Chainlink Price Forecast: LINK faces $150M sell-off amid Trump Media Truth.Fi crypto investment plan

- Chainlink price consolidated above $22 on Wednesday, on course to end an 11.7% four-day losing streak.

- The top 1,000 Chainlink whale wallets have sold 6.7 million LINK (~$150 million) since Trump’s inauguration.

- On Wednesday, Trump Media announced the launch of Truth.Fi, a crypto investment and fintech platform.

- Chainlink's ties to Trump’s portfolio surfaced after Trump-backed World Liberty Financial acquired millions worth of LINK on Inauguration Day.

Chainlink (LINK) price consolidated above $22 on Wednesday, showing signs of stabilization after a tumultuous week that saw the token lose 11.9%. LINK has struggled to break free from a downturn that began on Inauguration Day. However, renewed market momentum spurred by President Donald Trump’s deepening involvement in the crypto sector could provide a much-needed catalyst.

Chainlink Price Action: LINK Hovers Near $22 Amid Market Rebound

The global cryptocurrency market rebounded slightly on Wednesday with Bitcoin (BTC) price reclaiming $102,500 and Ethereum (ETH) trading above $3,100.

Chainlink (LINK) price action followed suit, recording a mild 0.81% uptick to trade at $22 as of press time.

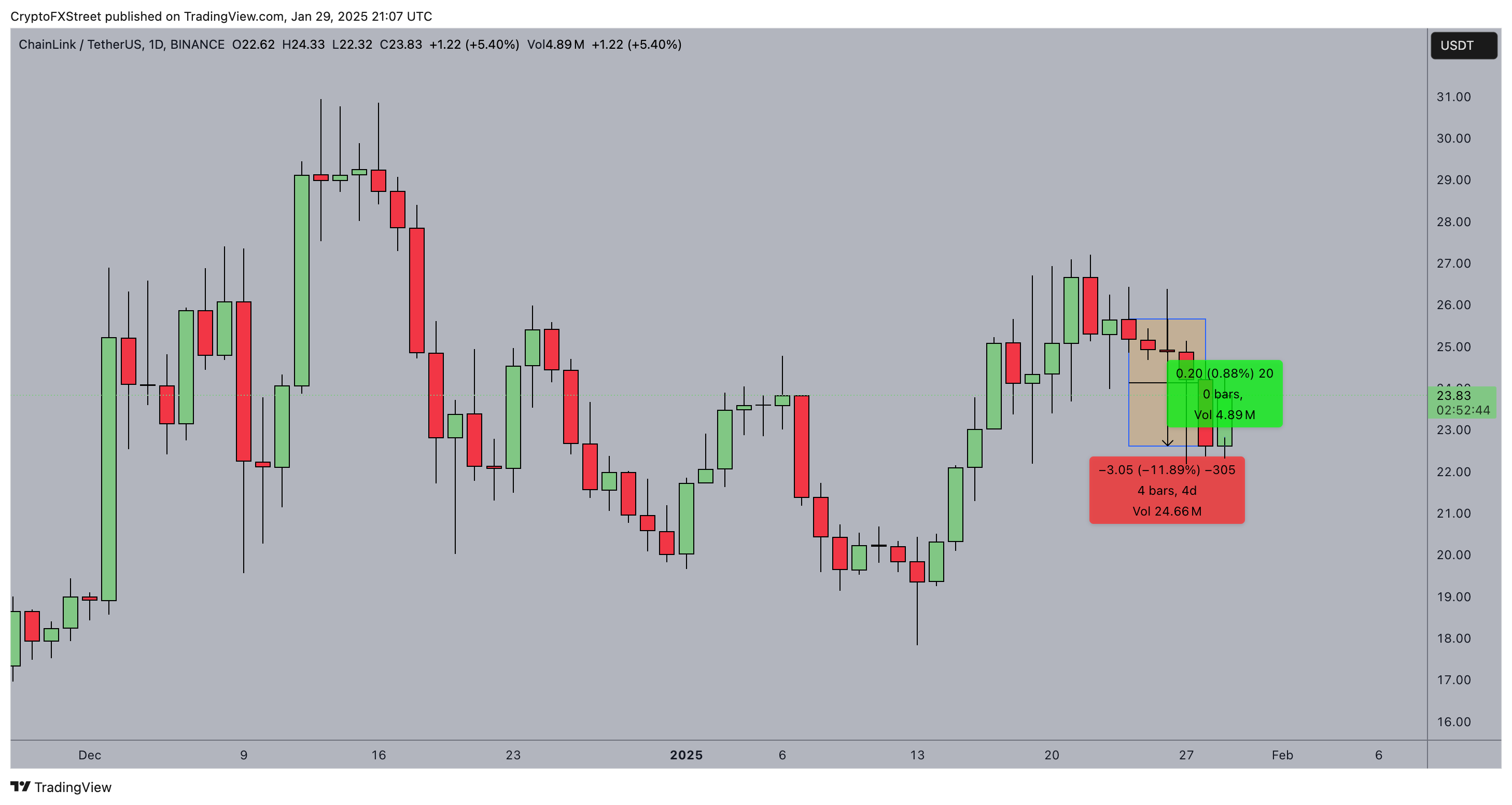

The LINKUSDT daily price chart shows that a close above $22 could mark the end of four consecutive losing sessions.

Chainlink Price Action (LINKUSDT)

Chainlink Price Action (LINKUSDT)

Despite the modest recovery, Chainlink remains under bearish pressure. The token needs to establish support above the $22 level to escape its prolonged decline.

With trading volumes still relatively subdued, bullish momentum hinges on fresh market catalysts.

