U.S. January Nonfarm Payrolls Preview: Likely to Beat Expectations, but with Limited Impact on US Stocks

The U.S. January nonfarm payrolls report, originally scheduled for release on February 6, has been delayed due to the partial shutdown of the U.S. federal government and is finally set to be published on February 11. Recently, the U.S. Manufacturing Purchasing Managers' Index (PMI) has delivered a strong performance, leaving the market with expectations of a modest improvement in the January nonfarm payrolls data. Against the backdrop of the U.S. economy demonstrating robust resilience and the coordinated easing of monetary and fiscal policies, the nonfarm payrolls data are likely to beat the market consensus expectations.

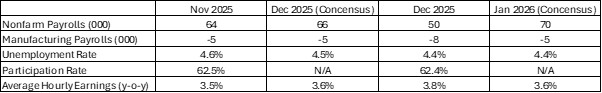

Looking back at the U.S. job market in December 2025, nonfarm payrolls increased by 50,000 during the month, falling short of both the market expectation of 66,000 and the revised November figure of 56,000. The unemployment rate came in at 4.4%, edging down from the market forecast of 4.5% and the prior month’s reading of 4.6%. The labor force participation rate dipped slightly to 62.4% from the previous 62.5%, while average hourly earnings rose 3.8% year-on-year, outpacing the market expectation and the prior month’s reading of 3.6%. Overall, the month’s labour market data showed a mixed performance, which also reflected a generally solid showing of the U.S. job market in December 2025.

Figure: US Job Market Indicators

Source: Refinitiv, TradingKey

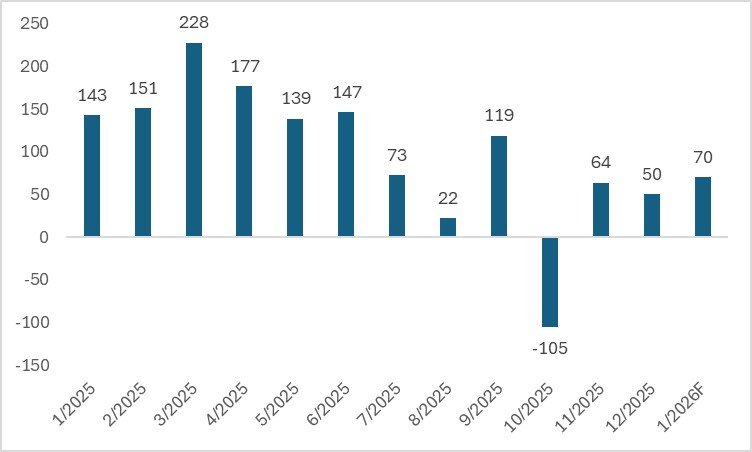

The U.S. Bureau of Labor Statistics (BLS) will release the January nonfarm payrolls data on February 11. The current median market expectation for the month’s nonfarm payroll additions stands at 70,000, higher than that of December 2025, while the projected unemployment rate is flat with the prior month’s reading of 4.4%. Overall, the market holds the view that the U.S. job market will see modest improvement and the unemployment rate remain stable. Private employment-related data and various high-frequency indicators released last week fell notably short of expectations, making the release of this nonfarm payrolls data the core focus of the market. Notably, since the COVID-19 crisis, the initial readings of U.S. nonfarm payrolls in the first quarter have tended to exhibit a seasonal characteristic of outperforming expectations strongly.

Figure: US Nonfarm Payrolls (000)

Source: Refinitiv, TradingKey

Specifically, the likelihood of the January nonfarm payrolls data beating expectations aligns with the trend where initial jobless claims have stayed low and continuing jobless claims have declined consistently in the preceding weeks. The low volume of unemployment benefit claims indicates a slowdown in corporate layoffs in January, a phenomenon largely driven by seasonal factors; a strong showing in the January nonfarm payrolls data would similarly be a reflection of this seasonal trend.

Furthermore, over the past several years, the U.S. job market has underperformed during traditional hiring peak seasons – for instance, employment growth has consistently fallen short of expectations in June-August and October, a trend that re-emerged in 2025, when the private sector added a mere 1,000 jobs that October. Coupled with the weak hiring activity observed ahead of the holiday season last December, the employment data has formed a low base effect. Against this backdrop, employment growth in January is expected to stage a notable rebound, with the number of new jobs added likely to surpass the market consensus expectation of 70,000.

If the above projection materializes, from an economic perspective, a strong performance in the job market would likely reduce the urgency for the Federal Reserve to cut interest rates, thereby exerting a bearish impact on the stock market. However, we believe a single month’s data is insufficient to reflect the overall trend of the job market, and January still falls within the window period where seasonal adjustments provide significant positive support to nonfarm payrolls data. Consistent with the pattern in previous years, simply extrapolating January’s strong data to subsequent months and concluding that the labor market has achieved a sustained stabilization based on this would be misleading.

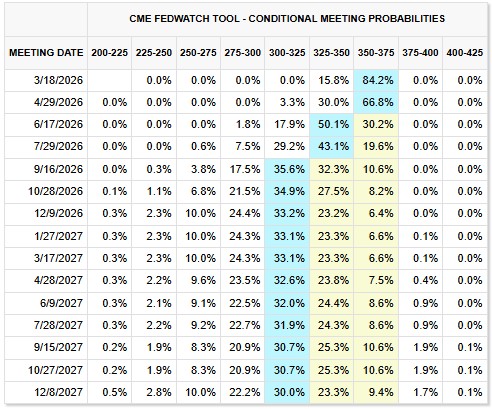

Overall, we project that even if the January nonfarm payrolls data delivers a strong showing, the labor market as a whole will continue to weaken gradually, a trend that is highly likely to unfold progressively in the spring and summer of this year. Based on this, we still endorse the market’s expectations for Federal Reserve rate cuts, namely two 25-basis-point rate cuts totaling 50 basis points within the year. In summary, the actual figure of the January nonfarm payrolls data will have a relatively limited impact on the subsequent trend of U.S. stocks.

Figure: Federal Reserve Interest Rate Expectations

Source: CME Group, TradingKey