Trump family-linked Bitcoin mining firm to go public via Nasdaq merger

- Trump family-backed American Bitcoin will go public through a stock-for-stock merger with Nasdaq-listed Gryphon Digital Mining, trading under the ticker “ABTC.”

- Hut 8 will retain majority ownership and continue as American Bitcoin’s exclusive infrastructure following the merger.

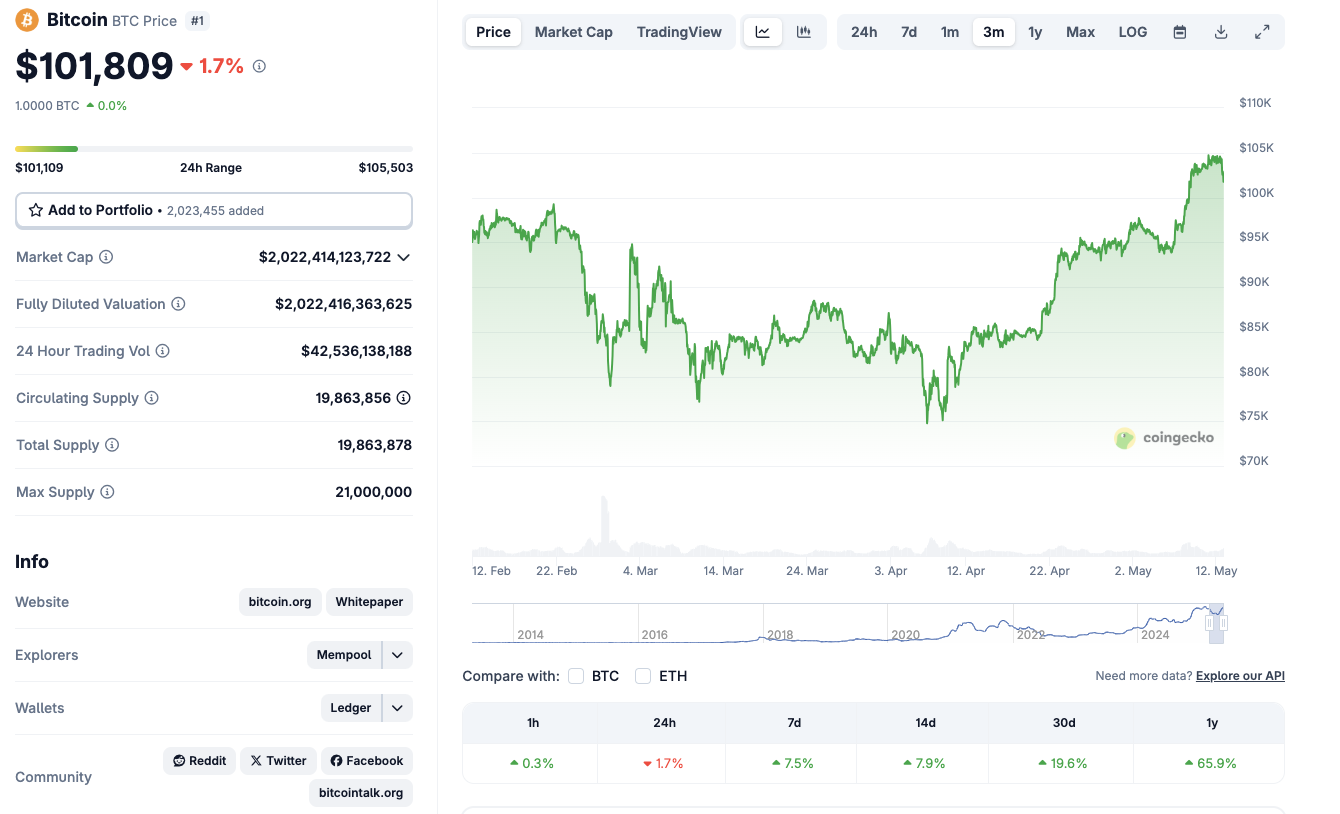

- Bitcoin price dropped 3% to $101,809 after peaking at $105,800 on Monday, signaling active profit-taking.

American Bitcoin, backed by Trump affiliates, merges with Gryphon to secure Nasdaq listing and expand U.S.-based Bitcoin mining operations

Trump-backed American Bitcoin secures Nasdaq listing via Gryphon Digital merger

American Bitcoin, a Trump-linked mining venture, will go public under the ticker “ABTC” after merging with Nasdaq-listed Gryphon Digital Mining. The all-stock deal, announced Monday, aims to accelerate the company’s Bitcoin accumulation strategy and boost infrastructure scale across the United States. The merger is expected to close in Q3 2025, pending regulatory approvals.

“This transaction marks the next step in scaling American Bitcoin as a purpose-built vehicle for low-cost Bitcoin accumulation at scale,” said Hut 8 CEO Asher Genoot.

Post-merger, American Bitcoin stockholders will retain 98% of the combined company, with Hut 8 continuing as the majority shareholder.

Hut 8 retains control and secures long-term infrastructure role

According to the merger filings, Hut 8 will remain the exclusive infrastructure and operations partner of American Bitcoin, locking in commercial agreements that provide recurring revenue across its power and digital units. The company formed American Bitcoin in March via a merger with American Data Centers (ADC), a venture led by Eric Trump and Donald Trump Jr.

Eric Trump will join the new entity’s leadership, alongside directors Mike Ho, Justin Mateen, and Michael Broukhim. The combined operation positions itself as a low-cost accumulation vehicle at the intersection of Bitcoin mining and U.S. infrastructure, leveraging public capital markets for expansion.

What’s next?

The listing positions American Bitcoin to tap into U.S. capital markets, while reinforcing institutional enthusiasm for crypto-native firms. With Hut 8 holding over 10,000 BTC and retaining 80% equity in the merged company, the structure preserves long-term Bitcoin upside for shareholders without burdening its balance sheet.

Bitcoin (BTC) price action today

Bitcoin hit an intraday peak of $105,800 on Binance before retreating to $101,809 — down 3% on the day.

Bitcoin price action, May 12, 2025 | Source: Coingecko

The pullback signals moderate profit-taking following last week’s surge, though steady buy orders at the $101K level suggest underlying support. Volatility remains elevated amid structural shifts in mining and capital flows.