Metaplanet’s Stock Hits 3-Month High After $104 Million Bitcoin Purchase

Japanese firm Metaplanet saw its stock price surge to three-month highs on Monday after announcing its latest Bitcoin (BTC) acquisition. The company added 1,004 BTC to its treasury, marking its third significant purchase this month.

A week earlier, it had acquired 1,241 BTC, surpassing El Salvador’s reserves. Previously, on May 7, Metaplanet made a comparatively smaller purchase of 555 BTC.

Metaplanet Stock Benefits From Bitcoin Purchases

According to the official disclosure, the latest transaction was valued at 15.19 billion yen (approximately $104.3 million). Metaplanet’s average buying cost was 15.13 million yen, equivalent to $103,873 per BTC.

“From July 1, 2024, to September 30, 2024, the Company’s BTC Yield was 41.7%. From October 1, 2024, to December 31, 2024, the Company’s BTC Yield was 309.8%. From January 1, 2025, to March 31, 2025, the company achieved a BTC Yield of 95.6%. Quarter to Date, from April 1, 2025, to May 19, 2025, the Company’s BTC Yield is 47.8%,” the statement read.

Metaplanet issues zero-coupon ordinary bonds to fund these purchases. In May 2025, it issued bonds worth $64.7 million. This includes $24.7 million from the 12th Series issued on May 2, $25 million from the 13th Series approved on May 7, and $15 million from the 15th Series issued on May 13.

The company now holds a total of 7,800 Bitcoin, with an aggregate investment of 105.38 billion yen, or roughly $712.5 million. The average historical purchase price across its Bitcoin holdings stands at 13.5 million yen per BTC, approximately $91,343 per coin.

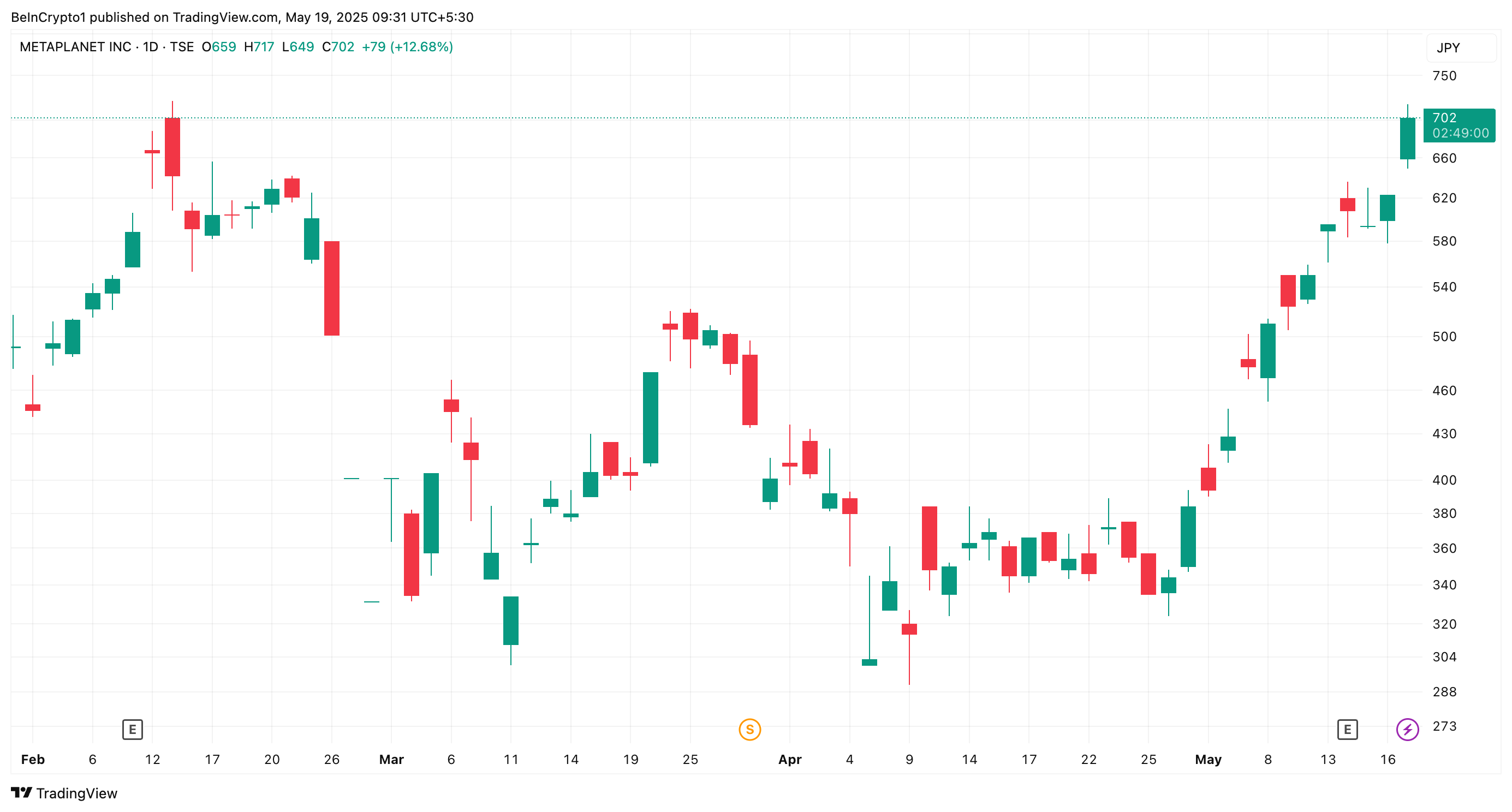

Meanwhile, following the news, Metaplanet stock, 3350.T, appreciated by 12.6%, according to Yahoo Finance data. At press time, its trading price was 702 yen ($4.8), marking highs last seen on February 13.

Metaplanet Stock Performance. Source: TradingView

Metaplanet Stock Performance. Source: TradingView

Over the past month alone, 3350.T’s value has increased by 101.7%, greatly benefiting from Bitcoin’s latest rally. In fact, since adopting a Bitcoin reserve strategy, the stock prices have increased over 15-fold.

The firm’s financial performance further supports this upward trajectory. In its Q1 FY2025 earnings report, Metaplanet disclosed revenues of $6 million, with 88% derived from Bitcoin options trading.

This highlighted the important role BTC plays in its financial success. As the firm continues integrating Bitcoin into its economic strategy, it is setting a new benchmark for corporate crypto adoption in the region.