EUR/GBP pressured on speculation the ECB is sharpening its sword

- EUR/GBP stays pressured at two-year lows on speculation the ECB could slash interest rates before year-end.

- Lower interest rates would reduce foreign capital inflows, weighing on the Euro.

- The Pound holds its ground despite weak PMI data and mildly dovish comments from BoE Governor Bailey.

EUR/GBP trades at two-year lows in the 0.8320s on Thursday, having fallen a quarter of a percent on the day mainly due to a softer Euro (EUR). The Single Currency is falling as a result of increasing market speculation that the European Central Bank (ECB) will have to cut interest rates more aggressively – and to a lower base – than previously expected, to avert a hard landing for the Eurozone economy.

The Pound Sterling (GBP), meanwhile, remains stable due to the relatively high 5.00% bank rate of the Bank of England (BoE) which now stands out as one of the highest in the G10, and acts as a magnet to capital. In addition, the BoE is not expected to cut interest rates at the same pace as most other leading central banks, suggesting this could favor the Pound into the end of 2024.

EUR/GBP declines as markets revise outlook for Eurozone

EUR/GBP is losing ground on Thursday and lies at multi-year lows as the Euro weakens against the Pound Sterling.

The catalyst for this weakness stems from a surprise drop in Eurozone economic data, in particular inflation. Headline inflation in the Euro Area was revised down to 1.7% in September from its 1.8% preliminary estimate, and fell below the ECB’s 2.0% target for the first time in over three years, according to recent data from Eurostat. The surprise fall provided the catalyst for speculation the bank might need to cut interest rates more aggressively than previously expected.

A Reuter’s story on Wednesday added fuel to the fire after it reported that the ECB was considering cutting interest rates to below the “neutral” rate. The neutral rate, also known as the “equilibrium level” of interest rates, is a theoretical level at which inflation should remain unchanged. The story added to speculation the ECB was sharpening its sword and led investors to sell the Euro.

