HBAR Price Shows Bullish Divergence, But Weak Fundamentals Still Haunt the Rally

HBAR, Hedera’s native token, is showing signs of life after weeks of sideways chop, but not everything under the hood looks healthy. A clean RSI divergence, improving funding rates, and a rare CMF crossover into the positive territory hint at a possible breakout.

Yet, under the surface, development activity remains stuck near multi-month lows. The question now is whether this rally has enough substance or if it’s just another technical bounce without backbone.

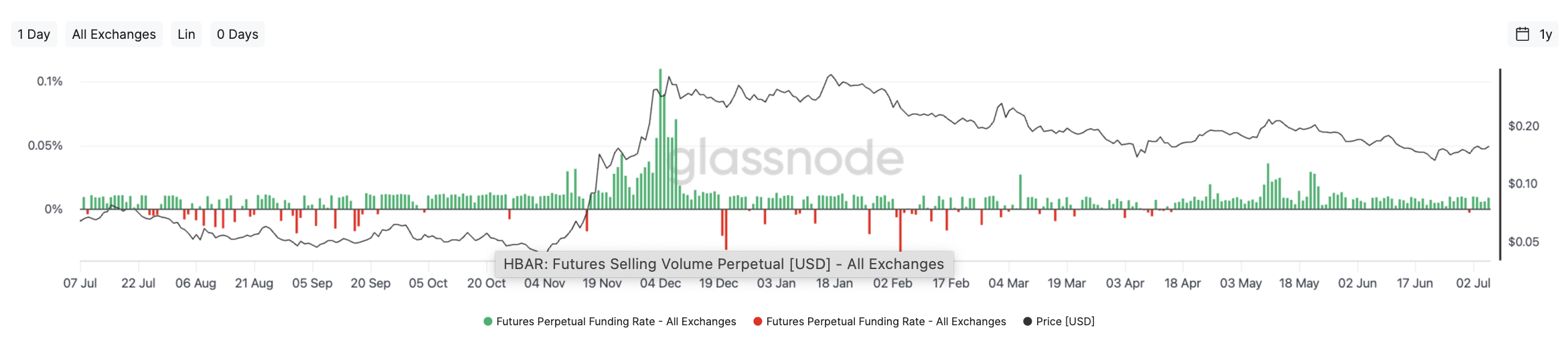

Funding Rates Show Bullish Build-Up, But No Euphoria Yet

Futures traders have been steadily rotating bullish on HBAR, as seen in the rising funding rates across perpetual contracts. Since early June, the majority of candles have stayed green, meaning long positions are paying shorts, a typical sign of bullish bias returning.

HBAR price and funding rates: Glassnode

HBAR price and funding rates: Glassnode

The last time HBAR maintained this pattern for an extended stretch was in September–October 2024. That period preceded a brief price rally, which aligns with the current slow upward grind.

