Ripple Price Forecast: XRP risks another 10% plunge as retail demand wobbles

- XRP struggles to hold $2.40 amid growing risk-off sentiment in the broader crypto market.

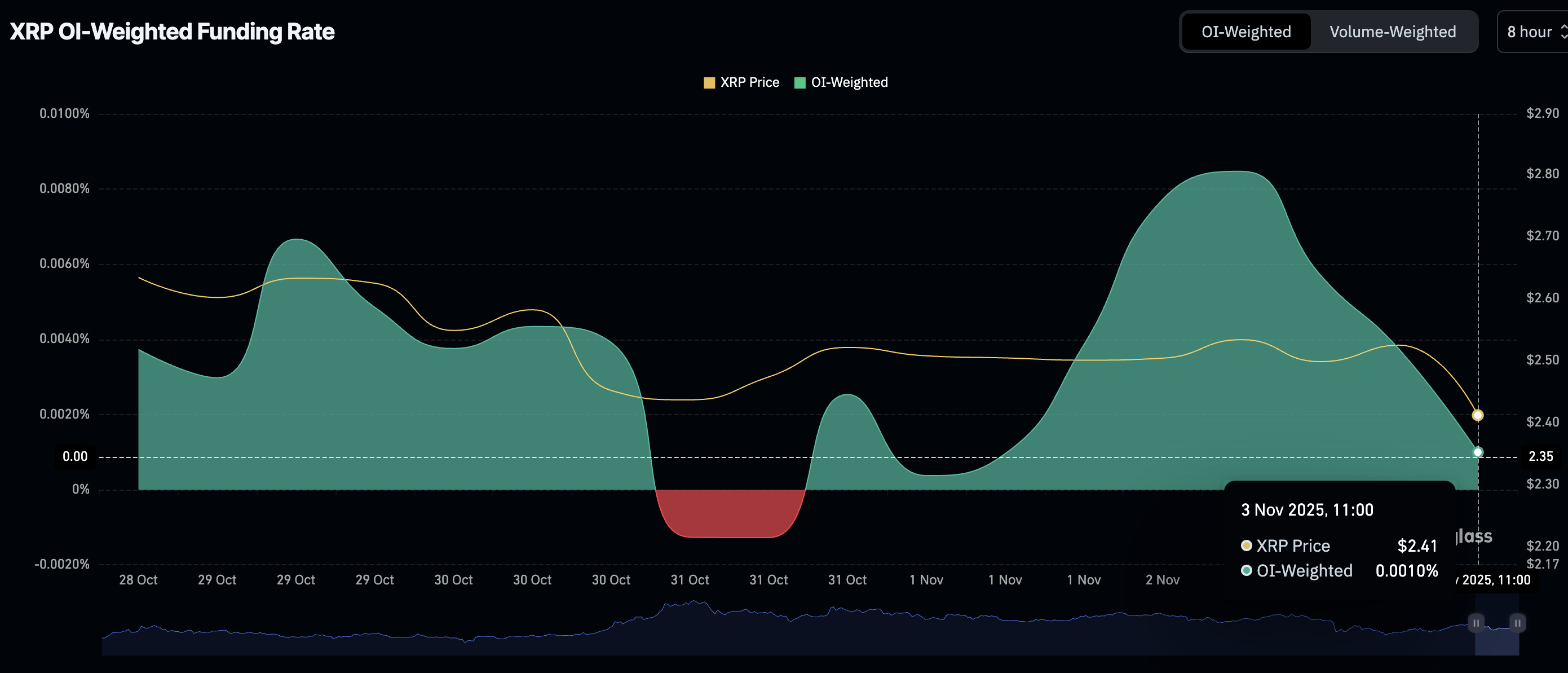

- XRP’s derivatives market remains suppressed, with the Open Interest-weighted funding rate falling sharply to 0.0010%.

- Short-term recovery could be an uphill task, as evidenced by the futures Open Interest’s stability below $5 billion.

Ripple (XRP) recovery remains elusive, trading above $2.40 at the time of writing on Monday. The broader cryptocurrency market is heavily weighed down by risk-off sentiment, triggering a persistent sell-off.

Meanwhile, demand for XRP has remained significantly suppressed since the October 10 sell-off, which saw over $19 billion in crypto assets liquidated on a single day, as evidenced by the weak XRP derivatives market.

XRP extends intraday decline amid low retail interest

XRP highlights a weakening technical structure, worsened by waning retail demand. According to CoinGlass data, the XRP Open Interest (OI), representing the notional value of outstanding futures contracts, averages $4.33 billion at the time of writing, down from $9.09 billion, which marked its peak level in October.

If investors increasingly reduce their risk exposure, the prevailing decline could accelerate toward $2.18, a support area tested on October 17.

XRP Futures Open Interest | Source: CoinGlass

The XRP OI-weighted funding rate holds at 0.0010%, down from 0.0085% on Sunday. This drop suggests traders may be intentionally closing their long positions and piling into short positions, thereby depriving XRP of the tailwind needed to sustain its recovery.

XRP OI-weighted funding rate | Source: CoinGlass

Technical outlook: Assessing XRP price above key support

XRP is largely in bearish hands, testing a short-term support at $2.40 at the time of writing on Monday. The Relative Strength Index (RSI) at 41 and falling toward oversold territory on the daily chart indicates that bearish momentum is increasing.

The Moving Average Convergence Divergence (MACD) indicator on the same daily chart will likely trigger a sell signal in upcoming sessions. Such a signal occurs when the blue MACD line crosses and settles below the red signal line, calling upon investors to reduce their risk exposure.

XRP’s position below key moving averages, including the 200-day Exponential Moving Average (EMA) at $2.60, the 50-day EMA at $2.64 and the 100-day EMA at $2.72, reinforces the bearish outlook.

XRP/USDT daily chart

XRP is also staring at a 10% decline if its immediate support at $2.40 breaks. A daily close below this level may mean a prolonged bearish streak this week. Key areas of interest for traders are the support at $2.18, last tested on October 17, and $1.90, previously tested in June.

Still, traders cannot rule out a knee-jerk trend reversal if support at $2.40 holds, which could encourage investors to buy the dip. Key milestones that could mark the transition from bearish to bullish sentiment include a break above the 200-day EMA at $2.60, the 50-day EMA at $2.64, the 100-day EMA at $2.72 and the descending trendline, which has been in place since XRP achieved its new all-time high of $3.66 in July.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.