EUR/GBP Daily Chart

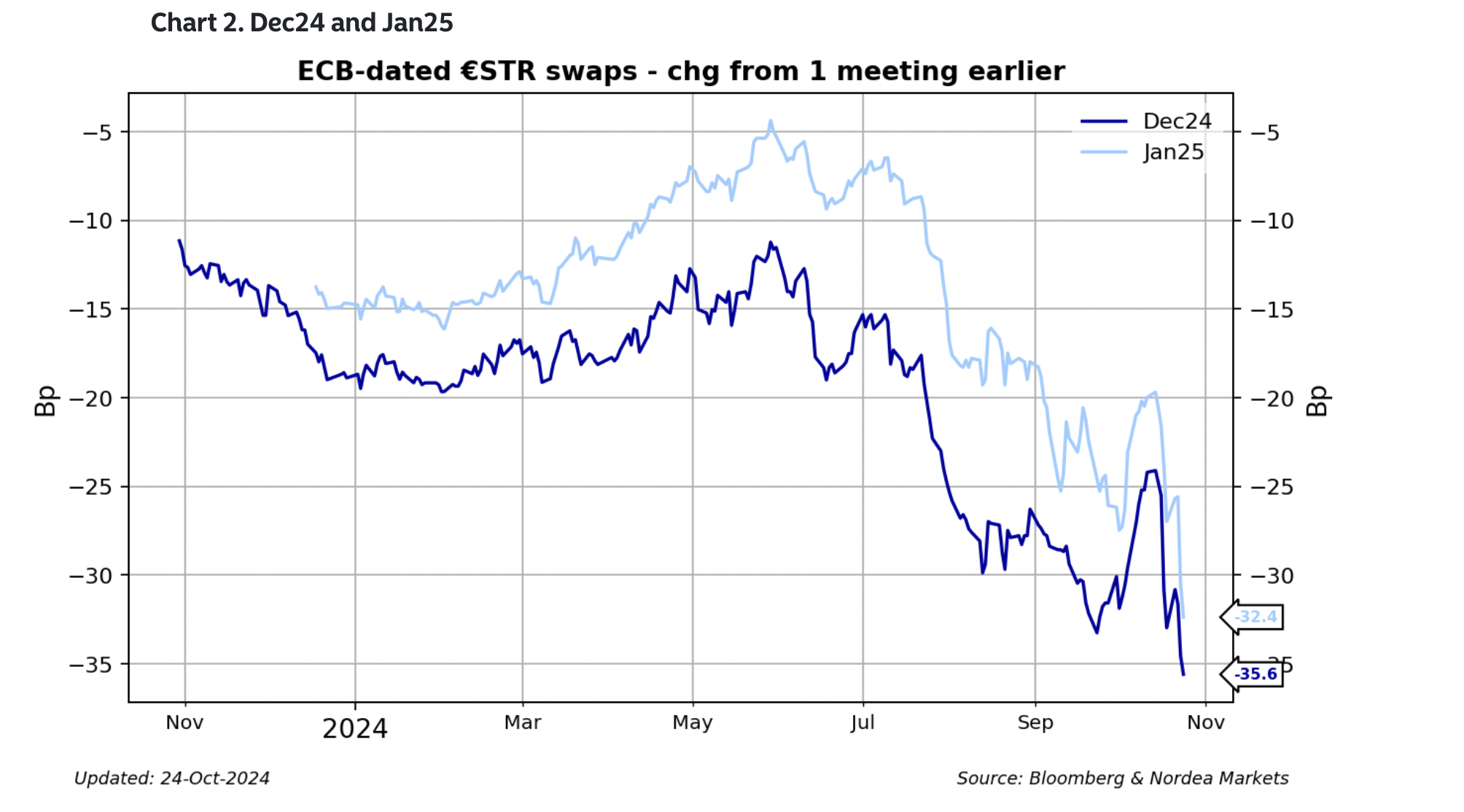

“Rates are falling significantly as markets are pricing a higher probability of the ECB going for a 50 bps rate cut in December,” said Andres Larsson, Senior FX Analyst at Nordea Bank, adding, “..and a higher probability of the ECB eventually cutting rates to below neutral,”

According to Larsson, the market is pricing in “-35.6bp for the December ECB meeting and -32.4bp for the ECB meeting on 25 January.” This is substantially higher than a few weeks ago.

Eurozone data out on Thursday failed to quell speculation. Mixed preliminary October PMIs revealed Manufacturing activity rising but still in contraction territory (below 50) at 45.9 vs. 45.1 expected. The Services PMI dipped to 51.2 vs. 51.5 expected and 51.4 in September.

“Today’s PMIs were more or less in line with expectations, although the employment component dropped below 50, pointing to the risk of rising unemployment ahead,” said Larsson.

Employment and wages could be a key determining factor for whether the ECB decides to go for a “Christmas slasher” or not.

