AAVE eyes $300 breakout as Avara’s founder visits the White House

- AAVE hits a four-month high as the DeFi token recorded quick gains early in the week.

- Avara’s founder, Stani Kulechov, meets Bo Hines at the White House, boosting the risk-on sentiment.

- The technical outlook suggests a high likelihood of a $300 breakout, leading to an extended rally.

Aave (AAVE) edges higher to $289, recording over 15% gains in the last 24 hours at press time. The increasing risk-on sentiment in the broader crypto market, with Bitcoin (BTC) hitting $110,000 on Monday, boosts the Decentralized Finance (DeFi) tokens. Additionally, the recent visit of Stani Kulechov to the White House to meet Trump’s Executive Director of Digital Assets Advisors fuels the bullish momentum as the technical outlook suggests an imminent breakout of $300.

Avara Founder meets Bo Hines amid the SEC’s roundtable on DeFi

Stani Kulechov, the founder of Avara, parent company to Aave, recently visited the White House for a meeting with Donald Trump’s Executive Director of the Council of Advisers on Digital Assets. Sharing a portrait with Hines in an X post on Monday, Stani captioned the discussion as being about the protection of DeFi innovation in the US.

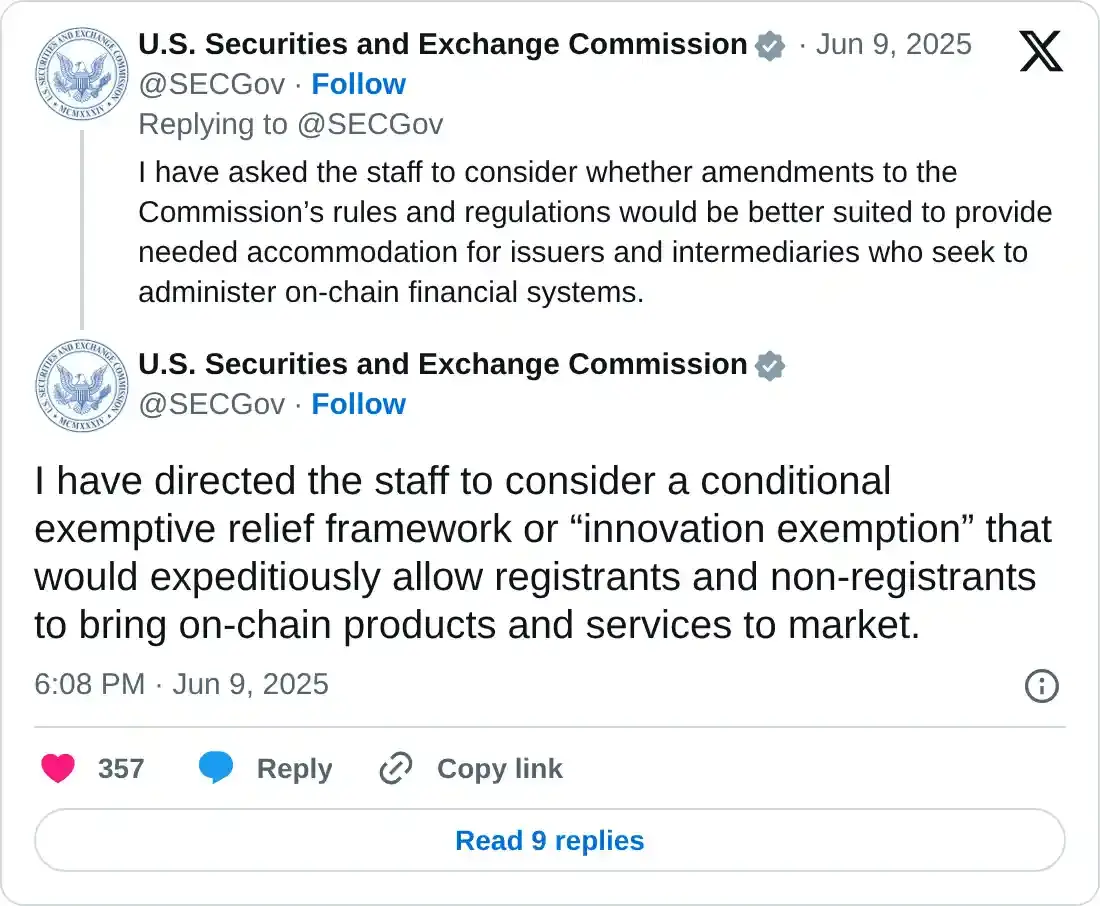

The meet-up aligns with the US Securities and Exchange Commission (SEC) roundtable on DeFi and American Spirit on Monday. Notably, during the roundtable meeting, Paul Atkins, the Chairman of the SEC, advised a conditional exemption relief framework to facilitate the production of more DeFi products and services.

