Pi Network Price Forecast: PI signals an early reversal amid the new Pi Node version launch

- Pi Network edges higher, gradually recovering from last week’s 12% decline.

- The launch of a new Pi Node version aims to improve the node initialization process.

- Technicals share a bullish bias as PI nears the breakout of an Adam and Eve pattern on the 4-hour chart.

Pi Network (PI) edges higher at press time on Thursday as it trades in the green for the third consecutive day. The recovery could have been driven by the launch of the new Pi Node version, while the technical outlook shares the possibility of extended gains with a bullish pattern breakout.

Pi nodes remain concentrated amid new version launch

Pi nodes are devices connected to the Pi Network that contribute to its decentralization, security, and transaction verification. On Thursday, the 0.5.3 version of the Pi Node was launched, with a focus on improving the robustness of node initialization.

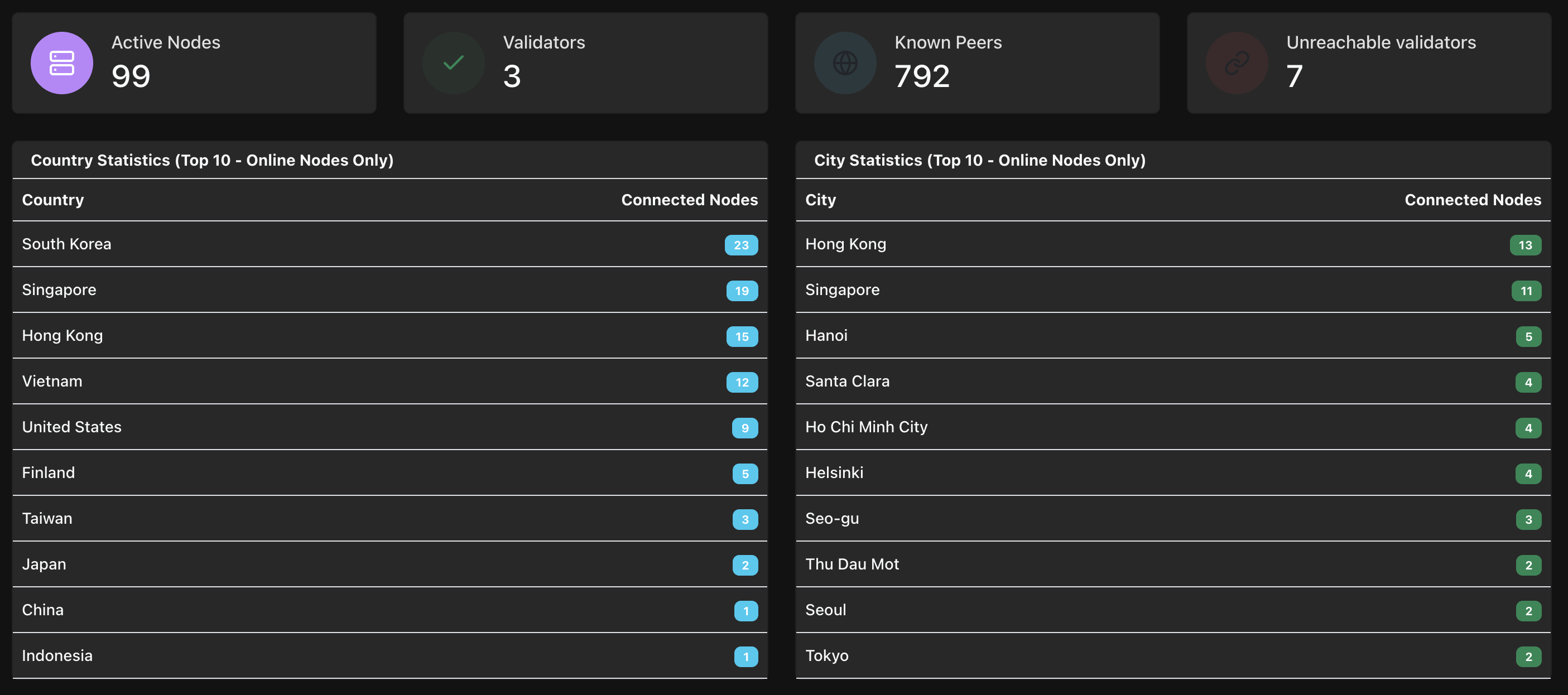

PiScan data shows 99 active nodes in the network on Thursday, with South Korea leading the way with 23 connected nodes. However, with a total of 10 validators and 792 known peers, Pi Network lags in decentralization.

Pi Nodes. Source: PiScan

Pi Network eyes further gains as it nears a pattern breakout

Pi Network edges higher at press time on Thursday, inching closer to the $0.50 psychological level. The recovery in PI exceeds the $0.4734 resistance, which serves as the neckline of an Adam and Eve pattern, as illustrated in the 4-hour chart below.

Typically, the Adam and Eve pattern signals a bullish reversal after a prevailing downtrend. A potential daily close above $0.4734 level would release the trapped bullish momentum within the pattern.

A potential uptrend in Pi Network could target the $0.5015 level, last tested on July 3.

The technical indicators on the 4-hour chart indicate a surge in bullish momentum, as the Moving Average Convergence/Divergence (MACD) indicator displays a series of green histograms rising above the zero line.

Additionally, the Relative Strength Index (RSI) reads 62, inching closer to the overbought zone. Sidelined investors must remain cautious, as the indicators in the 4-hour chart could experience sharp reversals.

PI/USDT daily price chart.

On the downside, a reversal in PI from the $0.4734 resistance could result in a retest of the $0.4523 level, marked by the low of July 7.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.