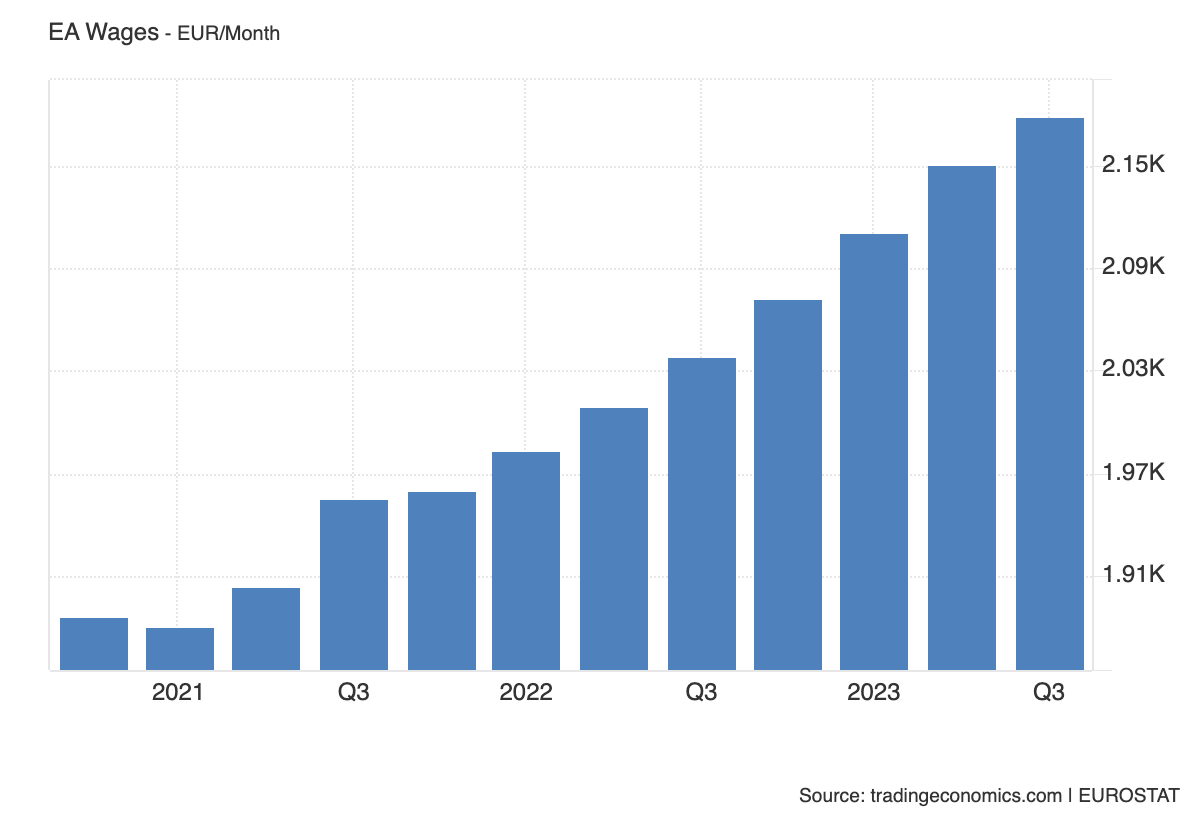

The ECB’s Chief Economist Philip Lane has said that wage inflation is likely to stay elevated in the second half of 2024 and contribute to higher broad inflation during the period before falling in 2025.

According to Q2 Wage Growth data, Eurozone wages rose 4.5% which, though lower than the 5.2% in the previous quarter, remained high. There is still no data for Q3, however, but the Eurozone Average Monthly Wage continues to rise quite strongly, reaching EUR 2,180 in September.

EUR/GBP at historic lows as Pound stands firm despite weak data

Sterling, meanwhile, remains firm despite weaker-than-expected UK PMI data for October. This showed Manufacturing PMI falling to 50.3 vs. 51.5 expected and actual in September, and Services PMI at 51.8 vs. 52.4 expected and actual in September. The data could limit gains for the EUR/GBP pair.

“The weak PMI print along with the sharp slowdown in inflation raise the likelihood the BoE dials up its easing cycle, which can further curtail GBP upside momentum on the crosses,” said Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman (BBH).

The Consortium of British Industry (CBI) October distributive trades survey was also softer than expected. CBI Total orders came in at -27 vs. -28 expected while selling prices came in at 0 vs. 9 expected and 8 in September. “Most importantly, its quarterly measure of business optimism came in at -24 vs. -5 expected and -9 in July and is the lowest since October 2022,” said Haddad.

In a recent speech, BoE Governor Andrew Bailey struck a mildly dovish chord after saying that “disinflation is happening I think faster than we expected it to, but we have still genuine question marks about whether there have been some structural changes in the economy.”

At the same time Bailey did not reiterate the need for a more “activist” and “aggressive” stance on cutting interest rates as he had done in a previous speech. Markets took the view that this meant Bailey acknowledged he had overstepped the mark in the previous comments and that he was trying to steer the ship back to a more “cautious” approach. As such, Sterling held its ground.