Canada CPI expected to show sticky inflation in January, still above BoC’s target

- Canadian inflation is expected to rise by 2.4% YoY in January.

- The core CPI is still seen well above the BoC’s 2% target.

- The Canadian Dollar has given away some gains vs. the US Dollar recently.

The publication of Canada’s January Consumer Price Index (CPI) figures on Tuesday will be the focus of attention. Indeed, Statistics Canada data will provide the Bank of Canada (BoC) with a much-needed update on price pressures ahead of its March 18 meeting, where policymakers are widely expected to keep rates steady at 2.25%.

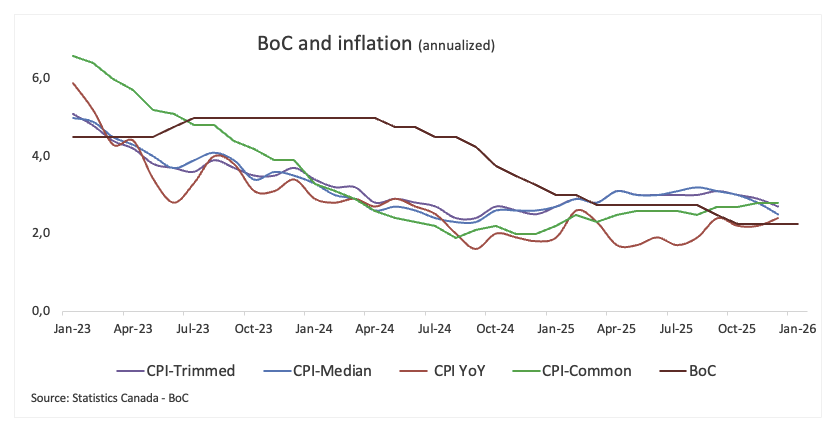

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%. The bank will also closely monitor its core measure (which strips food and energy costs), which held steady at 2.8% YoY in the last month of 2025.

Analysts remain uneasy after last month’s inflation pickup, and the risk of US tariffs feeding into domestic prices is adding another layer of uncertainty.

What can we expect from Canada’s inflation rate?

At its latest meeting, the central bank made it clear that policy is broadly where it needs to be to keep inflation close to the 2% target, assuming the economy evolves as expected. That said, officials were equally keen to stress that they are not on autopilot. If the outlook weakens or inflation risks resurface, they stand ready to adjust.

Indeed, on inflation, the tone was cautiously reassuring. Headline inflation is expected to hover near target, with spare capacity in the economy helping to offset some of the cost pressures linked to trade reconfiguration. Still, underlying inflation remains somewhat elevated, a reminder that the disinflation process is not yet fully complete.

Inflation, therefore, remains the key variable to watch. A glance at the latest figures showed that the headline CPI edged up to 2.4% YoY in December, while core inflation eased to 2.8% YoY. Additionally, the bank’s preferred gauges, CPI-Common, Trimmed Mean, and Median, also moderated, but at 2.8%, 2.7%, and 2.5%, respectively, they continued to run above the 2% objective.

When is the Canada CPI data due, and how could it affect USD/CAD?

Markets will fully focus on Tuesday at 13:30 GMT, when Statistics Canada publishes January's inflation figures. There’s a sense of nervous anticipation, with traders wary that price pressures may prove more stubborn than hoped and keep the broader uptrend intact.

A hotter-than-expected print would likely reignite concerns that tariff-related costs are finally filtering through to consumers. That, in turn, could nudge the BoC towards a more cautious tone in the near term. It would also tend to lend the Canadian Dollar (CAD) some short-term support, as investors reassess a policy outlook that increasingly hinges on how trade tensions and their impact on inflation unfold.

Pablo Piovano, Senior Analyst at FXStreet, notes that the Canadian Dollar has surrendered some gains in the last few days, motivating USD/CAD to rebound modestly past the 1.3600 hurdle, all following its YTD floor just below the 1.3500 support reached in late January.

Piovano indicates that the resurgence of a bullish tone could prompt spot to confront the February top at 1.3724 (February 6), ahead of the provisional 55-day SMA around 1.3760. Further up comes the always relevant 200-day SMA near 1.3820, prior to the interim 100-day SMA near 1.3870 and the 2026 ceiling at 1.3928 (January 16).

On the flip side, Piovano points out that a key support lies at the 2026 bottom, at 1.3481 (January 30). The loss of this level could open the door to a visit to the September 2024 floor at 1.3418 (September 25).

“In addition, momentum indicators continue to lean bearish: the Relative Strength Index (RSI) approaches the 45 mark, while the Average Directional Index (ADX) near 28 is indicative of quite a firm trend,” he says.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Jan 28, 2026 14:45

Frequency: Irregular

Actual: 2.25%

Consensus: 2.25%

Previous: 2.25%

Source: Bank of Canada

Economic Indicator

BoC Consumer Price Index Core (YoY)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Tue Feb 17, 2026 13:30

Frequency: Monthly

Consensus: -

Previous: 2.8%

Source: Statistics Canada