Bitcoin Price Forecast: BTC edges below $84,000 as US Crypto Strategic Reserve hype fades

- Bitcoin price extends its decline on Tuesday and erases its weekend gains.

- US President Trump’s announcement of the Crypto Strategic Reserve was turned into a short-term “buy the rumor, sell the news” event.

- Economist Peter Schiff called for a Congressional investigation into President Trump’s Truth Social posts.

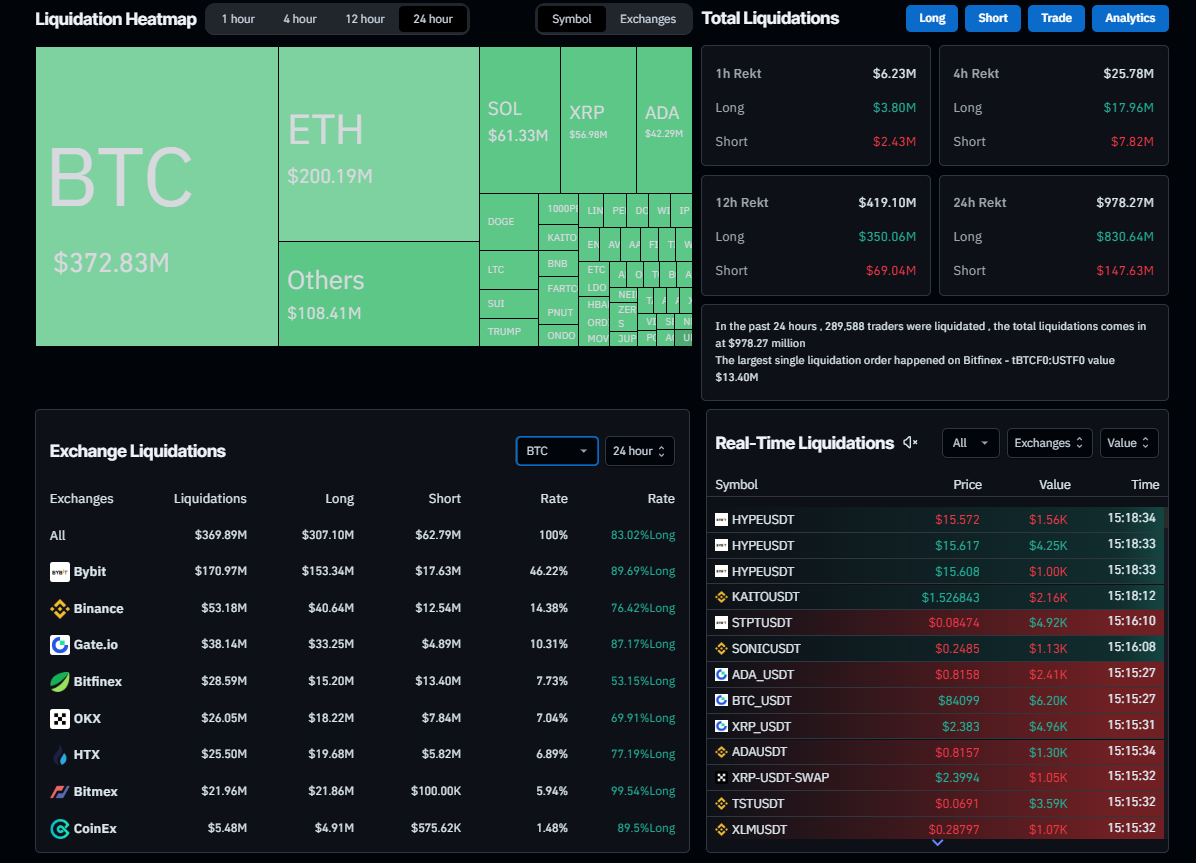

Bitcoin (BTC) price extends its decline on Tuesday, trading around $83,900 and erasing its weekend gains. US President Donald Trump’s announcement of the Crypto Strategic Reserve on Sunday was turned into a short-term “buy the rumor, sell the news” event and wiped 289,815 traders with over $978.62 million in the past 24 hours.

Moreover, Economist Peter Schiff called for a Congressional investigation into President Trump’s Truth Social posts, claiming in his X post on Tuesday that they “helped pull off the biggest crypto rug pull of all time.”

