Crypto Today: BTC price at $84K, Tether tops Canada for US Treasuries as SUI and Tron lead $50B altcoin rally

- Cryptocurrencies’ aggregate valuation surges 1.7% on Friday, pulling in $47 billion of inflows despite BTC price downturn.

- Bitcoin price trades below the $84,000 mark with bulls deploying support strategies to prevent major liquidations.

- Besides BNB, top-five ranked altcoins including ETH, XRP and SOL posted losses, signaling rotation of funds toward low-cap assets.

Bitcoin market updates:

Bitcoin price tumbles below $84,000 on Friday as investors rotated funds toward altcoins.

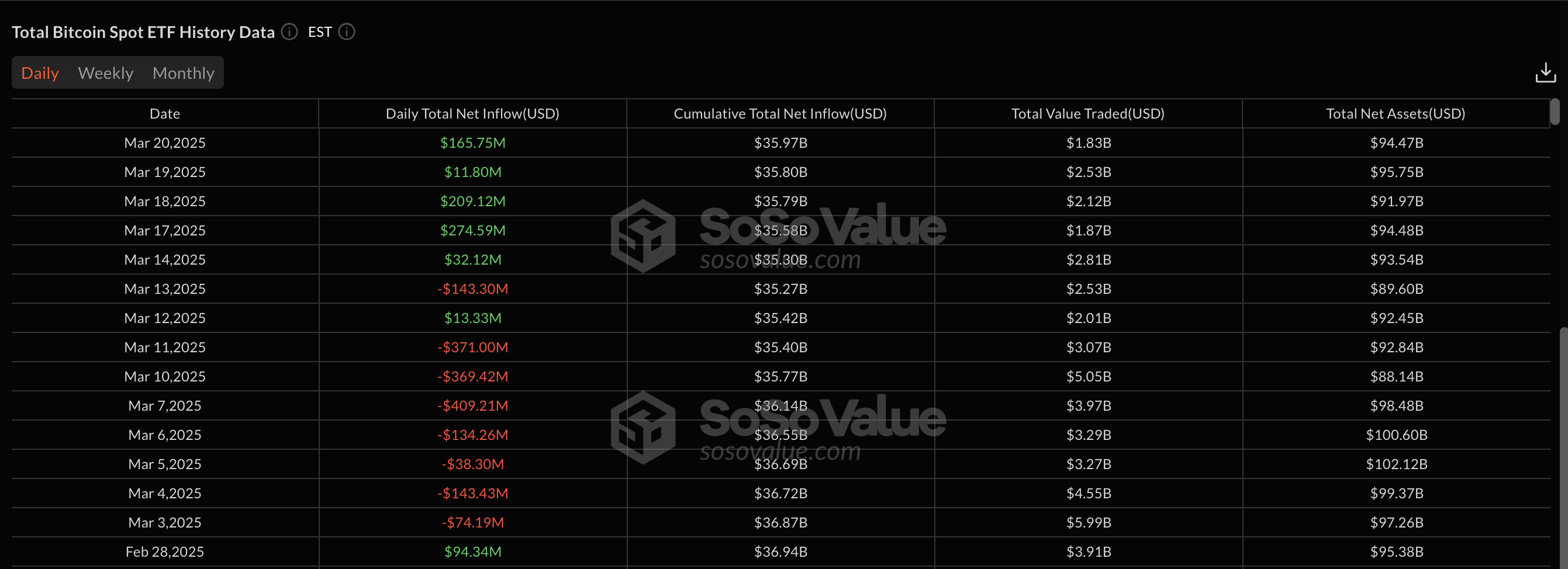

Bitcoin ETFs saw another $165 million outflows on Thursday, extending its consecutive days of inflows to four days, dating back to last Friday.

Bitcoin ETF Flows, March 20 | SosoValue

During this period, BTC ETFs have invested over $680 million. Notably, Bitcoin ETFs have not posted a four-day buying streak since January.

The recent trading patterns suggest US corporate investors continue to make strategic accumulations rather than taking profits after booking mild gains when BTC price hit $85,900 on the positive impact of the US Fed rate pause announced on Wednesday.

Altcoin Market Updates: XRP, SOL, ETH trade sideways as investors lean toward low caps

The global cryptocurrency market currently stands at $2.79 trillion, reflecting a 1.74% increase over the last 24 hours.

Despite the uptick in overall market capitalization, investor sentiment remains cautious with the Fear & Greed Index registering at 31 (Fear).

Meanwhile, Bitcoin dominance continues to hold firm, but the Altcoin Season Index at 21/100 suggests that the market is still favoring BTC over alternative assets.

Tron and SUI led gainers among the top-20 ranked assets, posting 3% gains, respectively.

Limited upside amid low-cap rotation

Despite the broader market’s modest gains, leading altcoins have struggled to gain momentum.

Ethereum (ETH) is trading at $1,966.41, showing a 1.24% decline over the past 24 hours but maintaining a 3.36% weekly increase.

XRP currently sits at $2.38, down 4.13% on the day, while Solana (SOL) is priced at $126.45, reflecting a 3.37% daily drop.

Crypto market performance, March 20 | Source: Coinmarketcap

In contrast, lower-cap altcoins have led the day’s gains, signaling a shift in investor focus away from large-cap assets. The underperformance of major altcoins suggests that traders may be reallocating funds into smaller, high-growth assets, as recent regulatory wins and the latest US Fed rate decision boosted risk-on appetite.

