Crypto Today: ETH, ADA and XRP traders panic ahead of Mt. Gox’s $930M BTC repayments

- Cryptocurrencies market capitalization falls to $2.75 trillion as it declines by another 4% on Tuesday.

- Ethereum, Dogecoin and Chainlink emerge as top losers among the 20 largest assets.

- A $930 million Bitcoin transaction from wallets linked to the defunct Mt. Gox exchange sparked major concerns.

- Bitcoin seller fatigue triggers a rebound above $80,000, snapping a rut of 15% losses in five consecutive days.

Bitcoin market updates:

- Bitcoin price fell to record lows around $76,606 on Tuesday before rebounding 8% to retake the $82,000 level at midday US trading session.

- The Bitcoin market wobbled after wallets linked to the defunct Mt. Gox exchange transferred 11,335 BTC worth approximately $930 million. This sparked major concerns that a major sell-off could be imminent as the deadline for repayment to creditors approaches

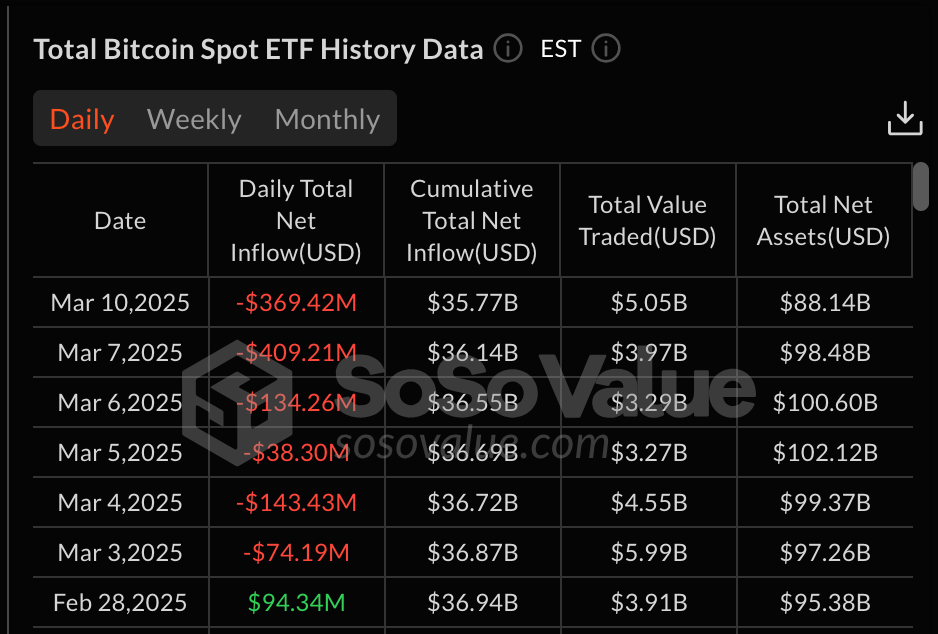

Bitcoin ETF Flows, March 2025 | Source: SosoValue

- Bitcoin ETFs saw withdrawals of $369 million on Tuesday, marking six consecutive days of outflows since the start of March.

Chart of the day: Crypto spot vs derivatives market analysis

Zooming out, the broader crypto market saw a 3.9% decline in total capitalization, reflecting increased volatility as Bitcoin hovered near $83,176.

-638773202543565622.png)

Crypto Spot vs Derivatives Market Analysis

Despite strong spot trading volumes across major altcoins, derivatives data suggests divergence in sentiment, with some assets showing strength while others face short pressure.

Altcoin market update: Spot and derivatives markets data flashing mixed signals

Altcoin trading metrics markets exhibited mixed signals on Tuesday, with Ethereum (ETH), Cardano (ADA), and Ripple (XRP) taking center stage amid speculation surrounding congressional approval for the crypto strategic reserve.

-

Cardano (ADA) gains 10.9% but faces liquidation risks

ADA surged 10.9% in the last 24 hours to $0.7365, outperforming most major altcoins.

Meanwhile, derivative traders show signs of caution—ADA-related liquidations stood at $1.37 million, with a majority being long positions. This signals that the rally may be overextended, increasing the likelihood of a short-term pullback.

- XRP sees 8.7% uptick but short traders remain active

XRP climbed 8.7% to $2.18, maintaining momentum despite broader market turbulence.

But, short positioning remains high, with XRP derivatives witnessing $24.96 million in liquidations. A growing short bias suggests traders anticipate resistance near $2.20, increasing the probability of downward pressure if spot demand weakens.

- Ethereum (ETH) is up 6.81% but struggling for momentum after $140M liquidations

ETH price jumped 6.81% to $1,949.46, attempting to reclaim key technical levels.

However, derivatives data shows $140.57 million in liquidations, with shorts covering a significant portion. While this could signal near-term resilience, failing to hold above $1,950 may see ETH retest $1,900 support.

With $830.8 million in total liquidations over 24 hours and Bitcoin dominance still exerting pressure, altcoin sentiment remains fragile. For sustained upside, assets like ADA, XRP, and ETH will need stronger spot demand to counter the influence of leveraged short positioning.

Crypto news updates:

-

Texas proposes $250 million Bitcoin reserve bill

Texas lawmakers have introduced HB 4258, a bill that would allocate $250 million from the state’s economic stabilization fund to Bitcoin and other digital assets.

If passed, the legislation would take effect in 2025, allowing municipalities and counties to invest up to $10 million in digital assets.

The proposal follows the recent Senate-backed SB 778 and marks Texas’ second major legislative push to establish a state-backed Bitcoin reserve.

The bill is part of Texas’ broader initiative to integrate digital assets into its financial system.

The Texas Blockchain Council highlighted the proposal as a strategic move, aligning with the state’s industrial growth in the Texas Triangle region.

Supporters argue the measure strengthens Texas’ position as a leader in Bitcoin adoption, while critics remain cautious about potential risks associated with state-backed cryptocurrency investments.

Thailand SEC approves Tether’s USDT for regulated trading and payments

Thailand’s Securities and Exchange Commission has officially recognized Tether’s USDT as an accepted cryptocurrency, allowing it to be traded on regulated exchanges and used for payments.

The approval, which takes effect on March 16, 2025, is part of Thailand’s broader efforts to update digital asset regulations and provide greater flexibility for investors and businesses in the sector.

With a market capitalization of $142 billion, USDT is the world’s largest stablecoin, widely used for liquidity and settlement in global markets.

Thailand’s decision to approve USD₮ marks a step toward deeper integration of stablecoins into the country’s financial ecosystem, potentially expanding their role in digital payments and investment strategies.

Starknet to integrate Bitcoin and Ethereum for unified Layer 2 network

Starknet has unveiled plans to create the first Layer 2 solution capable of settling transactions on both Bitcoin and Ethereum.

The initiative seeks to bridge the two largest blockchain ecosystems, allowing Bitcoin to participate in decentralized finance (DeFi) applications while maintaining its core security features. The protocol aims to address Bitcoin’s current limitations, such as high transaction fees and limited smart contract capabilities, by leveraging Layer 2 scaling solutions.

To enable seamless Bitcoin integration, Starknet is developing multiple bridging mechanisms, including federated bridges, a BitVM-powered bridge, and a future trustless bridge.

These solutions are designed to enhance Bitcoin’s functionality beyond a store of value, enabling yield generation and broader DeFi participation.

Starknet emphasized that the initiative will combine both existing and emerging technologies to ensure a secure and efficient Bitcoin-Ethereum interoperability framework.