Solana Drops to 2-Year Lows — History Suggests a Bounce Toward $100 is Incoming

Solana has spent recent sessions under heavy pressure, sliding to levels not seen in nearly two years. The sharp decline followed broader market weakness, dragging SOL well below prior support zones.

Despite the drawdown, early signs of stabilization are emerging. Historical patterns suggest Solana may be preparing for a recovery that could eventually carry the price back toward, and potentially beyond, the $100 mark.

Solana Has Seen Similar Conditions Before

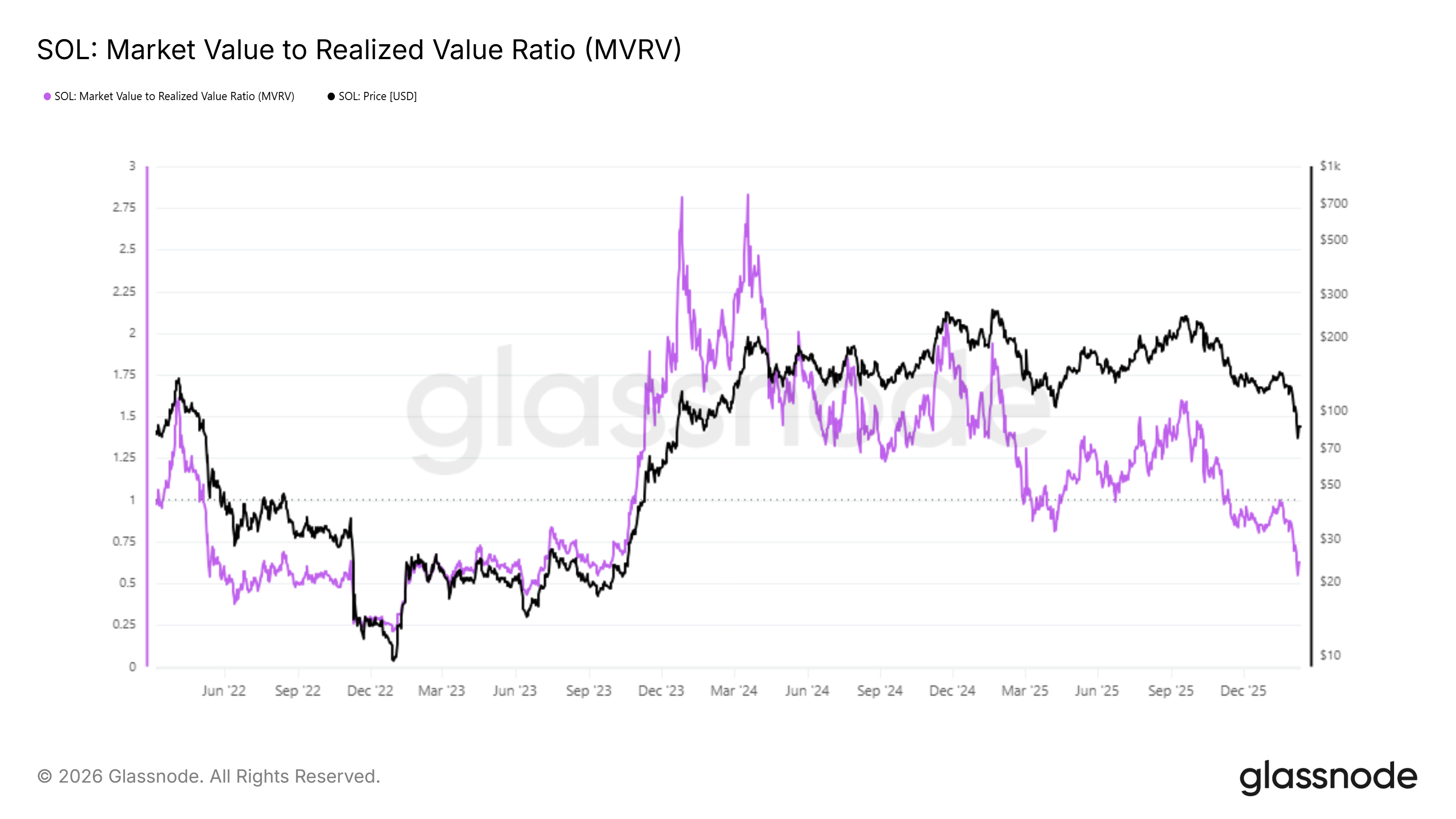

On-chain valuation metrics indicate Solana is deeply undervalued. The Market Value to Realized Value ratio has fallen to a near two-and-a-half-year low. This reading shows the market value of SOL is significantly below the aggregate cost basis of circulating tokens, reflecting widespread unrealized losses among holders.

