Two 'Made in USA' tokens to watch as altcoin season beckons

- The Altcoin Season Index has risen to 78, indicating a potential rally for Bitcoin's alternative tokens.

- Solana edges closer to $250, supported by positive market sentiment and institutional interest.

- Chainlink eyes a short-term breakout toward $30.00 amid optimism for ETF approval in the fourth quarter.

The cryptocurrency market is ending the week largely in the green, backed by Bitcoin (BTC) surging above $116,000 and correcting slightly toward the $115,000 level on Friday. Altcoins, led by Solana (SOL) and Ethereum (ETH), continue to sustain the bullish outlook, hinting at the much-anticipated altcoin season.

As the crypto market generally edges higher, investors are looking to position themselves amid a wide selection of tokens with the potential to rally.

What is an altcoin season?

The cryptocurrency bull cycle is often categorized into two: The Bitcoin bull cycle and an altcoin season. A Bitcoin bull cycle refers to a period characterized by a sustained rally in the price of BTC, backed by increased investor interest, confidence and high trading volume.

During this period, Bitcoin experiences a significant increase in value, while altcoins generally lag. Bitcoin bull cycles often set the tone for a broader rally in the cryptocurrency market.

As for the altcoin season, this is a period when alternative cryptocurrencies (altcoins) experience significant price surges, outperforming Bitcoin in terms of market gains. Investors tend to shift their focus from Bitcoin during this period, eyeing higher returns as prices, capitalisations and trading volume increase.

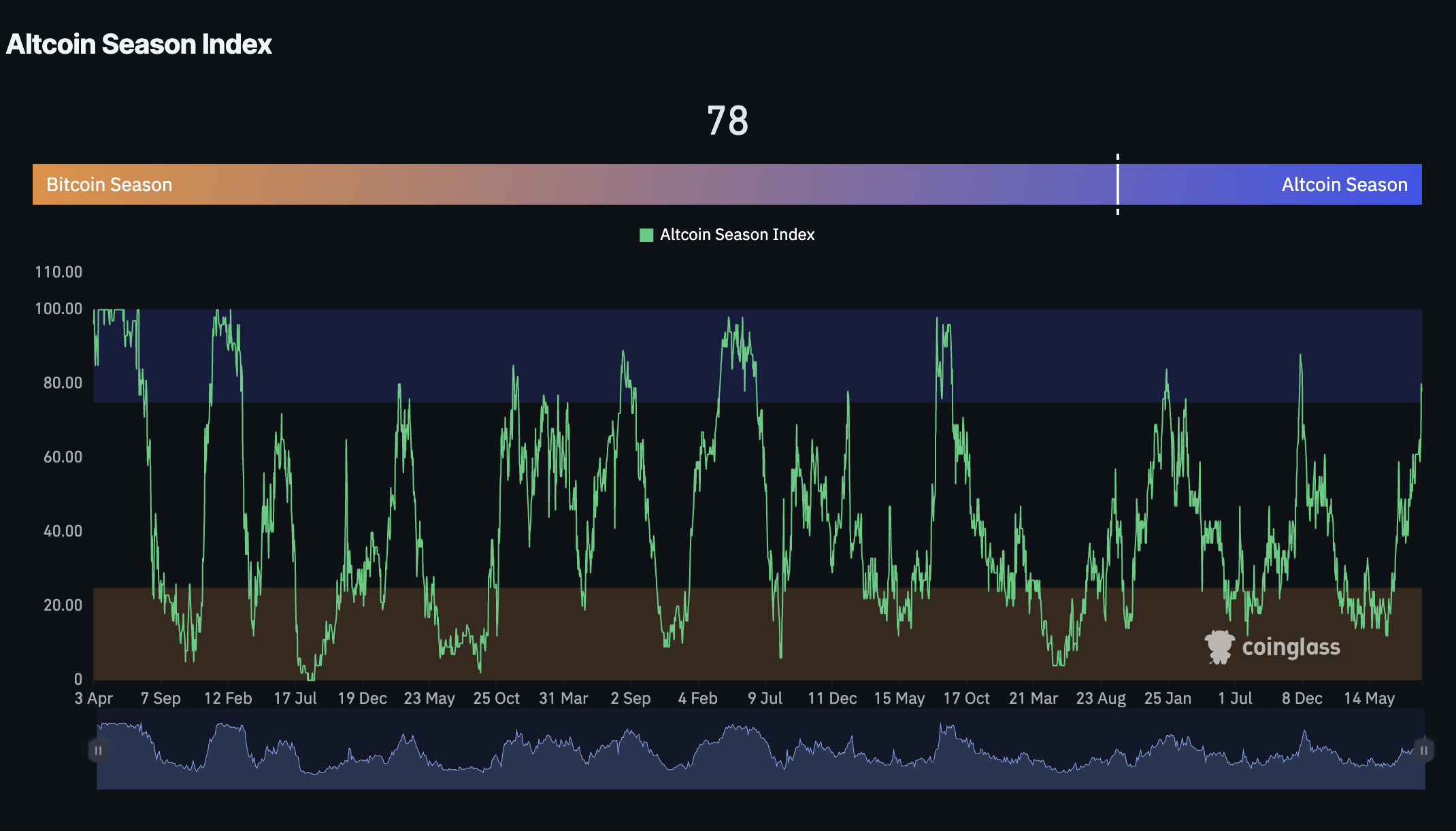

According to CoinGlass, the altcoin season begins when the Altcoin Season Index hits 75. According to the chart below, the index is currently at 78, suggesting that the altcoin season has commenced.

Several 'Made in USA' tokens, including Solana and Chainlink (LINK), are worth watching for potential entry opportunities as the altcoin season commences.

Altcoin Season Index | Source: CoinGlass

Solana nurtures bullish outlook as bulls set eyes on $250

Solana has since increased by 53% from early August to exchange hands at $239 at the time of writing on Friday. The token maintains a robust technical structure, positioned significantly above key moving averages, including the 50-day Exponential Moving Average (EMA) at $195, the 100-day EMA at $182 and the 200-day EMA at $274.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator, sustained since Wednesday on the daily chart, implies bullish momentum is building. The subsequent uptrend in the Relative Strength Index (RSI) at 69 indicates steady buying pressure, with more traders seeking to increase their exposure.

SOL/USDT daily chart

Interest in Solana goes beyond retail traders, with institutions such as Forward Industries raising funds toward SOL-focused treasuries. If demand for Solana steadies in the coming days and weeks, a breakout toward its record high of $296 could be in the offing.

Chainlink offers bullish signals

Chainlink bulls are largely in control, supported by multiple bullish signals, including the MACD indicator's buy signal, which is on the cusp of confirmation on the daily chart.

A slightly upward slope of the RSI at 58 reinforces the bullish grip as buying pressure increases. Higher RSI readings toward overbought territory suggest that bullish momentum is building, increasing the chances of a sustainable uptrend.

Key levels for traders include the seller congestion at $27.83, which was tested on August 22, and the supply area at around $30.93, previously tested in mid-December.

LINK/USDT daily chart

Chainlink's position above the upward-facing 50-day EMA at $21.86, the 100-day EMA at $19.74 and the 200-day EMA at $18.08 underpins the strong investor conviction in the current uptrend. These same moving average levels could serve as tentative support if profit-taking causes instability and an extended pullback in the LINK price.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.