Best Place to Buy Gold in Australia: Top 8 Options for Investors in 2026

Gold has always played a unique role in Australian portfolios. In times of inflation pressure, currency volatility or global uncertainty, many investors turn to gold as a store of value or a portfolio hedge.

But in 2026, buying gold in Australia no longer means a single path. Investors now face multiple options: online trading platforms, gold CFDs, bullion dealers, mints, ETFs, and even banks. Each option serves a different type of investor—and choosing the wrong one can mean higher costs, poor liquidity or unnecessary risk.

This guide breaks down the best place to buy gold in Australia, ranked by popularity, accessibility and practicality for modern investors. We compare 8 proven options, starting with the most flexible choice for today’s active traders.

1: Mitrade – Best Platform for Gold CFD Trading

![]()

For investors who prioritise flexibility, liquidity and cost efficiency, Mitrade has become one of the most popular ways to gain exposure to gold in Australia—without the burden of physical ownership.

Instead of buying bullion, investors trade gold CFDs, allowing them to speculate on gold price movements without storage, insurance or delivery concerns.

Why Australian investors choose Mitrade:

Mitrade appeals to investors who want to buy gold online in Australia in a modern, liquid way. It is especially popular among traders who actively manage risk, hedge portfolios or trade gold alongside forex and indices.

Best for:

Active investors, short- to medium-term traders, portfolio hedging, cost-sensitive users.

Trade XAU/USD with Tight Spreads

2: CommSec – Gold ETFs on the ASX

For investors who prefer regulated, long-term exposure to gold through the ASX, CommSec is one of the most widely used platforms in Australia.

CommSec is the online brokerage arm of Commonwealth Bank of Australia, giving investors direct access to ASX-listed gold ETFs.

Why Australians buy gold ETFs via CommSec:

Buying gold through CommSec appeals to investors who want portfolio stability, transparency and institutional backing rather than active trading.

Best for:

Long-term investors, SMSF holders, conservative portfolios.

3: Commonwealth Bank – Bank-Based Gold Investments

Some Australian investors still prefer to buy gold through a traditional bank, and Commonwealth Bank is the most recognisable name in this space.

While banks do not offer active gold trading, they provide gold-linked investment products and certificates under strict regulatory frameworks.

Commonwealth Bank gold investment overview:

Buying gold through Commonwealth Bank prioritises institutional trust over flexibility.

Best for:

Risk-averse investors who value brand trust and simplicity.

4: Perth Mint – Physical Gold and Government-Backed Security

The Perth Mint is one of the most recognised names in the Australian gold market. Backed by the Government of Western Australia, it is widely regarded as one of the safest places to buy physical gold in Australia.

Key features of Perth Mint:

Perth Mint suits long-term investors who want direct ownership of physical gold and are comfortable with storage logistics.

Best for:

Long-term wealth preservation, physical gold holders, conservative investors.

5: ABC Bullion – Specialist Bullion Dealer

ABC Bullion is a long-established precious metals dealer with strong brand recognition across Australia. It offers both physical gold sales and allocated storage services.

ABC Bullion overview:

Compared to mints, ABC Bullion offers more flexibility in product choice, though costs remain higher than digital alternatives.

Best for:

Investors wanting physical gold with professional storage.

6: Jaggards – Sydney-Based Investment Gold Dealer

Jaggards is a well-known dealer in Sydney offering premium investment gold with competitive buyback options.

Jaggards Features:

While local shops offer immediacy, pricing transparency can vary significantly.

Best for:

Investors in NSW, collectors, medium-term holders.

7: BullionVault – Digital & Fractional Gold Ownership

BullionVault allows Australians to buy fractional physical gold stored in global vaults, combining online convenience with physical security.

BullionVault Features:

Best for: Investors seeking digital access to physical gold and low entry cost.

8: GoldPass (Perth Mint) – Digital Gold Account

GoldPass is a digital gold account offered by Perth Mint, providing Australians with fractional gold ownership and easy online management.

GoldPass Features:

While convenient, investors must carefully assess counterparty risk.

Best for:

Small investors, beginners testing gold exposure.

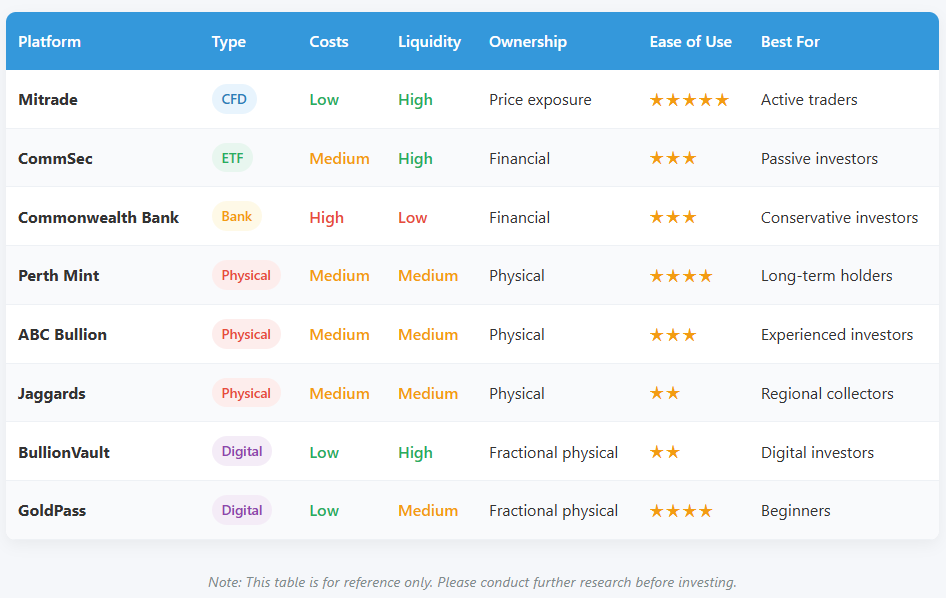

Comparison Summary: Best Ways to Buy Gold in Australia

“Trade gold CFDs with an ASIC-regulated broker. Fast AUD funding via PayID. ”

Final Thoughts: What Is the Best Place to Buy Gold in Australia?

There is no single “best” option for everyone. The best place to buy gold in Australia depends on your investment goals, time horizon and risk tolerance.

If you value flexibility, low costs and liquidity, platforms like Mitrade stand out.

If you prefer long-term physical ownership, trusted providers like Perth Mint remain relevant.

For passive portfolios, gold ETFs offer simplicity.

Understanding these differences is key to making smarter gold investment decisions in 2026.

1. Is it safe to buy gold online in Australia?

Yes, if you use ASIC-regulated platforms or well-established bullion providers like Mitrade, CommSec, or Perth Mint.

2. What is the cheapest way to invest in gold in Australia?

Gold CFDs and ETFs typically have lower upfront costs compared to physical gold.

3. Can I buy gold in Australia without storing it?

Yes. CFDs, ETFs and digital gold allow exposure without physical storage.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.