Such conditions have historically marked late-stage corrections rather than early sell-offs. When realized value exceeds market value by this margin, selling pressure often diminishes. Investors become less inclined to exit at a loss, setting the stage for stabilization. This valuation imbalance supports the view that SOL is trading below fair value..

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

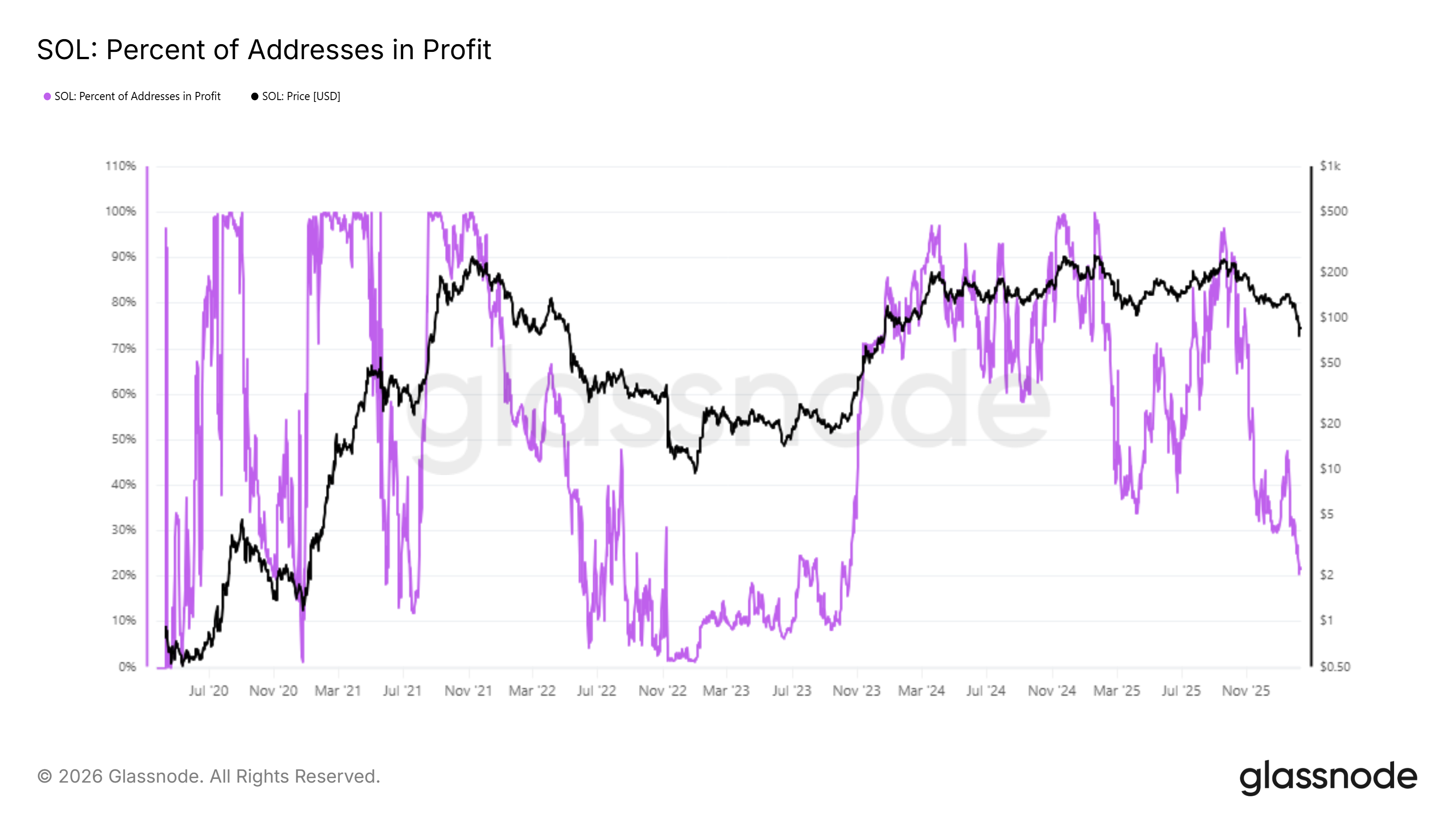

Profitability data reinforces this outlook. Only 21.9% of Solana addresses are currently in profit, meaning roughly 78.1% of holders are underwater. This level of distress has historically aligned with market bottoms, as lower prices tend to attract demand from value-oriented participants.

In previous cycles, profitability dropping near or below 20% preceded notable recoveries. Reduced profit-taking limits supply, while depressed prices encourage accumulation. If history repeats, Solana could benefit from renewed interest as investors position for a rebound from deeply discounted levels.

