AI Spending Is Poised to Hit $700 Billion in 2026. 2 Top Stocks to Buy to Capitalize on This Massive Number.

Key Points

Applied Materials guidance suggests its growth will accelerate amid healthy spending on AI infrastructure.

Applied Digital provides critical data center infrastructure, which explains why its revenue is growing exponentially.

- 10 stocks we like better than Applied Digital ›

The major hyperscalers in the U.S. are forecast to spend at least $700 billion in capital expenditures (capex) this year to bolster their artificial intelligence (AI) infrastructures. That points toward a major increase over last year's estimated spending of $394 billion.

There are several stocks investors might want to consider buying to capitalize on this massive spending on AI data centers in 2026. Let's take a closer look at two critical players in the AI ecosystem that can deliver solid gains to investors thanks to the huge capex opportunity mentioned -- Applied Materials (NASDAQ: AMAT) and Applied Digital (NASDAQ: APLD).

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Stronger AI spending is boosting Applied Materials' growth

Semiconductor equipment manufacturer Applied Materials saw its stock jump 8% after releasing its fiscal 2026 first-quarter results (for the quarter ended Jan. 25, 2026) on Feb. 12. The company's revenue and earnings comfortably exceeded Wall Street's expectations, while the guidance was the icing on the cake. Applied Materials' fiscal Q1 revenue fell 2% from the prior-year period, while non-GAAP (generally accepted accounting principles) earnings were flat at $2.38 per share.

The good news is that Applied Materials' revenue guidance of $7.65 billion for the current quarter points toward a revenue rise of nearly 8% year over year. Additionally, its earnings guidance of $2.64 per share suggests a potential 10% jump.

Applied Materials CEO Gary Dickerson remarked on the company's latest earnings call that "the race to build out AI infrastructure is driving unprecedented spending on semiconductors, semiconductor manufacturing capacity, and research and development." The company reported healthy semiconductor equipment demand from both foundries and memory manufacturers, which isn't surprising, as companies like Micron Technology and Taiwan Semiconductor Manufacturing have raised their capex to bolster their production lines.

The massive $700 billion spending by the top four U.S. hyperscalers suggests that the likes of Micron and TSMC may have to add more capacity than they anticipated. This can become a tailwind for Applied Materials for the rest of the year, potentially accelerating its revenue and earnings growth. This probably explains why Applied Materials' earnings growth is anticipated to jump from 18% in the current fiscal year to 24% in the next one.

As a result, there is a strong chance this AI stock will continue to rise despite gaining an impressive 110% over the past year.

Applied Digital's business is likely to experience even more stunning growth

Applied Digital is known for designing, developing, and operating AI data centers. The company's business is booming due to the aggressive AI data center buildout.

Applied Digital's business model involves constructing data centers tailored to its clients' needs and generating revenue from the fit-out services it provides. The company also receives lease revenue from its tenants for operating those data centers.

Applied Digital is currently building two data center campuses in North Dakota. It has already contracted potential lease revenue worth $16 billion for the next 15 years. Applied Digital is currently constructing 600 megawatts (MW) of data center capacity at its two campuses, and the good part is that it is in advanced discussions to build another three campuses that can generate 900 MW.

According to CEO Wesley Cummins:

Having secured two hyperscale leases in the region, inbound demand has increased meaningfully. As a result, we are in advanced discussions with another investment-grade hyperscaler across multiple regions, including additional locations in the Dakotas and select Southern U.S. markets.

Don't be surprised to see Applied Digital break ground on even more campuses this year, considering the $700 billion capex spending by the major hyperscalers. Importantly, the new campuses should help Applied Digital bring in more fit-out revenue while also improving its revenue pipeline for the long run through additional leases.

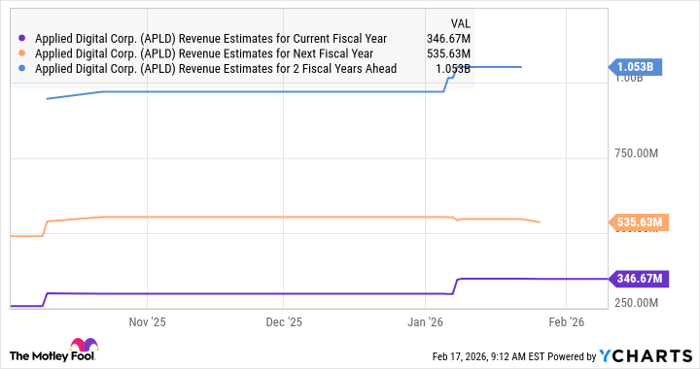

Applied Digital's revenue shot up by 250% year over year in the second quarter of fiscal 2026 to $127 million. Analysts expect its outstanding growth trajectory to continue.

Data by YCharts.

Of course, investors will have to pay almost 33 times sales to buy Applied Digital stock right now. But that multiple is justified by the tech stock's stunning growth rate, a robust lease revenue pipeline, and the potential to add more data center sites to meet the growing demand for AI computing power.

Should you buy stock in Applied Digital right now?

Before you buy stock in Applied Digital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Applied Digital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $420,595!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,356!*

Now, it’s worth noting Stock Advisor’s total average return is 899% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 20, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Applied Materials, Micron Technology, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.