The increased support of the SEC for DeFi is evident in the plan to launch a crypto framework, as tasked to the Crypto Task Force by SEC Commissioner Mark Uyeda on January 21.

AAVE’s rising TVL and lending boost protocol growth

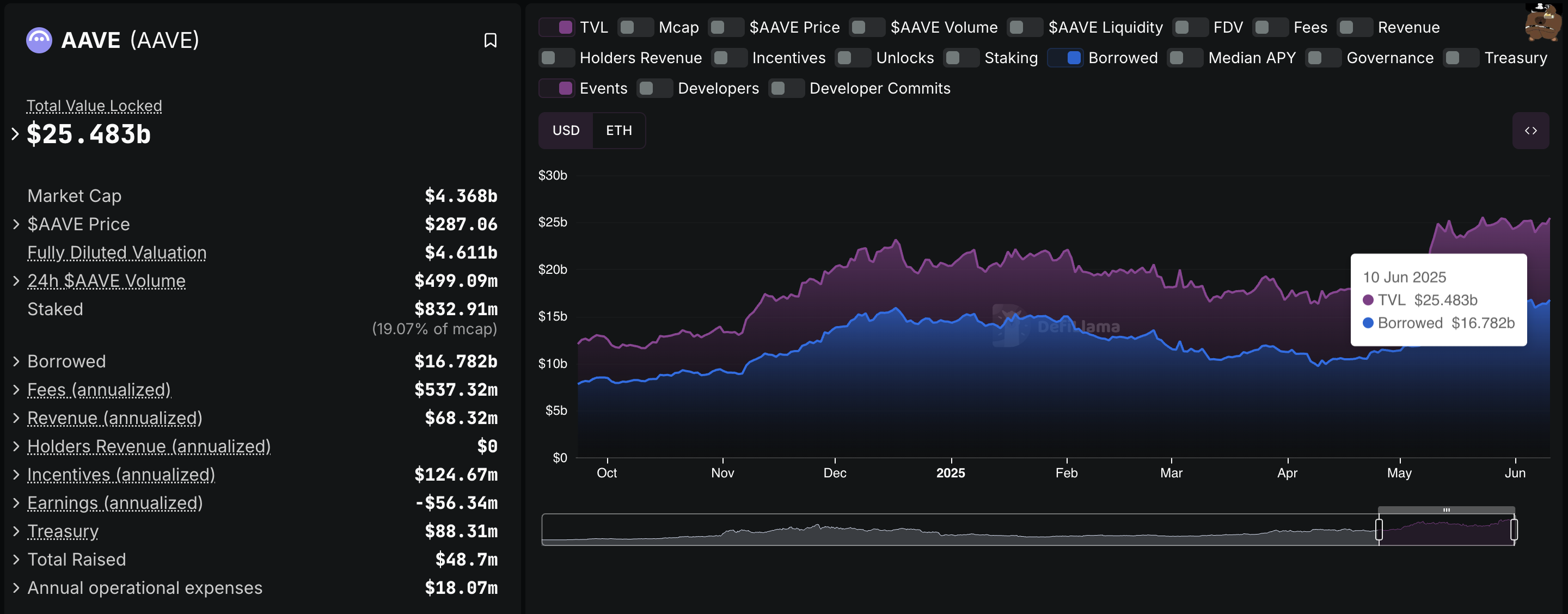

The Aave protocol witnesses fundamental network growth, driven by the expansion of Total Value Locked (TVL) and lending business. According to DeFiLlama, AAVE’s TVL has surpassed the $25 billion mark, standing at $25.483 billion.

The lending business of AAVE reaches a new record, with the borrowed sum hitting $16.782 billion. This suggests increased user activity on the platform for lending and borrowing.

AAVE Total Value Locked. Source: DeFiLlama

AAVE nears $300 breakout, $338 target in sight

AAVE recorded an 11% rise on Monday, creating a bullish engulfing candle and marking its highest daily close since February 1. Extending the gains, the DeFi token registers an intraday increase of over 2%.

With a bullish start to the week, AAVE challenges the $290 resistance, aligning with the 61.80% Fibonacci level, a retracement from December’s high at $399 to the year-to-date low at $114.

A potential close above $290 could increase the chances of a $300 breakout, flashing a buying opportunity for sideline investors. According to the Fibonacci levels, the 78.6% retracement level at $338 could be the immediate price target.

The Moving Average Convergence/Divergence (MACD) indicator is on the verge of triggering a buy signal. It will manifest when the blue line crosses above the red line and green histograms emerge from the zero line.

The Relative Strength Index (RSI) is at 67 points upward, signaling a surge in bullish momentum. Approaching the overbought conditions, RSI could signal a bearish turnaround if it dips again.

However, a sideways trend above the overbought boundary line at 70 could prolong the uptrend.

AAVE/USDT daily price chart. Source: Tradingview

On the flip side, a failure to push the closing price above $290 could result in a steep reversal to the 50% Fibonacci level at $256.