Crypto markets tumble amid Middle East tensions, wiping $1.15 billion in liquidation

Market sentiment sours; conflict in the Middle East escalates, with reports suggesting Iran says it will respond "harshly" against Israel.

Asian equities and cryptocurrency markets traded in the red on Friday as geopolitical risk intensified.

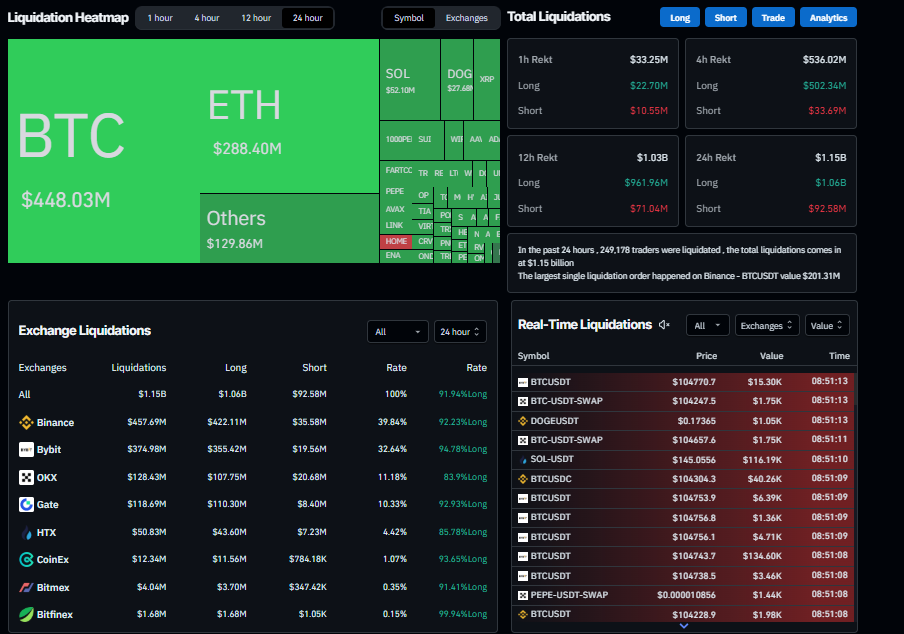

CoinGlass data shows that over $1.15 billion in leveraged positions were liquidated across crypto markets in the past 24 hours.

Rising geopolitical tensions in the Middle East have triggered a sharp decline in risk assets, with cryptocurrency markets facing significant losses. The Kobesissi Letter reports suggesting Iran says it will respond "harshly" against Israel. These rising tensions have brought a gloomy market mood for investors, triggering the liquidation of over $1.15 billion in the cryptocurrency market, as well as the Asian equities market, which followed suit as geopolitical risk intensified.

Risk aversion increases as Middle East conflict escalates

The cryptocurrency markets continued to trade in the red on Friday, with Bitcoin (BTC) falling below $103,000 during the early Asian trading session. Major altcoins, such as Ethereum (ETH), Ripple (XRP), and Solana (SOL), among others, followed the downward trend, crashing sharply that day.

The rising conflict in the Middle East fueled this correction. According to the Kobeissi Letter report on Friday, Iran says it will respond "harshly" against Israel and the US following tonight's attacks. These ongoing geopolitical risks have triggered risk-off flows in the market, which do not bode well for riskier assets.

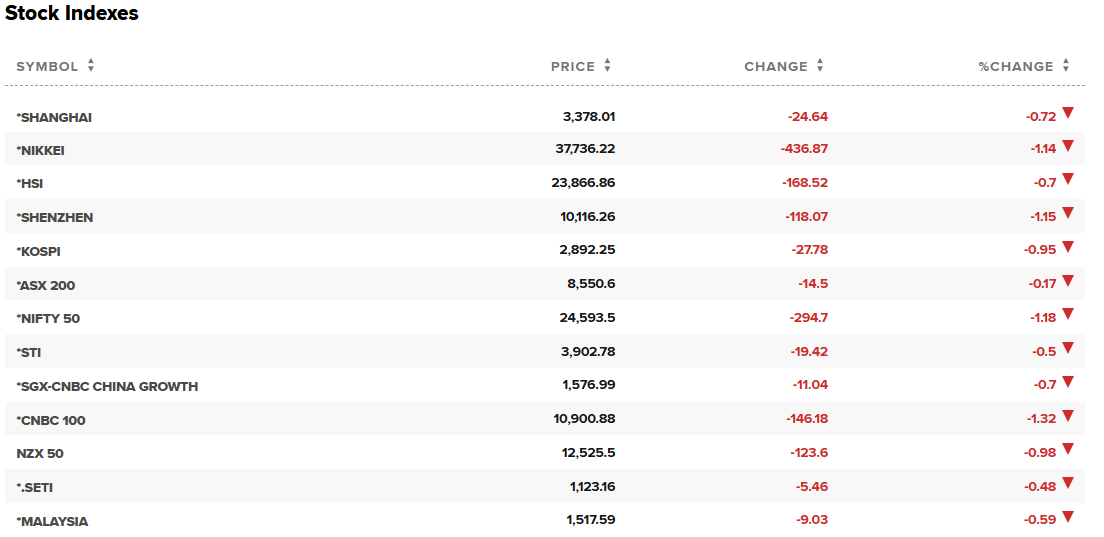

The Asian markets also tumble on this news, as major indexes trade down on Friday, as shown in the graph below. However, safer assets like Gold continue to set new intraday highs, with XAU/USD nearing $3,444 following these headlines.

Asian stock indexes chart.

The effects of rising geopolitical tensions have triggered a wave of liquidation in the cryptocurrency markets. According to the CoinGlass Liquidation Map chart, a total of 249,178 traders were liquidated in the last 24 hours, resulting in a total liquidation value of $1.15 billion. The largest single liquidation order occurred on Binance, involving BTCUSDT, valued at $201.31 million.

Bitcoin saw over $448 million in liquidation, while Ethereum saw $288.40 million. Huge liquidations like this could spark Fear, Uncertainty and Doubt (FUD) among investors and cause a rise in selling pressure, leading to further price declines.

Liquidation Heatmap chart. Source: Coinglass

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.