The State Street SPDR Dow Jones REIT ETF Could Soar If These 2 Things Go Right

Key Points

The State Street SPDR Dow Jones REIT ETF enables you to invest broadly in the REIT sector.

REITs are very sensitive to changes in interest rates.

A falling 10-year Treasury yield and inflation rate could be the catalysts needed to boost this ETF.

- 10 stocks we like better than SPDR Series Trust - State Street SPDR Dow Jones REIT ETF ›

The State Street SPDR Dow Jones REIT ETF (NYSEMKT: RWR) aims to track the performance of real estate investment trusts (REITs). The exchange-traded fund (ETF) holds 100 REITs, providing investors with broad exposure to the entire sector. That makes it a potentially great way to play a rebound in the commercial real estate sector.

Here's a look at two catalysts that could send shares of this top REIT ETF soaring.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Long-term interest rates start to fall

REITs are highly sensitive to changes in interest rates. Higher rates increase borrowing costs, making it more expensive for REITs to refinance maturing debt and fund growth initiatives such as acquisitions and development projects. In addition to this growth headwind, higher rates make lower-risk fixed-income investments more attractive to income-seeking investors. That weighs on the value of commercial real estate.

However, while higher rates are a headwind for REITs, falling rates are a tailwind, as they reduce borrowing costs and boost commercial property values. Given this dynamic, falling rates could cause REITs and REIT ETFs like RWR to soar.

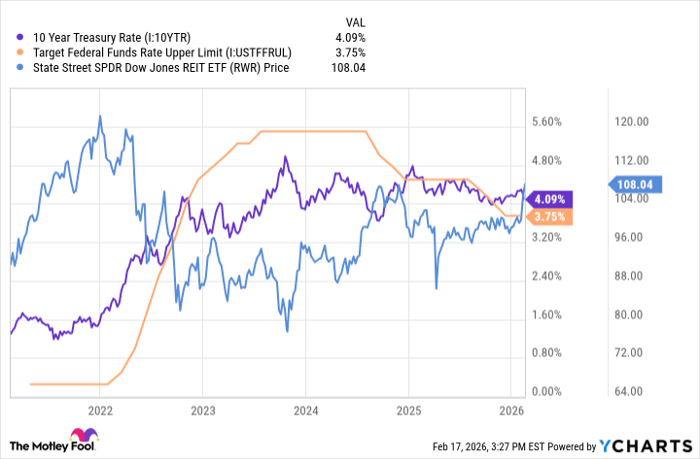

While the Federal Reserve has been cutting the Federal Funds Rate (a short-term interest rate) over the past couple of years, that hasn't yet had much impact on longer-term rates like the 10-year treasury yield, which has a greater impact on REITs:

10 Year Treasury Rate data by YCharts

As that chart shows, RWR's value tends to move in the opposite direction to the 10-year. If that key interest rate benchmark falls below 4%, RWR's value should soar.

This catalyst could cause the 10-year to drop

Several factors can influence the 10-year Treasury rate, including the Federal Reserve, geopolitical risks, economic trends, and inflation. Of all these factors, I'm watching inflation the closest. It's a key gauge the Federal Reserve uses to set policy and tends to have the greatest impact on long-term rates.

The annual inflation rate in the U.S. rose 2.4% over the 12 months ending in January, less than economists expected. It was also down from 2.7% in 2025 and well below the 7% peak following the pandemic. This growth rate is edging closer to the Federal Reserve's 2% target.

After remaining elevated for the past few years, the inflation rate could finally come down within the target range this year. The impact of tariffs is starting to wear off as a year passes since the U.S. raised tariff rates. Additionally, oil prices are lower (causing gas prices to decline), and the U.S. didn't experience a major natural disaster last year (which should help limit insurance premium growth). If inflation continues to fall, REIT share prices should rise as long-term rates decline.

This ETF could soar if REITs rally

The State Street SPDR Dow Jones REIT ETF enables you to invest broadly in the REIT sector. It could soar this year if the 10-year Treasury rate declines, which would likely happen if inflation falls into the Federal Reserve's 2% target range.

Should you buy stock in SPDR Series Trust - State Street SPDR Dow Jones REIT ETF right now?

Before you buy stock in SPDR Series Trust - State Street SPDR Dow Jones REIT ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Series Trust - State Street SPDR Dow Jones REIT ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 19, 2026.

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.