SOL Price Bounce Back Requires Breaching This Level

Solana is trading near $86 at the time of writing, holding above the 23.6% Fibonacci retracement. This level is often described as bear market support. As long as SOL remains above it, downside risk appears contained, increasing the probability of a technical bounce.

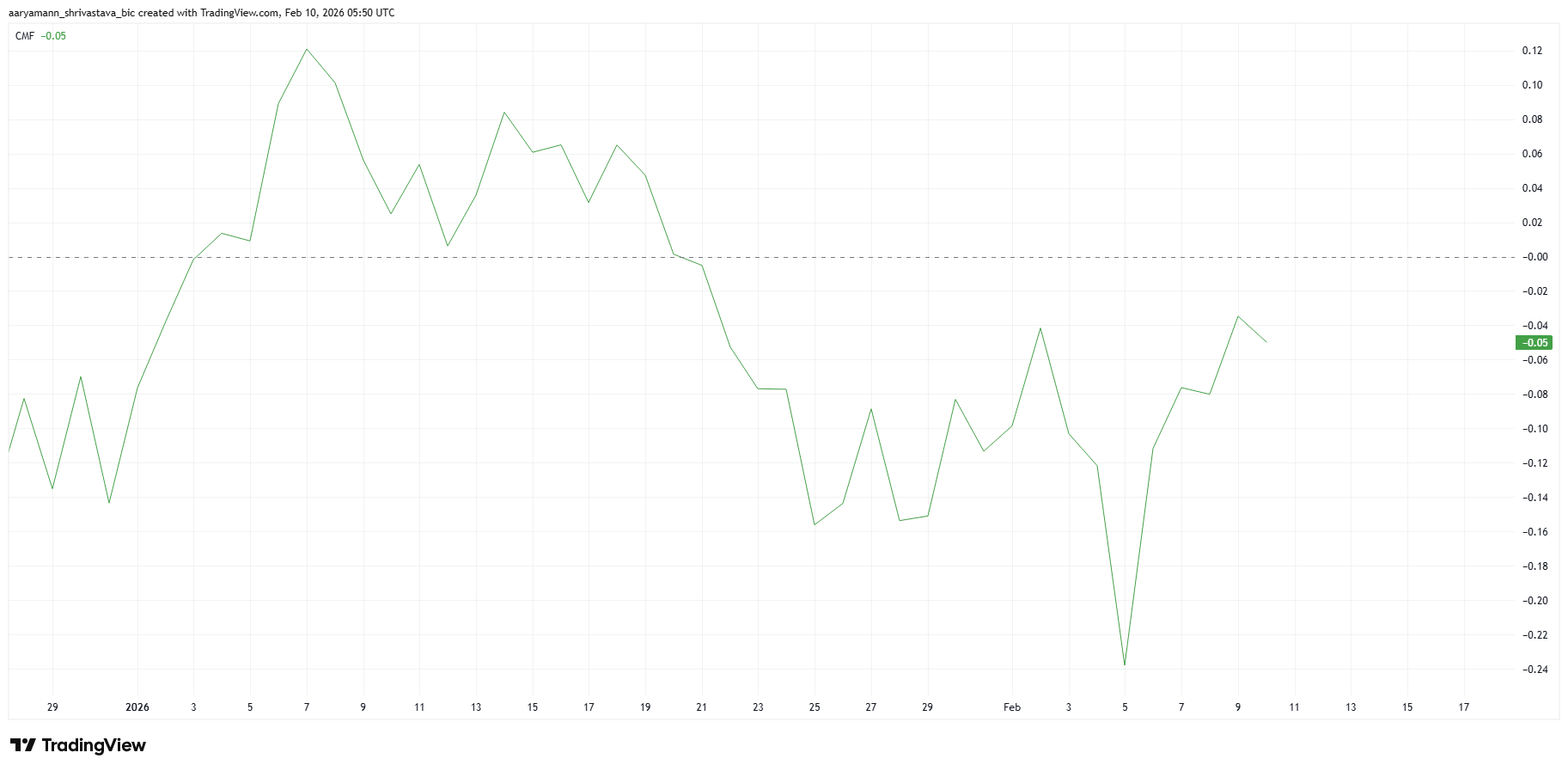

Current stabilization suggests SOL may be forming a bottom. Any recovery will likely depend on improving capital flows. The Chaikin Money Flow indicator shows an uptick while still in negative territory. This shift suggests outflows are slowing, an early signal that selling pressure is easing.

A decisive move above $90 would place Solana on a recovery path toward $100. Confirmation would come if price flips the 61.8% Fibonacci level near $105 into support. Failure of inflows to materialize, however, could reverse progress. A drop below $81 would expose SOL to further declines toward $75 or even $70.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.