Ripple Price Forecast: XRP consolidates as mixed signals prevail

- XRP extends sideways trading in a range between $1.45 and $1.50.

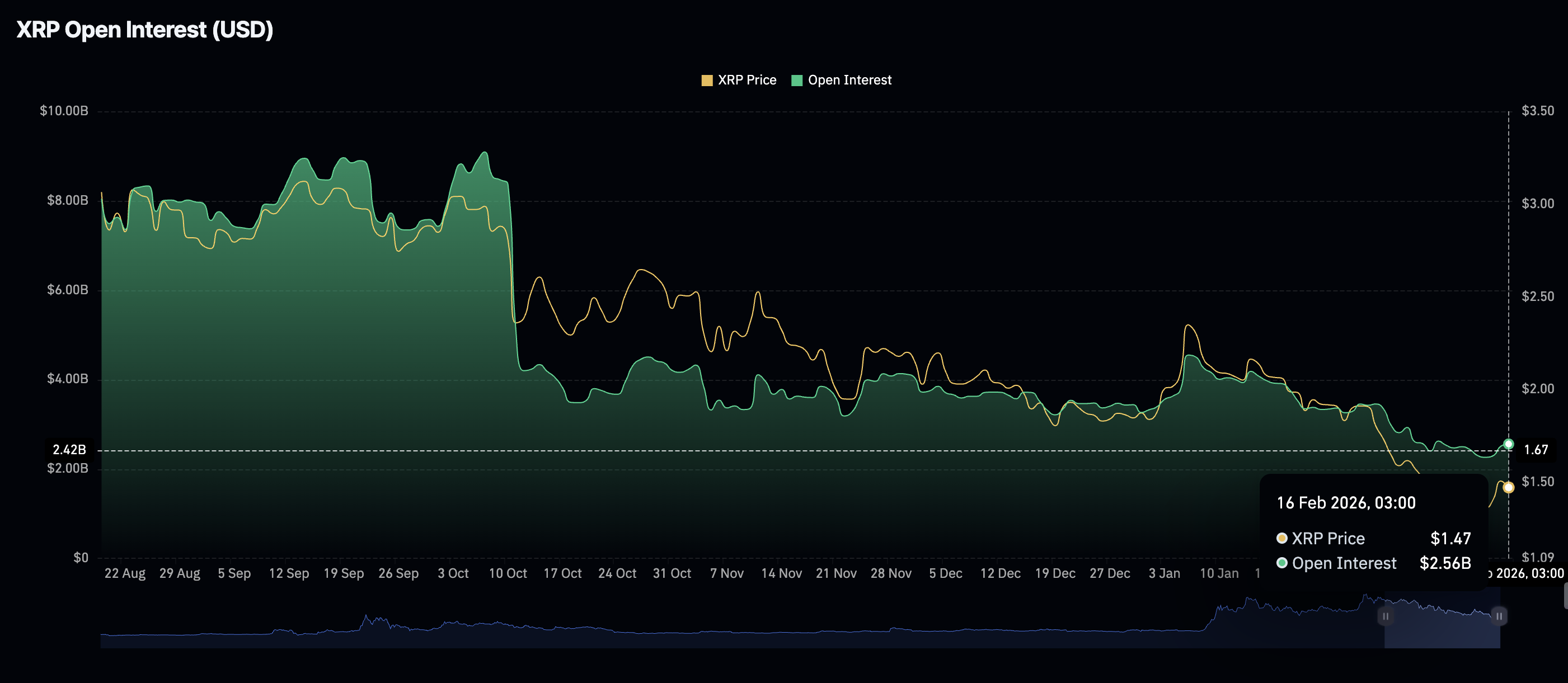

- The XRP derivatives market sustains a mild increase in futures Open Interest to $2.56 billion.

- XRP digital investment products recorded $33.4 million in inflows last week, bringing total assets under management to $2.5 billion.

Ripple (XRP) is trading in a narrow range between $1.45 (immediate support) and $1.50 (resistance) at the time of writing on Monday. The remittance token extended its recovery last week, peaking at $1.67 on Sunday from the weekly open at $1.43.

Last week's United States Consumer Price Index (CPI) report showed that inflation eased in January, fuelling optimism for at least two interest rate cuts by the Federal Reserve (Fed) in 2026. The increased likelihood of rate cuts tends to favor risk assets such as XRP, but the market's overall risk-off tone continues to weigh on the token.