Bitcoin dips below $84,000, wiping near $980 million from leverage traders in 24 hours

Bitcoin price declined more than 8% on Monday, closing at $86,220 and wiping out most of Sunday’s gains. At the time of writing on Tuesday, it continues to trade down at around $83,900.

This recent market downturn has triggered a wave of liquidation, wiping 289,815 traders with over $978.62 million in the past 24 hours. The largest single liquidation order happened on Bitfinex - tBTCF0:USTF0, with a value of $13.40 million, according to Coinglass data.

Liquidation Heatmap chart. Source: Coinglass

QCP Capital’s report on Tuesday highlights that this sell-off was exacerbated by President Trump’s renewed push for tariffs on Canada, Mexico, and China, reinforcing investor concerns over escalating trade tensions.

The report explained that the brief crypto rally following Trump’s Truth Social announcement on Sunday was swiftly erased. The surprise inclusion of Ripple (XRP), Solana (SOL), and Cardano (ADA) tokens in the crypto strategic reserve has divided the crypto community, with the initial euphoria over the project’s merits giving way to deeper scrutiny.

“This downturn could intensify pressure on Trump, especially after the strong support and donations he received from the crypto community during his campaign. Even the SEC’s latest move — pausing and dismissing enforcement cases against crypto firms — failed to stem the sell-off, underscoring broader risk aversion in the market,” says QCP’s analyst.

Moreover, Economist Peter Schiff called for a Congressional investigation into President Trump’s Truth Social posts, claiming in his X post on Tuesday that they “helped pull off the biggest crypto rug pull of all time.”

Schiff continued in his post that Trump orchestrated a “pump and dump scheme” and wanted to know who had advance notice of the posts.

Bitcoin institutional demand weakens

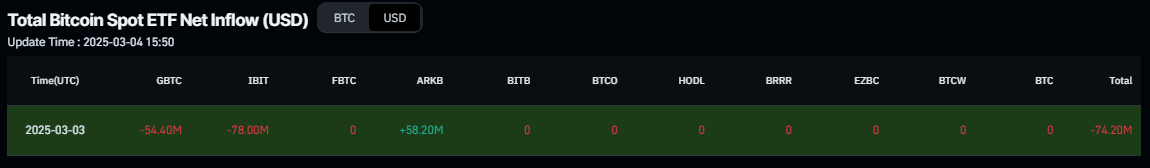

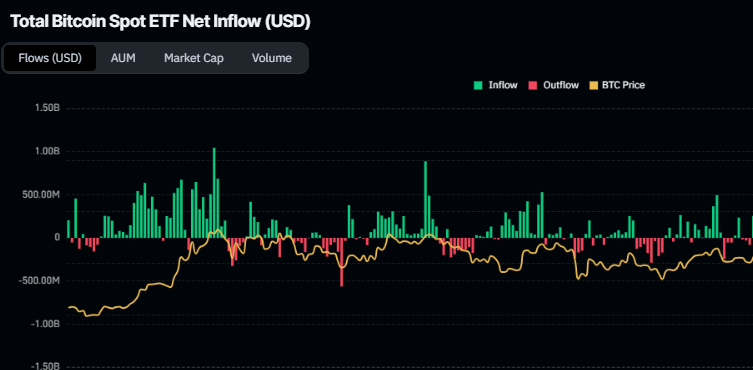

Bitcoin’s institutional demand continues to weaken as the week begins. According to Coinglass, Bitcoin spot Exchange Traded Fund (ETF) data recorded an outflow of $74.20 million on Monday after net outflows of $2.39 billion last week. If the magnitude of the outflow continues and intensifies, the Bitcoin price could see further corrections.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

Bitcoin Price Forecast: Bears take the lead

Bitcoin price recovered sharply during the weekend, rallying almost 12%, and closed above $94,000 on Sunday. However, BTC declined 8.54% on Monday and erased its recent recovery. At the time of writing on Tuesday, it continues to trade down by 2.7% at around $83,900.

The Relative Strength Index (RSI) on the daily chart reads 36 after being rejected from its neutral level of 50 on Sunday, indicating strong bearish momentum.

If BTC continues its downward momentum, it could extend the decline to retest its next support level at $73,000.

BTC/USDT daily chart

However, if BTC recovers, it could extend the recovery to retest its Sunday high of $95,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.