Crypto news updates:

-

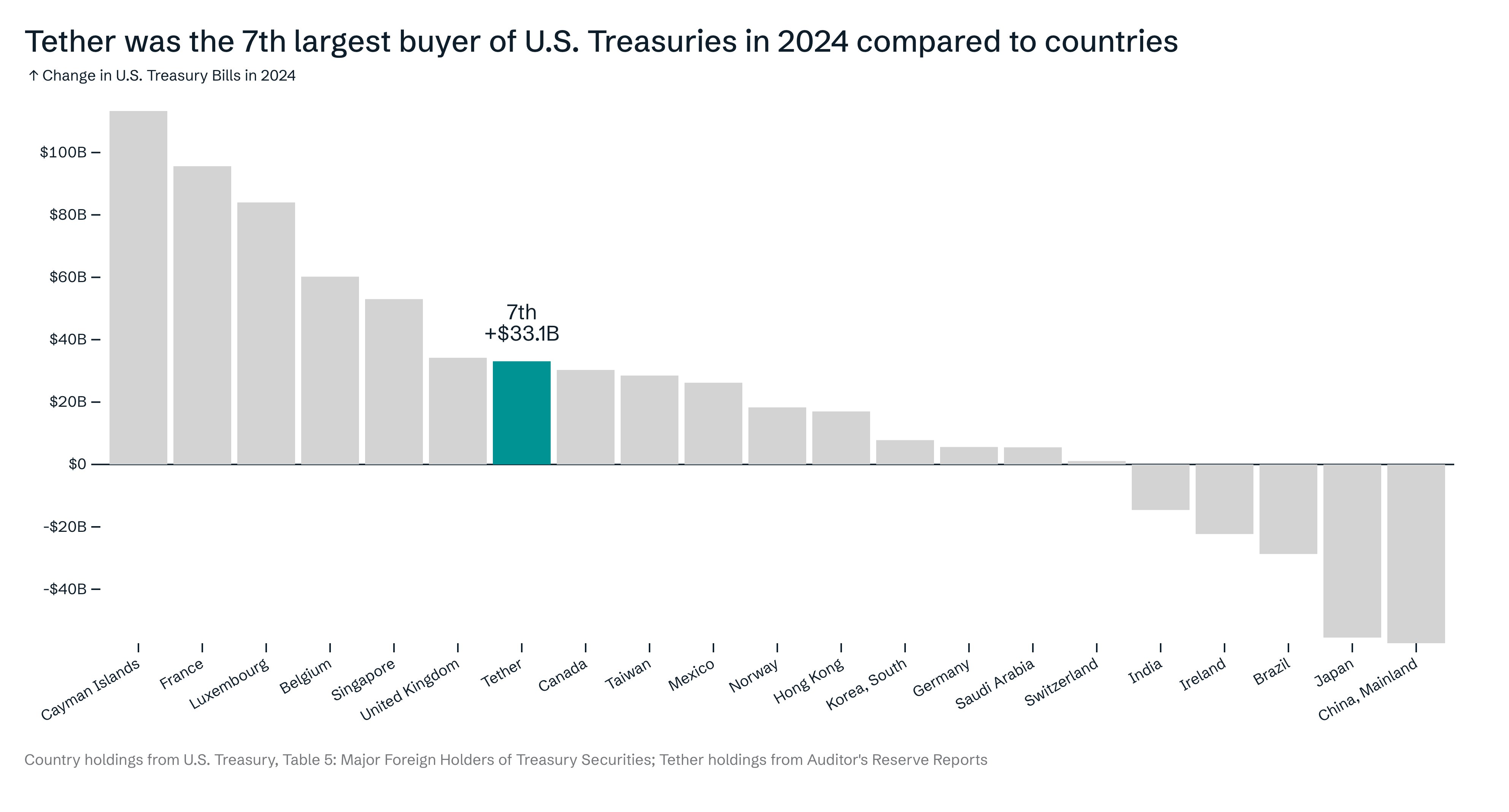

Tether surpasses Canada in US Treasury holdings, ranks seventh globally

Tether (USDT), the world’s largest stablecoin issuer, has emerged as the seventh-largest buyer of US Treasury bills in 2024, surpassing Canada in total holdings.

According to data compiled from US Treasury reports and Tether’s auditor reserve disclosures, the company added $33.1 billion in US Treasuries.

USD Treasury Holdings by Entity, Source: Tether

The report comes just a day after US President Trump advocated for stablecoin regulations during his speech at the Blockwork’s Digital Asset summit on Thursday.

-

Metaplanet appoints Eric Trump to strategic advisory board

Tokyo-based Metaplanet, Japan's largest corporate Bitcoin holder, has appointed Eric Trump to its newly established Strategic Board of Advisors.

Eric Trump, son of US President Donald Trump, is known for his advocacy of blockchain technology and brings expertise in finance and brand development to the firm.

Metaplanet appoints Eric Trump | March 21, 2025

Metaplanet appoints Eric Trump | March 21, 2025

Metaplanet's Representative Director, Simon Gerovich, stated that Eric Trump's appointment aims to bolster the company's Bitcoin-focused growth and innovation strategies. This move aligns with Metaplanet's goal to expand Bitcoin adoption and strengthen its position in the cryptocurrency market.

-

Trump Media executives launch $179M SPAC targeting crypto and data security firms

Executives from Trump Media & Technology Group have launched Renatus Tactical Acquisition Corp I, a special purpose acquisition company (SPAC) aimed at acquiring a US-based firm in cryptocurrency, blockchain, data security or dual-use technology.

The SPAC, incorporated in the Cayman Islands, has filed a registration statement with the Securities & Exchange Commission (SEC) outlining its plan to raise $179 million through an initial public offering and private placement.

Renatus is led by key figures tied to Trump Media, including CEO Eric Swider, Trump Media board chair Devin Nunes, and COO Alexander Cano.