Institutional and retail investors gain modest interest in XRP

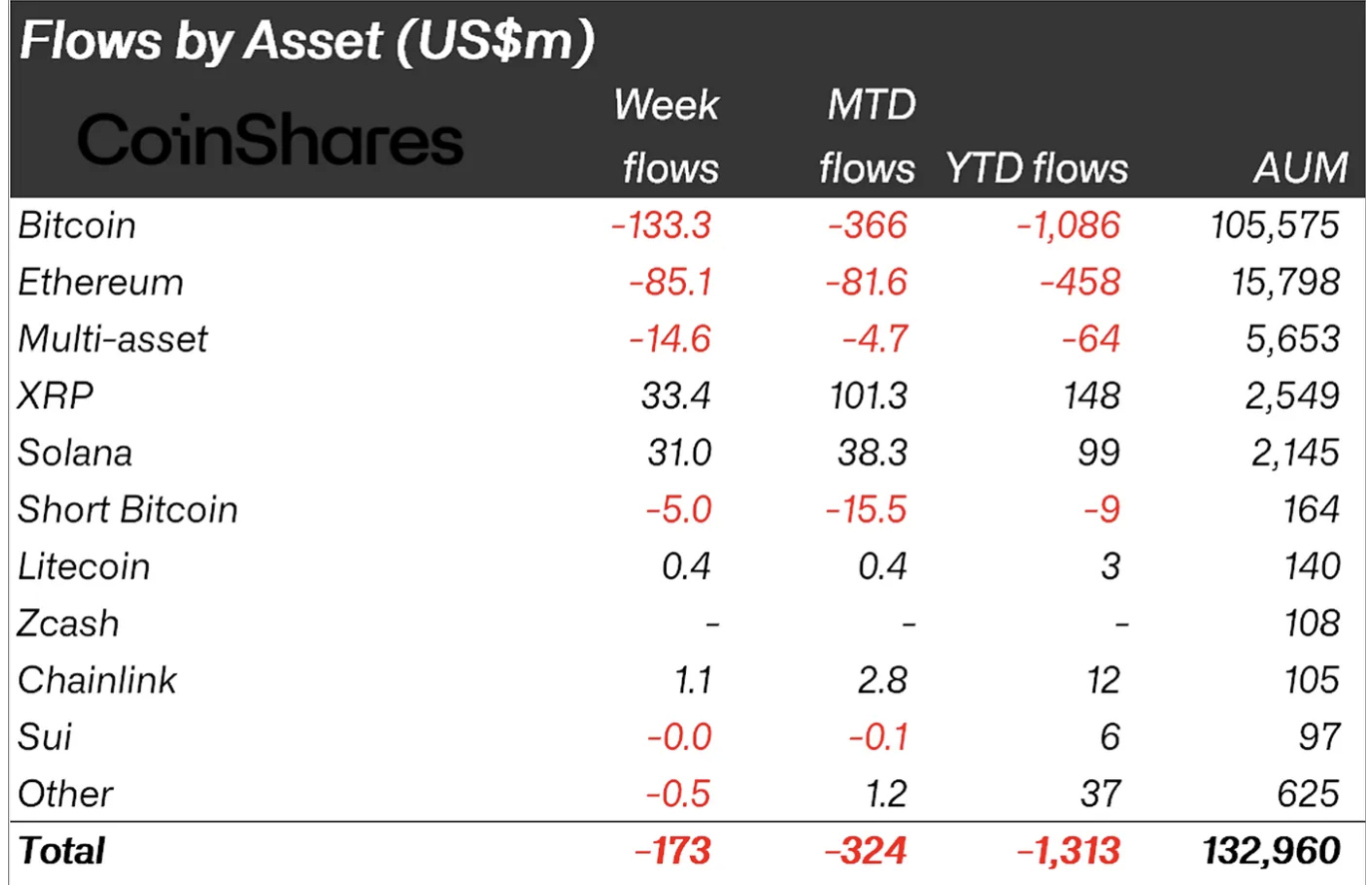

XRP's digital investment products recorded inflows last week, outpacing major assets such as Bitcoin (BTC) and Ethereum (ETH).

Total inflows averaged $33.4 million in the week through to Friday, according to CoinShares, bringing the cumulative assets under management (AUM) to $2.55 billion.

In contrast, Bitcoin and Ethereum led with outflows totaling $133.3 million and $85.1 million, respectively. Outflows across the board totaled $173 million last week, with CoinShares reporting that $3.74 billion has been withdrawn over the past four weeks.

"Digital asset investment products saw a fourth consecutive week of outflows totalling US$173m, bringing the cumulative four-week run of outflows to US$3.74bn," CoinShares states.

