Got $5,000? Here Are 5 Must-Buy Artificial Intelligence (AI) Stocks Right Now.

Key Points

Nvidia, Broadcom, and Taiwan Semiconductor are well positioned to cash in on the AI spending spree.

Microsoft hasn't been this cheap in a long time.

Alphabet is starting to emerge as an AI leader.

- 10 stocks we like better than Nvidia ›

Artificial intelligence (AI) spending isn't slowing down, despite the market's wishes for it to do so. I expect this trend to persist for at least the next few years, as the data centers that many AI hyperscalers have announced will take years to build. This should be taken as a bullish indicator for several of the companies involved in AI, and investors should still maintain their exposure to this high-growth trend.

I've got five AI stocks that are well worth buying right now, and investors should consider loading up on them before their prices rocket higher.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Nvidia

Nearly every list encompassing AI stock picks includes Nvidia (NASDAQ: NVDA), and for good reason. It has been the top computing unit provider in the AI realm since the buildout kicked off in 2023, and it doesn't look to be slowing down any time soon. It's making continuous improvements, marked by the launch of its latest chip architecture, Rubin. Rubin chips require four times fewer graphics processing units (GPUs) to train an AI model and 10 times fewer GPUs to perform inference. That kind of improvement makes customers continue to upgrade and purchase from Nvidia, and we're seeing that show up in the company's growth projections.

For fiscal year 2027 (ending January 2027), Wall Street analysts expect Nvidia to grow at a 65% pace, up from the projected 57% growth in FY 2026. Demand for Nvidia GPUs is continuing to accelerate, keeping it at the top of the AI buying list.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM) is similarly benefiting from massive AI buildouts. It's the world's largest chip foundry by revenue, and is a key supplier of chips to nearly every company involved in AI, including Nvidia. Taiwan Semiconductor also sees strong growth this year, with revenue growth of nearly 30% in U.S. dollars expected.

TSMC is a great neutral way to play the AI build-out, as it's not reliant on one company to produce the best computing unit. It thrives as long as there is increased AI spending. With the four major hyperscalers planning on spending around $650 billion on capital expenditures this year, it's positioned to cash in on this spending.

Broadcom

Broadcom (NASDAQ: AVGO) is an emerging competitor in the AI computing landscape. Some customers don't want to pay a massive premium for Nvidia GPUs when they don't use all the features packed into the unit. Instead, they're opting for an ASIC (application-specific integrated circuit) from Broadcom. These computing units are custom-designed for a specific workload. While they aren't as flexible as a GPU, they do offer similar or better computing power at a much lower price point.

Demand for its custom AI chips is exploding, and management projects revenue from AI chips to double in its upcoming quarter. Broadcom is just getting started and is a fantastic alternative to Nvidia as a stock pick.

Microsoft

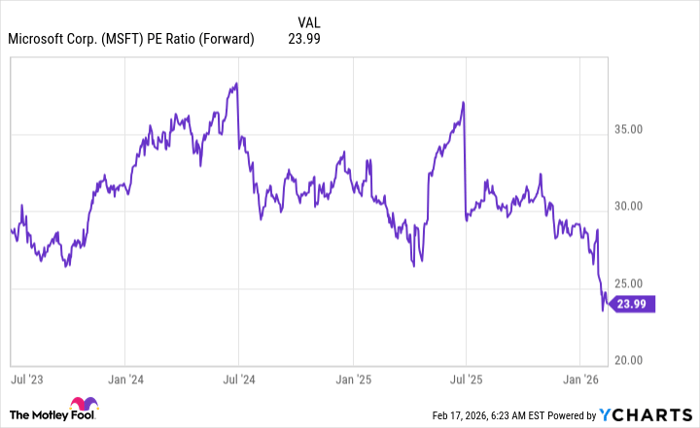

Microsoft (NASDAQ: MSFT) is in an odd spot. It used to be one of the premier AI stocks to own and traded at a premium, but investors are a bit skittish about it and have sold it heavily in 2026. Now, it trades for 24 times forward earnings, which is the cheapest it has been in some time.

MSFT PE Ratio (Forward) data by YCharts

Nothing has changed in the Microsoft investment thesis, and I think right now represents an excellent time to scoop up one of the companies whose infrastructure is being used to build out AI applications.

Alphabet

In Microsoft's place, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) seems to have risen. Alphabet has come back from near the bottom of the generative AI technology race to among the leaders. Gemini is recognized as one of the top AI models, and its Google Cloud platform is seeing impressive growth as a result. Alphabet is truly at the top of its game right now and could become the ultimate winner in the generative AI buildout.

Alphabet has strong prospects moving forward, and I'm excited to see what AI innovations they can drive over the next few years. While the stock may not have nearly the upside as the other four, I think it's an excellent bedrock to build a portfolio on.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 21, 2026.

Keithen Drury has positions in Alphabet, Broadcom, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.