Cronos Price Prediction: CRO bulls aim for next leg higher as momentum builds

- Cronos price climbs above $0.145 on Tuesday after rebounding from a key support level, signaling bullish momentum.

- Crypto.com announces a strategic partnership with Theta Network, integrating its institutional-grade custody solution to manage THETA tokens.

- Derivatives market reflects growing optimism, with CRO open interest hitting record highs and an increase in long positions.

Cronos (CRO), a Layer 1 blockchain by Crypto.com, is extending its gains. At the time of writing on Tuesday, it is trading above $0.145 after finding support around the key level it had previously tested. This rally follows the announcement of a partnership by Crypto.com with Theta Network. The bullish narrative is further supported by the rising Open Interest (OI) on the derivatives markets and an increase in long positions among traders.

Why is Cronos rallying?

Cronos price is trading 6% higher during the Asian trading session on Wednesday. This rally follows an announcement on Monday by Crypto.com of a strategic partnership with Theta Network, integrating its institutional-grade custody solution to manage THETA tokens.

This partnership manages 15 million THETA tokens that have been re-staked in an Enterprise Validator Node, which suggests growing institutional trust in decentralized platforms and gaining legitimacy through a regulated US custodian.

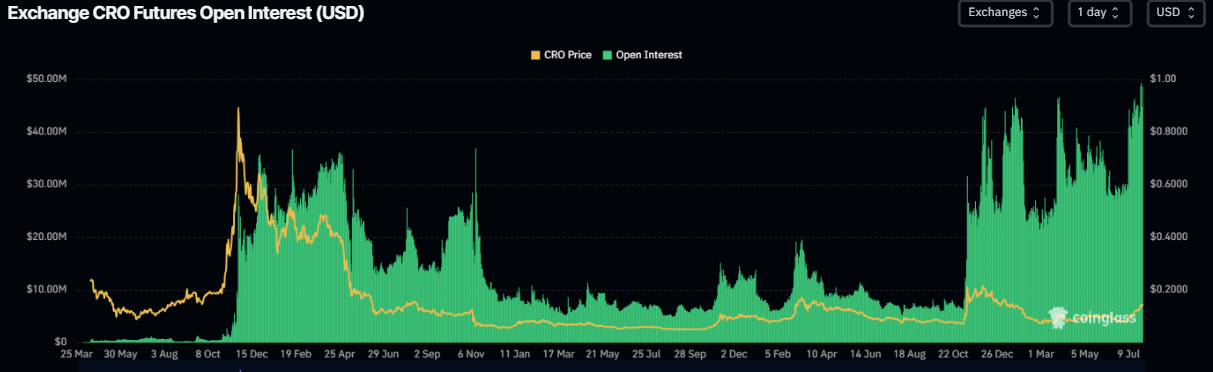

Apart from these recent developments, Futures’ OI in CRO at exchanges rose from $29.49 million on July 8 to $49.32 million on Monday, a new all-time high, according to data from CoinGlass. Rising OI represents new or additional money entering the market and new buying, which could fuel the current CRO price rally.

CRO open interest chart. Source: Coinglass

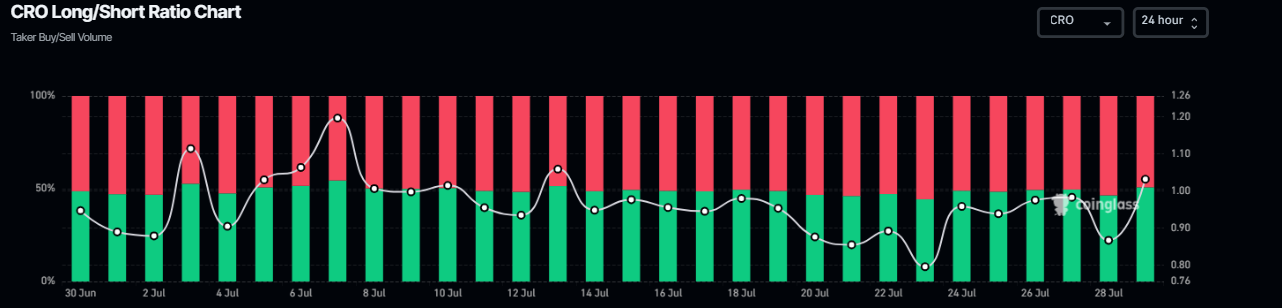

According to Coinglass’s data, the long-to-short ratio of Cronos reads 1.02 on Tuesday. This ratio, above one, reflects bullish sentiment in the markets, as more traders are betting on the asset price to rally.

CRO long-to-short ratio chart. Source: Coinglass

Cronos Price Forecast: CRO finds support around a key level

Cronos price rallied more than 22% after breaking above the weekly resistance of $0.108 since July 17, and closed above the daily level of $0.136 on Saturday. CRO declined slightly at the start of this week on Monday and retested this daily level of $0.136. At the time of writing on Tuesday, it trades higher by nearly 7% trading above $0.145.

If the daily level at $0.136 continues to hold as support, it could extend the rally toward its 61.8% Fibonacci retracement at $0.171.

The Relative Strength Index (RSI) reads 77, pointing upward above its overbought level of 70, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator on the daily chart showed a bullish crossover in early July, and it still holds. The rising green histogram bars above its neutral value indicate increasing bullish momentum and an upward trend ahead.

CRO/USDT daily chart

However, if CRO closes below the daily support at $0.136, it could extend the decline toward its psychological support at $0.120.