Whale Opens $27.53 Million Leveraged PEPE Long on Hyperliquid

A crypto whale’s high-stakes, 10x leveraged PEPE position on Hyperliquid faces mounting risk. The whale’s leveraged PEPE bet remains precarious, risking liquidation amid market instability.

With added margin but persistent losses, any adverse price move could trigger cascading sell-offs and broader crypto turbulence.

Whale Opens 10X Leverage on PEPE

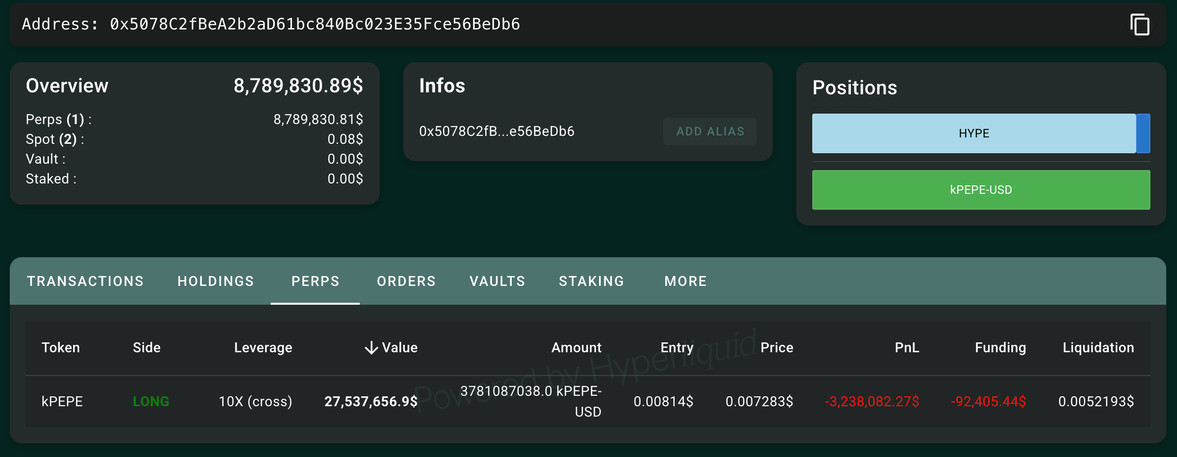

Crypto and DeFi analyst Ai revealed a notable gamble by a whale trader, placing a high-stakes bet on the PEPE meme coin. They opened a 10x leveraged long position worth $27.53 million on the Hyperliquid network.

However, the trade quickly turned against them, with unrealized losses amounting to $3.238 million.

The whale, identified by the address 0x507…BeDb6 initiated the position on March 24 at an entry price of $0.00814 per 1,000 PEPE. As it stands, they are now at risk of liquidation should the price fall to $0.005219.

To prevent forced closure, they have added 3.818 million USDC in margin (approximately $3.8 million).

Whale’s leveraged 10X PEPE bet on Hyperliquid. Source: Analyst Ai on X

Whale’s leveraged 10X PEPE bet on Hyperliquid. Source: Analyst Ai on X

The precarious nature of the position raises concerns about the broader risks to PEPE’s market stability and the implications for leveraged trading on Hyperliquid.

Using 10X leverage dramatically amplifies potential gains and losses, making this a highly volatile bet. Even minor price fluctuations can lead to significant swings in the whale’s account balance.

If PEPE’s price continues to decline and reaches the liquidation threshold, Hyperliquid’s automated systems will forcibly close the position.

This could further drive down PEPE’s price. Such liquidations often lead to cascading sell-offs as other leveraged traders get caught in a feedback loop, exacerbating market volatility.

Meanwhile, the whale’s decision to inject more margin suggests they are committed to defending their position. However, this also signals the pressure they are under to maintain solvency.

What Are the Perceived Risks?

PEPE’s inherent volatility adds another layer of risk. As a meme coin, its price movements are often driven by social sentiment rather than fundamental value. This makes it particularly vulnerable to quick price swings, which could trouble the whale’s position.

If negative market sentiment prevails due to external factors such as regulatory news or shifting trader interest, PEPE’s price could decline further.

Given that the market has already been experiencing a downturn, the likelihood of additional price pressure remains a significant concern.

Another critical issue is the potential for whale-induced market manipulation. Large-scale traders have the power to sway market trends, either through direct trades or by influencing sentiment.

By continuously adding margin to avoid liquidation, the whale may attempt to prop up PEPE’s price and prevent a major sell-off.

However, such efforts can only go so far. If the whale ultimately exits their position, it could trigger panic among smaller traders, leading to a rapid decline in PEPE’s value.

The broader impact on retail investors closely tracking whale activity could exacerbate instability.

The risks associated with liquidation cascades also cannot be ignored. Hyperliquid’s decentralized liquidation mechanism allows efficient order processing.

However, a large liquidation can spark a chain reaction in highly leveraged markets.

PEPE Price Performance. Source: TradingView

PEPE Price Performance. Source: TradingView

The PEPE price has fallen by over 5% in the last 24 hours and was trading for $0.00000721 as of this writing.

If PEPE’s price nears the whale’s liquidation point, other traders may begin preemptively selling to avoid losses, creating a snowball effect.

This could result in PEPE experiencing sharp price declines quickly, potentially affecting other meme coins and broader crypto markets.

KOL Opens Similar Leverage Position for Ethereum

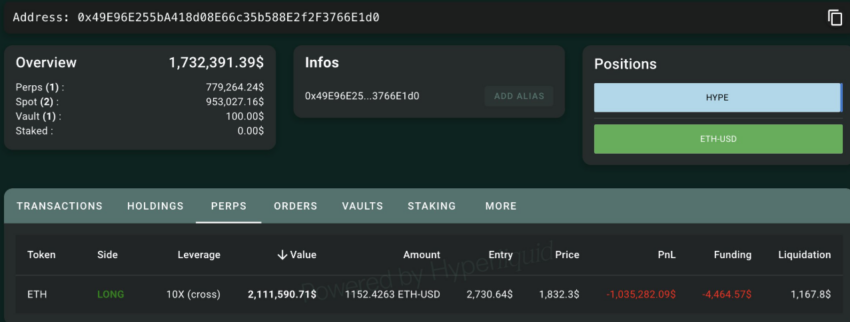

The risks are not limited to PEPE alone. A similar situation is unfolding with another prominent trader, CBB, a Key Opinion Leader (KOL) on X. They opened a 10X leveraged long position on Ethereum (ETH) worth $2.11 million.

Currently, they are facing an unrealized loss of $1.035 million due to an entry price of $2,730. Given current market conditions, this has proven to be too high.

However, unlike the PEPE whale, this trader has a more comfortable margin buffer, with a liquidation price of $1,167.8.

KOL takes a 10X leverage position on Ethereum. Source: Analyst Ai on X

KOL takes a 10X leverage position on Ethereum. Source: Analyst Ai on X

While not in immediate danger, this case further reflects the precarious nature of highly leveraged trading in volatile markets.

The unfolding drama surrounding these positions highlights the risks of excessive leverage, particularly in a declining market.

With PEPE’s whale struggling to maintain their position and Ethereum’s long traders facing mounting losses, the broader crypto market could see increased volatility in the coming days.