Ethereum Price Forecast: ETH rises 5% as Fusaka upgrade goes live on Holesky testnet

Ethereum price today: $4,320

- Ethereum's Fusaka upgrade has finalized on the Holesky testnet, bringing its mainnet launch a step closer.

- Fusaka features 12 EIPs, including PeerDAS, which aims to reduce costs and boost throughput on Layer 2 networks.

- ETH has cleared a descending trendline resistance and is aiming to test the 50-day SMA.

Ethereum (ETH) sees a 5% gain on Wednesday after its next major upgrade, Fusaka, finalized on the Holesky test network (testnet), bringing its mainnet launch a step closer.

Fusaka launches successfully on Holesky testnet

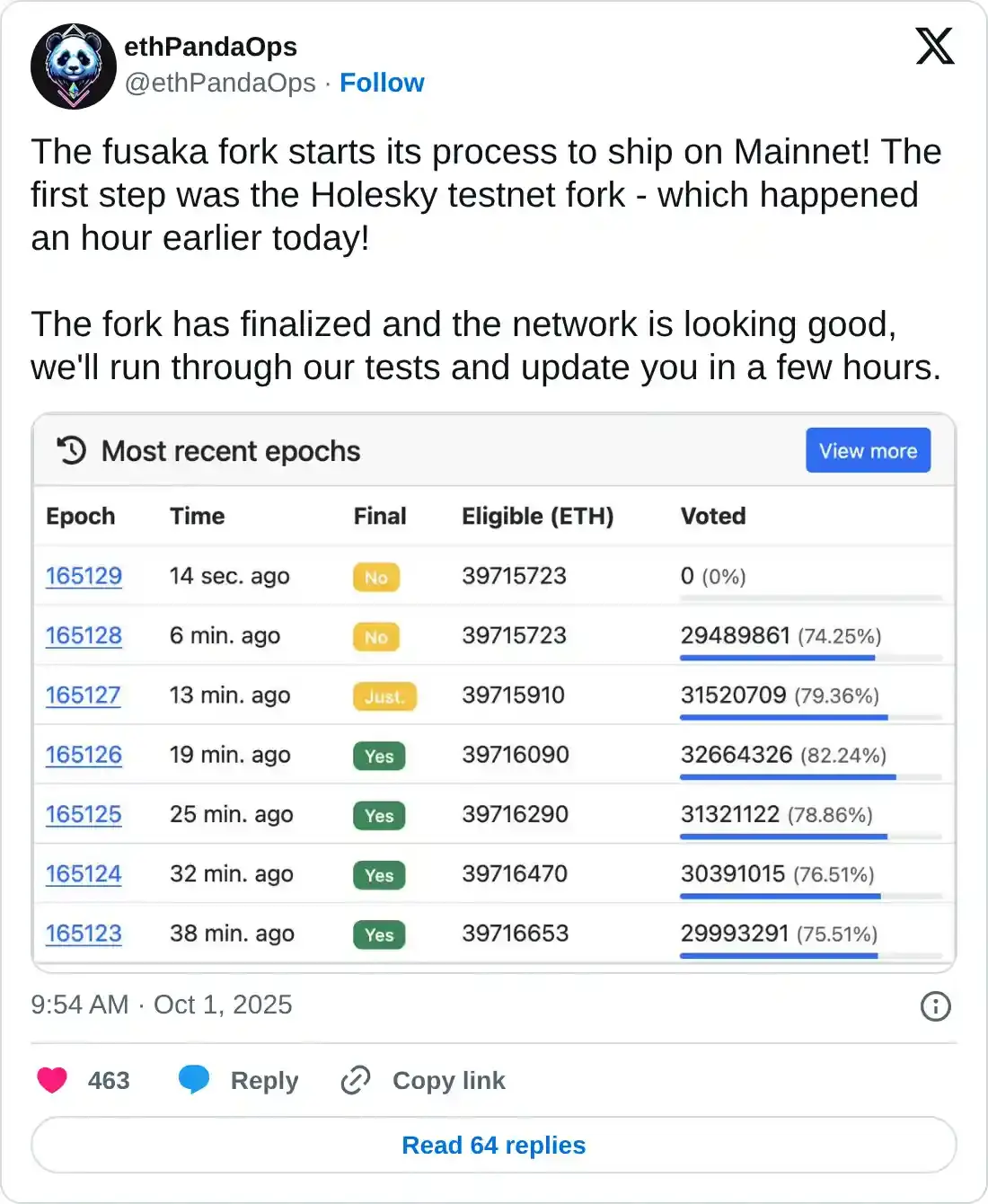

Ethereum has moved a step closer to launching its next major upgrade, Fusaka, after it successfully went live on the Holesky testnet on Wednesday.

Testnets are environments where developers safely deploy and validate new features before pushing them to the main blockchain network.

Validators and infrastructure providers are currently testing their systems to provide performance feedback on the upgrade.