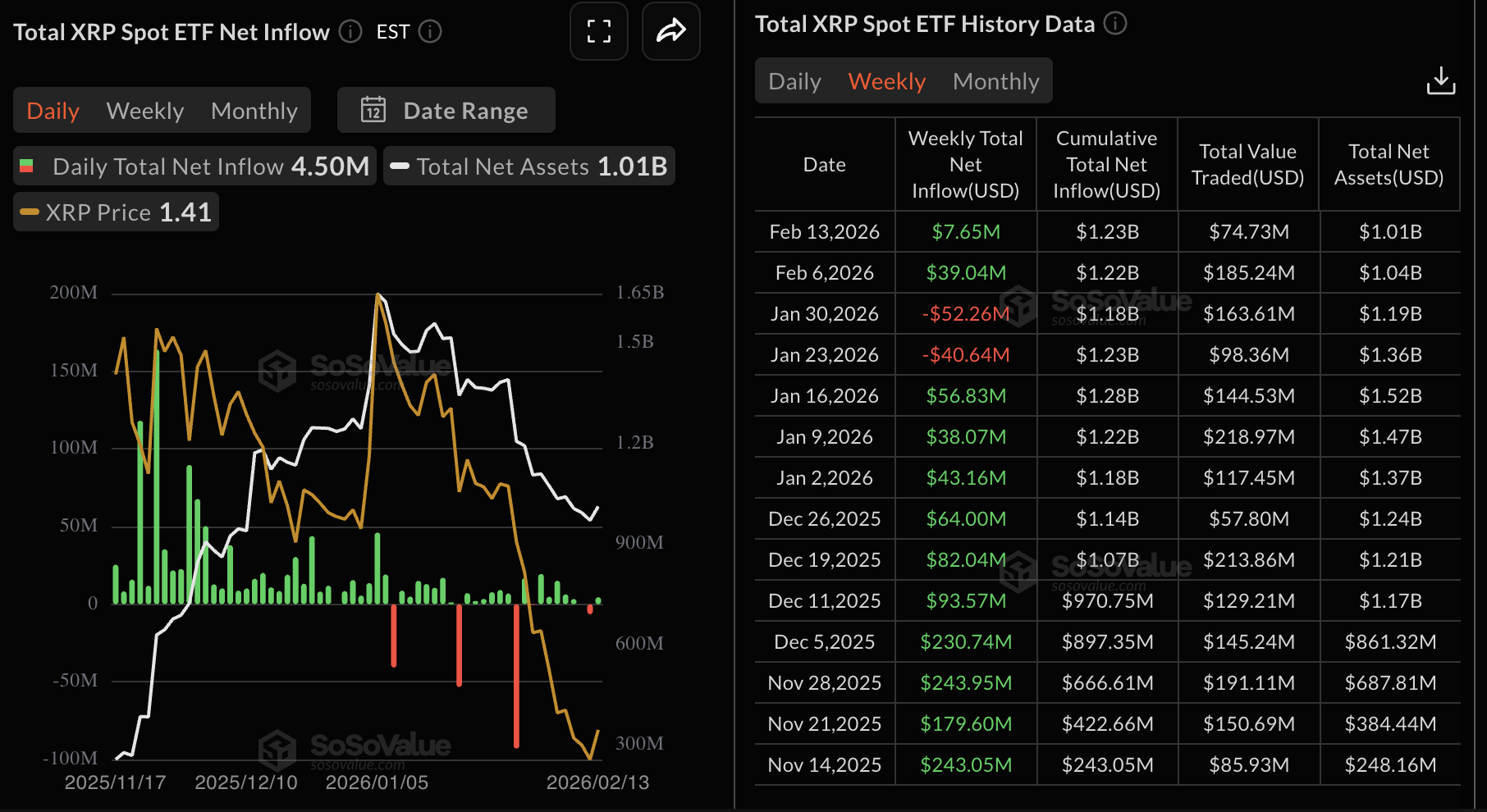

Meanwhile, XRP spot Exchange-Traded Funds (ETFs) recorded total inflows of approximately $7.65 million last week. Inflows resumed on Friday, with investors depositing $4.5 million into XRP ETFs. Steady inflows support positive market sentiment, increasing the odds of a sustainable price rebound.

The XRP derivatives market paints a slightly different picture, with futures Open Interest (OI) rising to $2.56 billion on Monday from $2.51 billion on Sunday. Retail interest has steadied since Friday, when OI averaged at $2.26 billion. Maintaining this positive trend could improve sentiment surrounding the token and stop the price decline.

Technical outlook: XRP holds higher support amid price volatility

The cross-border money transfer token is hovering at $1.48, while sitting well below the declining 50-day Exponential Moving Average (EMA) at $1.73, 100-day EMA at $1.94, and 200-day EMA at $2.14. This stack of falling averages caps rebounds and preserves a downside bias.

However, other technical indicators, such as the Parabolic SAR, print below XRP's spot price at $1.19, offering trailing support as the market attempts to establish a firm baseline.

The Moving Average Convergence Divergence (MACD) line has crossed above the signal line on the daily chart, with the green histogram bars expanding in support of a short-term bullish outlook. Similarly, the Relative Strength Index (RSI) stands at 42.5 and edges higher on the same chart, suggesting bearish pressure is easing, albeit gradually.

A descending trend line from 3.66 (record high) limits upside, with resistance near $2.11. A daily close above $1.73 (50-day EMA) would open the door to $1.94 (100-day EMA), while a break below the intraday low of $1.45 could revive selling pressure.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

(The technical analysis of this story was written with the help of an AI tool.)