Traders eye bullish impact as Trump launches TruthFi crypto investment arm

On Wednesday, Donald Trump confirmed the launch of TruthFi, a crypto-focused investment arm under the Trump Media and Technology Group (TMTG).

According to Reuters’ report, his initiative aims to invest in crypto assets, ETFs, collectibles, and other blockchain-based financial instruments.

The move has sparked bullish sentiment across the market, particularly for tokens closely linked to Trump-backed ventures.

WLFI adopts Chainlink (LINK) oracle feeds | Source: X.com

Chainlink’s association with Trump gained traction when World Liberty Financial (WLFI) was spotted acquiring large volumes of LINK on Inauguration Day.

While the exact figures remain unverified, on-chain data suggests that WLFI added millions of dollars worth of LINK to its portfolio.

The adoption of Chainlink’s oracle feeds by WLFI further solidifies the connection, raising expectations of increased institutional demand for LINK.

Trump’s formal unveiling of TruthFi on January 29 has reinforced optimism among traders, helping LINK recover from recent lows.

The investment arm’s focus on blockchain technology could provide additional utility for Chainlink’s oracle services, strengthening its market position.

Chainlink whales capitalize on Trump inauguration to book $150M profits

Last week, Trump’s growing influence in the crypto sector fueled optimism, particularly for tokens held in portfolios linked to Trump-backed entities.

Notably, Chainlink price had rallied to a 2025 peak of $27 on January 22. However, while analysts anticipate bullish momentum from Trump’s latest crypto investment move with Truth.Fi, on-chain data reveals that large investors have used the recent surge in market enthusiasm to book substantial profits.

