President Donald Trump's Nomination of Kevin Warsh to Become Fed Chair May Come With Unintended Consequences for Wall Street

Key Points

Jerome Powell's term as Fed chair ends on May 15, which is what led President Trump to nominate Kevin Warsh to replace him.

Warsh's critiques of the Federal Reserve's $6.6 trillion balance sheet may unsettle a historically pricey stock market.

Furthermore, Warsh would be taking over a historically divided Federal Open Market Committee (FOMC).

- 10 stocks we like better than S&P 500 Index ›

The stock market has been practically unstoppable over the last seven years. With the exception of 2022, the widely followed S&P 500 (SNPINDEX: ^GSPC) has gained at least 16% in the other six years. We've also witnessed the mature stock-driven Dow Jones Industrial Average (DJINDICES: ^DJI) and growth stock-propelled Nasdaq Composite (NASDAQINDEX: ^IXIC) climb to several record highs.

But when it seems that Wall Street can do no wrong is often when things do tend to go awry. While there is no shortage of headwinds for the stock market at present, perhaps nothing looms larger than the upcoming transition at the Federal Reserve.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

May 15 will mark Jerome Powell's last day as Fed chair. Image source: Official Federal Reserve Photo.

On May 15, Jerome Powell's latest four-year term as Fed chair will end. With President Donald Trump a vocal critic of Powell's oversight at America's foremost financial institution over the last year, it's been a foregone conclusion for some time that Powell wouldn't serve as Fed chair beyond his current term.

On Jan. 30, President Trump nominated Kevin Warsh to succeed Powell. Although Wall Street has mostly shrugged off this news, it may come with unintended consequences for stocks.

Warsh wants to shrink the Fed's balance sheet -- and that's potentially grim news for investors

To some extent, Trump's nomination of Warsh was viewed as a way to calm nerves on Wall Street. Warsh previously served on the Board of Governors of the Federal Reserve from February 24, 2006 -- March 31, 2011. His time on the Federal Open Market Committee (FOMC) -- the 12-person body responsible for setting and overseeing our nation's monetary policy -- provides the experience investors look for in an incoming Fed chair.

However, Warsh's track record as a voting member of the FOMC, along with his opinion(s) that were laid out in several speeches, may give investors pause.

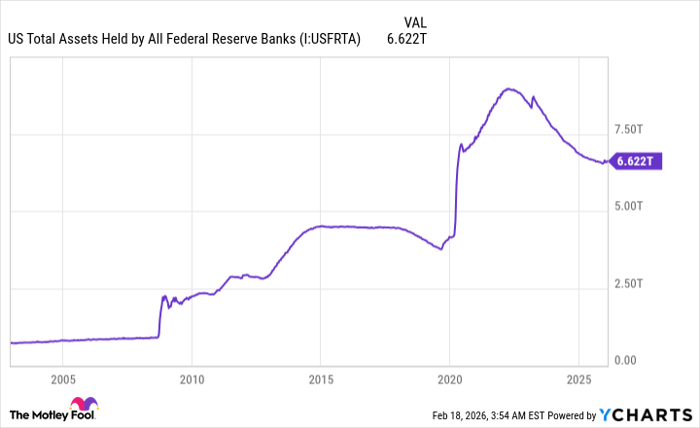

US Total Assets Held by All Federal Reserve Banks data by YCharts.

For instance, Warsh has long held the belief that the nation's central bank shouldn't be an active market participant. He's been particularly critical of the Fed's balance sheet, which currently holds approximately $6.6 trillion of assets -- mostly U.S. Treasury bonds and mortgage-backed securities (MBS).

During periods of economic uncertainty, the Fed has purchased long-term Treasury bonds and/or MBSs to lower long-term interest rates and/or support the housing market. It's important to note that bond yields and prices are inversely related. Thus, buying bonds and increasing their price results in lower yields and, ultimately, lower lending rates.

The issue at hand for investors isn't whether the Fed's balance should or shouldn't be reduced. It's what might happen to the U.S. economy and stocks if Warsh gets his wish. If U.S. Treasury bonds and MBSs are sold, the expectation is that yields will rise. In simple terms, we'd be talking about higher long-term borrowing costs and less-affordable mortgages.

Even though the Federal Reserve is in the midst of a rate-easing cycle, the above actions have the potential to raise interest rates, thereby stymying economic growth. Investors are practically counting on lower interest rates to support a historically pricey stock market.

Image source: Getty Images.

Warsh's ideology may clash with a historically divided FOMC

However, deleveraging the central bank's balance sheet isn't the only worry for Wall Street. Warsh's conflicting ideology, based on his track record as a voting member of the FOMC, points to potential unintended consequences for the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite.

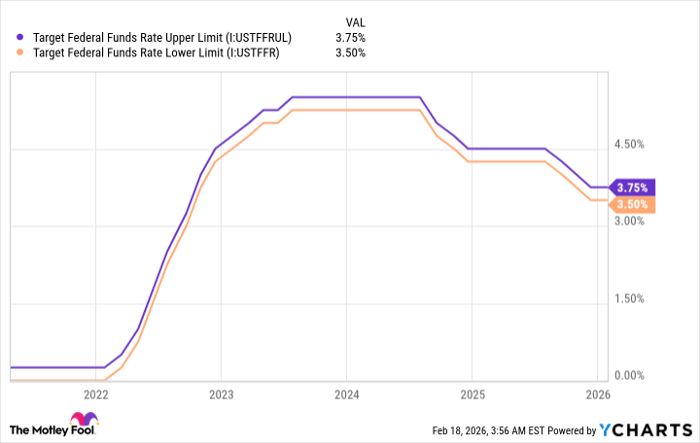

Historically, investors haven't punished the Fed or FOMC too harshly for being fallible. Since the members of the FOMC are relying on backward-looking economic data when making their monetary policy decisions, it's not uncommon for the central bank to be behind the curve when shifting its federal funds target rate (the overnight lending rate between financial institutions).

What investors aren't willing to tolerate is a non-unified approach to monetary policy by the FOMC members setting it. Each of the last five FOMC meetings has had at least one dissenting opinion.

What's noteworthy is that the October and December meetings featured dissents in opposite directions. Though the FOMC voted in favor of a 25-basis-point cut to the federal funds target rate in both meetings, at least one member favored no reduction, while another pushed for a 50-basis-point cut. Over the last 36 years, only three FOMC meetings have featured dissents in opposite directions -- and two have occurred since late October.

Target Federal Funds Rate Upper Limit data by YCharts.

Kevin Warsh would be taking over a historically divided FOMC. The concern is that Warsh's monetary policy approach hasn't always aligned with his voting peers. Using his voting track record prior to, during, and after the Great Recession as a guide, Warsh has consistently placed heightened emphasis on price stability and the prevailing inflation rate, and paid less attention to the unemployment rate.

Once again, I'm not taking sides and proclaiming this was the right or wrong stance from Warsh during a period of heightened uncertainty for the U.S. economy and stock market. Instead, I'm pointing out the expected ideological differences between Warsh and other voting members of the FOMC. Dissents may become even more pronounced under a Warsh-led Fed, which isn't something that would go over well on Wall Street.

Admittedly, we're a long way from proclaiming Kevin Warsh as the next Fed chair. He first needs a majority of the Senate Banking Committee to support his nomination, and this is far from a guarantee, with Republicans holding a slim 13 to 11 majority over Democrats. He'd then need a majority of votes in the Senate (51 votes) for confirmation.

But if Kevin Warsh can overcome these hurdles, stock market turbulence may follow.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 21, 2026.

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.