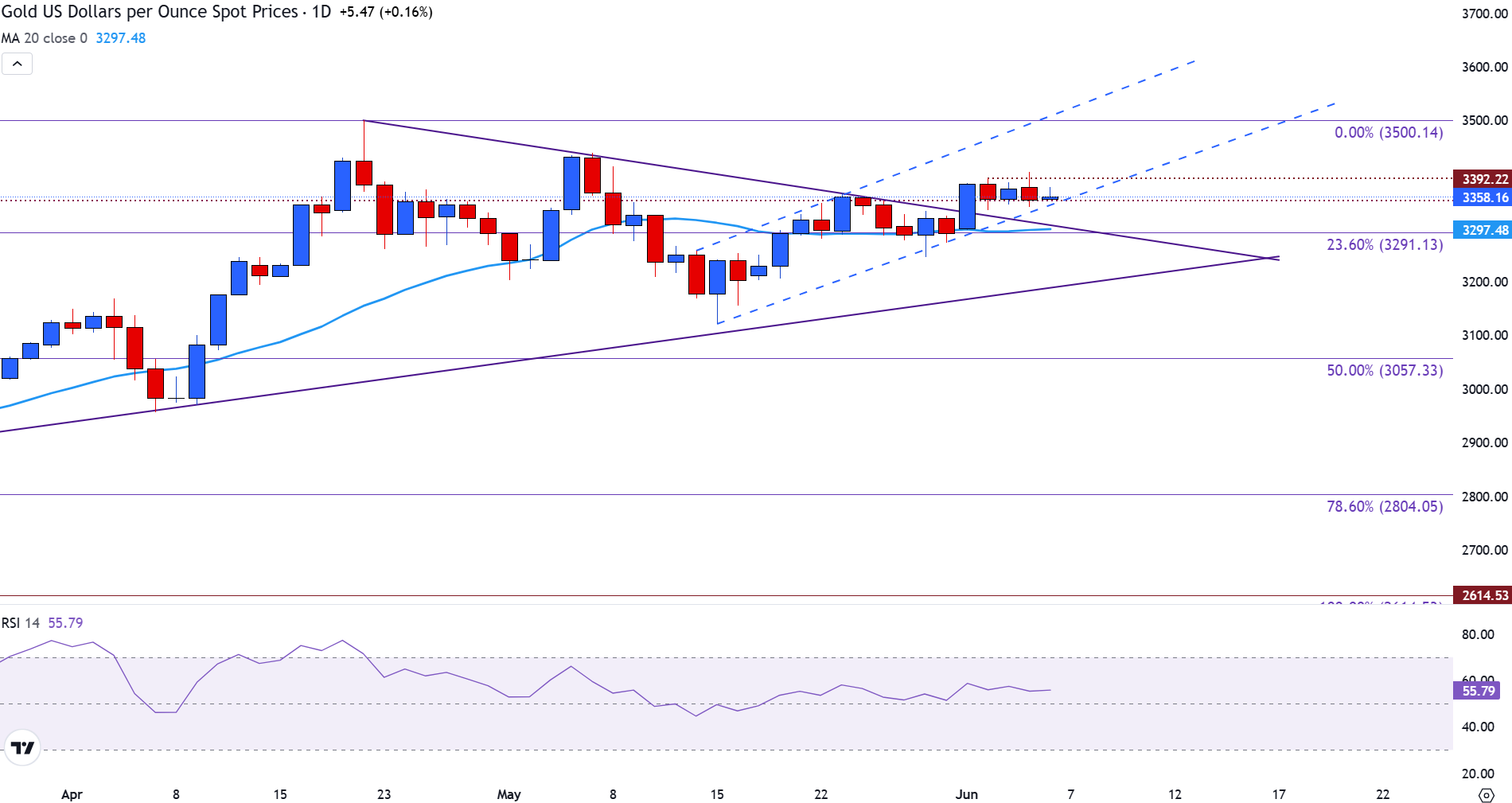

Gold threatens rising channel support

Gold is trading within a narrow range for the last four days, holding above the $3,350 level since XAU/USD recovered above it on Monday.

With a rising channel forming since the May 15 low, the price is currently nearing the lower bound of the pattern, providing imminent support at $3,360. Below that, the $3,350 psychological level remains firm, a break of which could see a move to the 20-day Simple Moving Average (SMA) at $3,297.

Meanwhile, as the Relative Strength Index (RSI) remains above the neutral zone in the daily chart, a reading of 56 suggests that bullish momentum has not entirely faded.

Gold daily chart

For an upside move, the Gold price has a few technical hurdles to clear. The $3,392 resistance level has limited the bullish potential throughout the week, followed by the $3,400 psychological level. If bulls clear this zone and bullish momentum gains traction, a move toward the April all-time high at $3,500 may be possible.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Jun 06, 2025 12:30

Frequency: Monthly

Consensus: 130K

Previous: 177K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.