Fusaka focuses on enhancing the consensus and execution layers by incorporating features from 12 Ethereum Improvement Proposals (EIPs). The most anticipated is PeerDAS (EIP-7594), which aims to boost throughput and reduce costs for Layer 2 networks by enabling validators to verify transactions without downloading the entire rollup data (blobs).

Fusaka comes just a few months after Ethereum's last major upgrade, Pectra, which went live on mainnet in May, introducing updates including smart wallet functionality, staking efficiency and blobs expansion.

With Fusaka finalized on Holesky, core developers are aiming to launch the upgrade on the Sepolia and Hoodi testnets on October 14 and 28, respectively. Developers have also set December 3 as a tentative date to roll out Fusaka on mainnet.

The Holesky testnet will shut down and be fully replaced by Hoodi after Fusaka goes live on mainnet. Holesky encountered several challenges during the test period for Pectra, failing to finalize for days before intervention from developers.

Ethereum Price Forecast: ETH clears descending trendline resistance, targets 50-day SMA

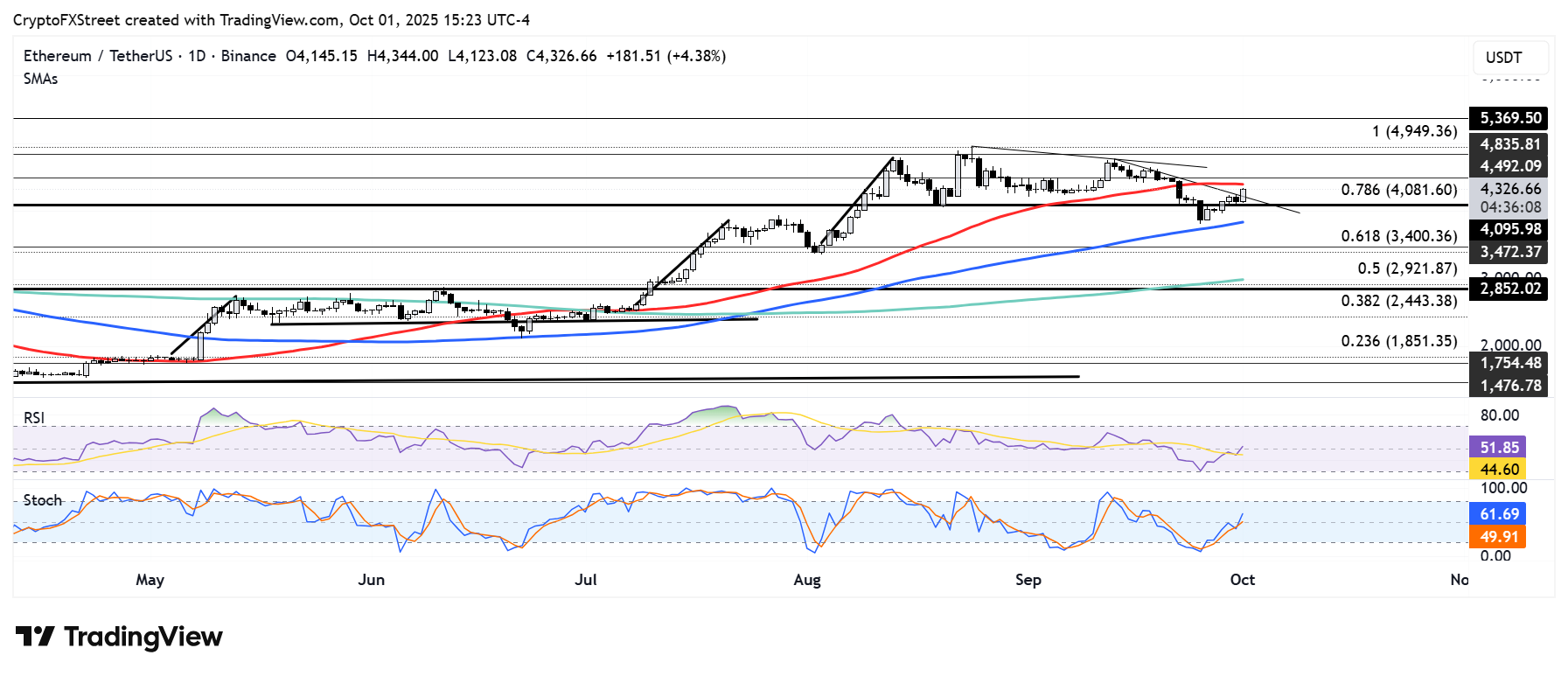

Ethereum saw $145.7 million in futures liquidations over the past 24 hours, led by $110.6 million in short liquidations, according to Coinglass data.

ETH broke above the descending trendline resistance extending from September 13 and is looking to test the 50-day Simple Moving Average (SMA). Just above the 50-day SMA, the top altcoin faces another hurdle at the $4,500 key level.

ETH/USDT daily chart

On the downside, ETH could find support around the $4,100 level or the 100-day SMA if bears regain momentum.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are slightly above their neutral levels, indicating a mild dominance in bullish momentum.