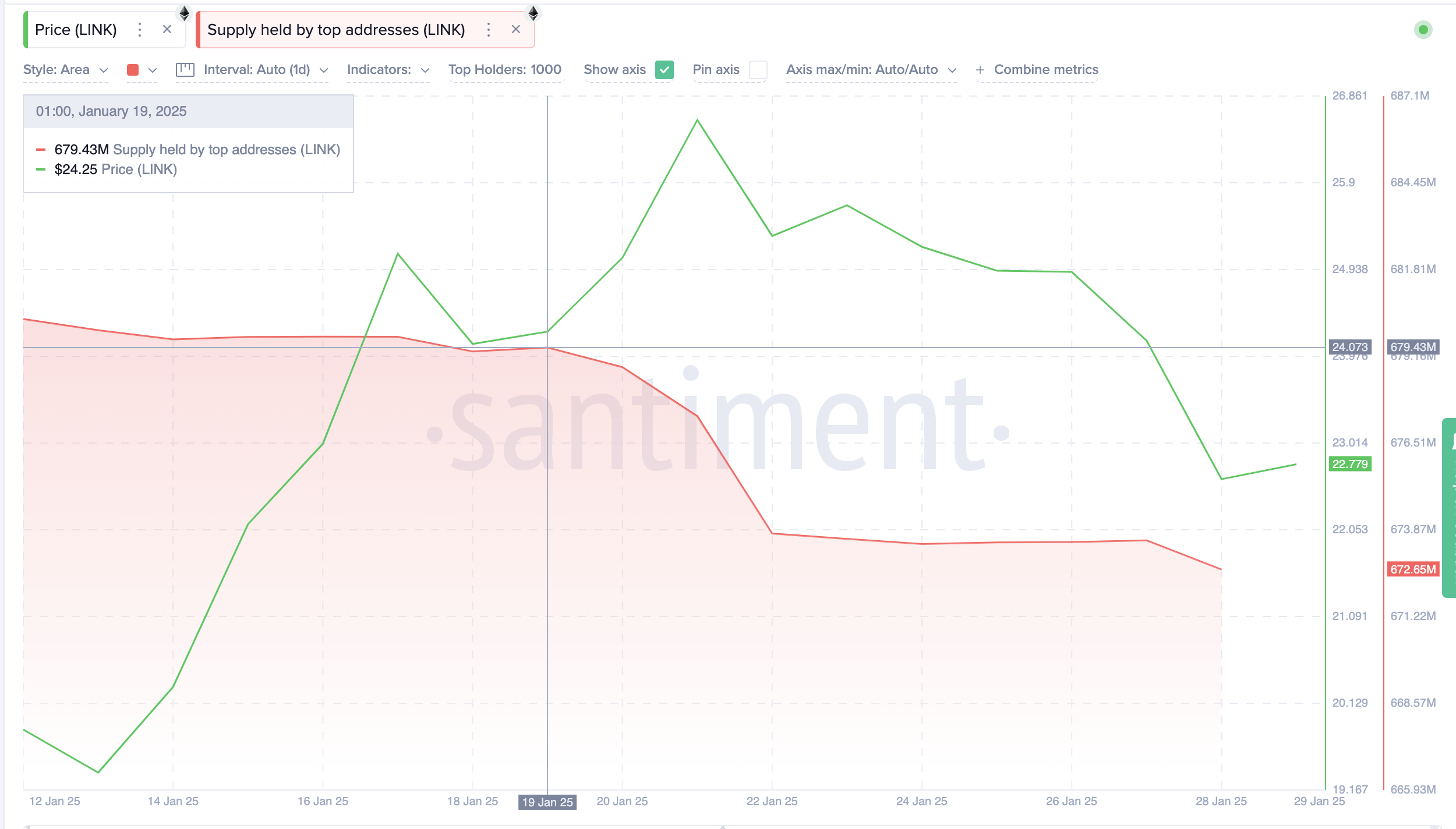

Santiment data highlights a significant sell-off among Chainlink’s largest holders.

The top 1,000 whale wallets held 679.4 million LINK tokens on January 19. However, since Inauguration Day, these wallets have persistently reduced their holdings, as illustrated by the downward-sloping red trendline on the chart below.

Chainlink (LINK) Top 1,000 Holder Balances vs. LINK Price | Source: Santiment

As of press time on Wednesday, the top 1,000 wallets now hold just 672.7 million LINK, indicating a net sell-off of 6.7 million LINK tokens within a 10-day period.

At current prices, this liquidation amounts to approximately $150 million in realized profits.

Such whale-driven sell-offs typically increase market supply, amplifying downward pressure on prices.

Considering the scale of liquidations within a short time frame, the market appears oversupplied, making it challenging for LINK to sustain upward momentum without an external catalyst.

LINK Price Forecast: $150M whale sell-off signals pull-back risks ahead

For LINK price to regain steady bullish footing, it requires a combination of increased trading volume backing the strong institutional demand backing positive tailwinds from Trump’s latest crypto moves.

The recent TruthFi launch and WLFI’s LINK acquisition have provided some optimism, but persistent whale liquidations remain a concern.

Without a decisive breakout above the $22.50–$23.00 range, LINK could continue its consolidation phase.

A resurgence in demand, possibly driven by new institutional inflows or broader crypto market recovery, is necessary to absorb the excess supply and reignite a sustainable rally.

Until then, LINK remains at risk of extended sideways trading with the potential for further retracements if selling pressure intensifies.

Chainlink (LINK) Price Forecast

Technical indicators also support this poignant stance that amid an ongoing $150 million whale sell-off, LINK’s 0.8% uptick on Monday could evolve into a bull trap.

If LINK decisively breaks above $25, it could signal a return to bullish momentum with targets at $27.50 and $30 in the near term.

This aligns with the upper Keltner Channel resistance. A move above this level would likely require higher trading volume and fresh institutional inflows.

Conversely, failure to hold above $22.50, could amplify short-term downside risks.

This could lead to rapid retesting of $19.50 (lower Keltner Channel), especially if selling pressure from whales intensifies.