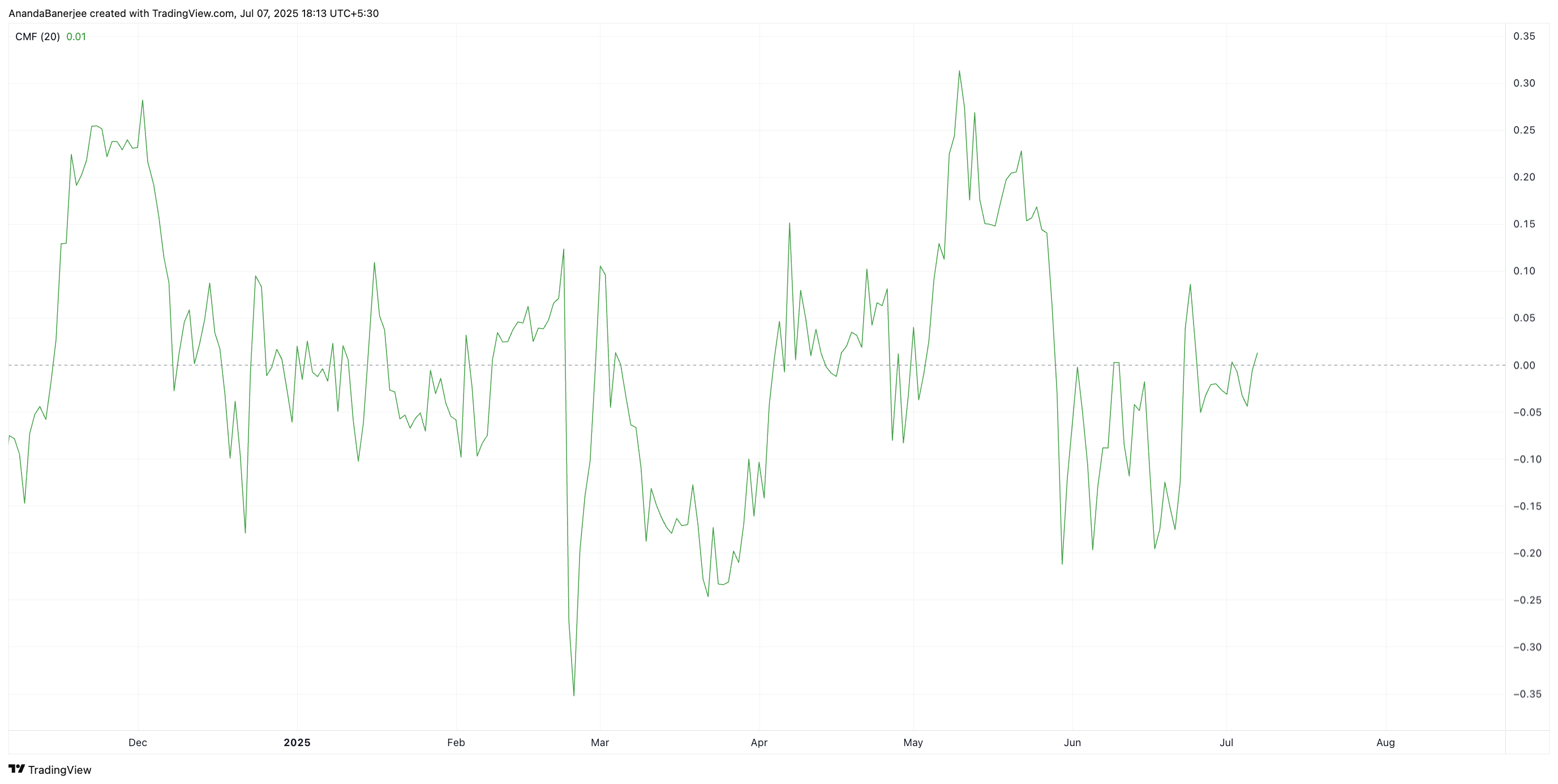

Chaikin Money Flow Crosses Into Positive Zone

For the first time in nearly two months, the Chaikin Money Flow (CMF) has crossed above the zero line. This indicator, which tracks buying and selling pressure weighted by volume, is often used to validate whether accumulation is genuine or just noise.

HBAR CMF: TradingView

HBAR CMF: TradingView

The current CMF reading around +0.01 is still marginal, but it breaks a long streak of negative values. That crossover alone doesn’t confirm sustained inflows, but when paired with a strengthening price structure and RSI divergence, it adds a layer of technical support.

Development Activity Remains Concerning

While price and derivatives sentiment are turning, Hedera’s development activity continues to trend downward. According to your Santiment chart, the purple line representing development contributions has been on a slow but steady slide since March.

HBAR price and development activity: Santiment

HBAR price and development activity: Santiment

It’s now sitting near its lowest level in six months, indicating fewer updates or visible work on the Hedera ecosystem.

Price Approaches Breakout With RSI Divergence

HBAR is trading just below a descending trendline that stretches from the March high to today’s structure. The token now sits just under the $0.162 resistance, a level that’s been tested three times in the past week but hasn’t yet broken.

HBAR price Bullish divergence: TradingView

HBAR price Bullish divergence: TradingView

What strengthens the bullish case here is the classic RSI divergence. While price action remains mostly flat or slightly down from mid-June, the Relative Strength Index (RSI) has been making higher lows. This gap between momentum and price typically signals a potential breakout.

HBAR price key levels: TradingView

HBAR price key levels: TradingView

If the breakout confirms above $0.162, the next resistance lies near $0.178, followed by $0.217. But a rejection here could drag the HBAR price back to $0.143 support, especially if development activity continues to stagnate.