Litecoin price set for $150 rally amid comments on LTC ETF approval

- Litecoin price surged above $130 on Thursday, rising over 37.5% this week.

- Bloomberg ETF analyst Eric Balchunas has hinted Canary Capital’s LTC ETF application could be approved next.

- Average LTC transaction size hit a 20-day peak of $44,300 on Wednesday, signaling active whale accumulation.

Litecoin price punched above the $130 mark on Thursday, extending its weekly time frame gains to a remarkable 37.5%. On-chain data trends reveal whales actively accumulating LTC as Bloomberg analysts ramp up speculation on LTC ETF approval.

Litecoin price hits 30-day peak as traders intensify Trump bets

Litecoin price surged to a 30-day high on Thursday, outperforming much of the broader crypto market amid intensified speculation surrounding Donald Trump’s impending inauguration on January 20.

The broader crypto market exhibited mixed performances with Bitcoin (BTC) struggling to maintain upward momentum after a modest 3.6% gain on Tuesday, stalling below the psychological $100,000 barrier.

Ethereum (ETH) also posted muted gains, hovering around $3,350, as traders appeared to adopt a selective investment strategy leaning toward mid-cap altcoins ahead of Trump’s inauguration.

Litecoin LTC price action | LTCUSDT

Litecoin price action, however, stood out on Thursday, as the double-digit daily gains on Thursday further emphasized growing demand from traders positioning ahead of Trump's inauguration.

As seen above, LTC price broke above the $130 mark, recording a 37.5% gain on the weekly time frame and marking one of its most notable rallies in recent months.

It remains to be seen if Litecoin can sustain its rally in the days ahead with LTC markets fast-approaching showing overbought conditions.

Bloomberg chief analyst Eric Balchunas talks up Litecoin ETF approval

Litecoin has emerged as one of the most in-demand cryptocurrencies ahead of Donald Trump’s inauguration on January 20.

The recent Litecoin price rally has been accompanied by heightened speculation about the imminent approval of a Litecoin spot ETF in the United States.

Canary Capital’s updated filing with the Securities & Exchange Commission (SEC) has further fueled optimism among market participants.

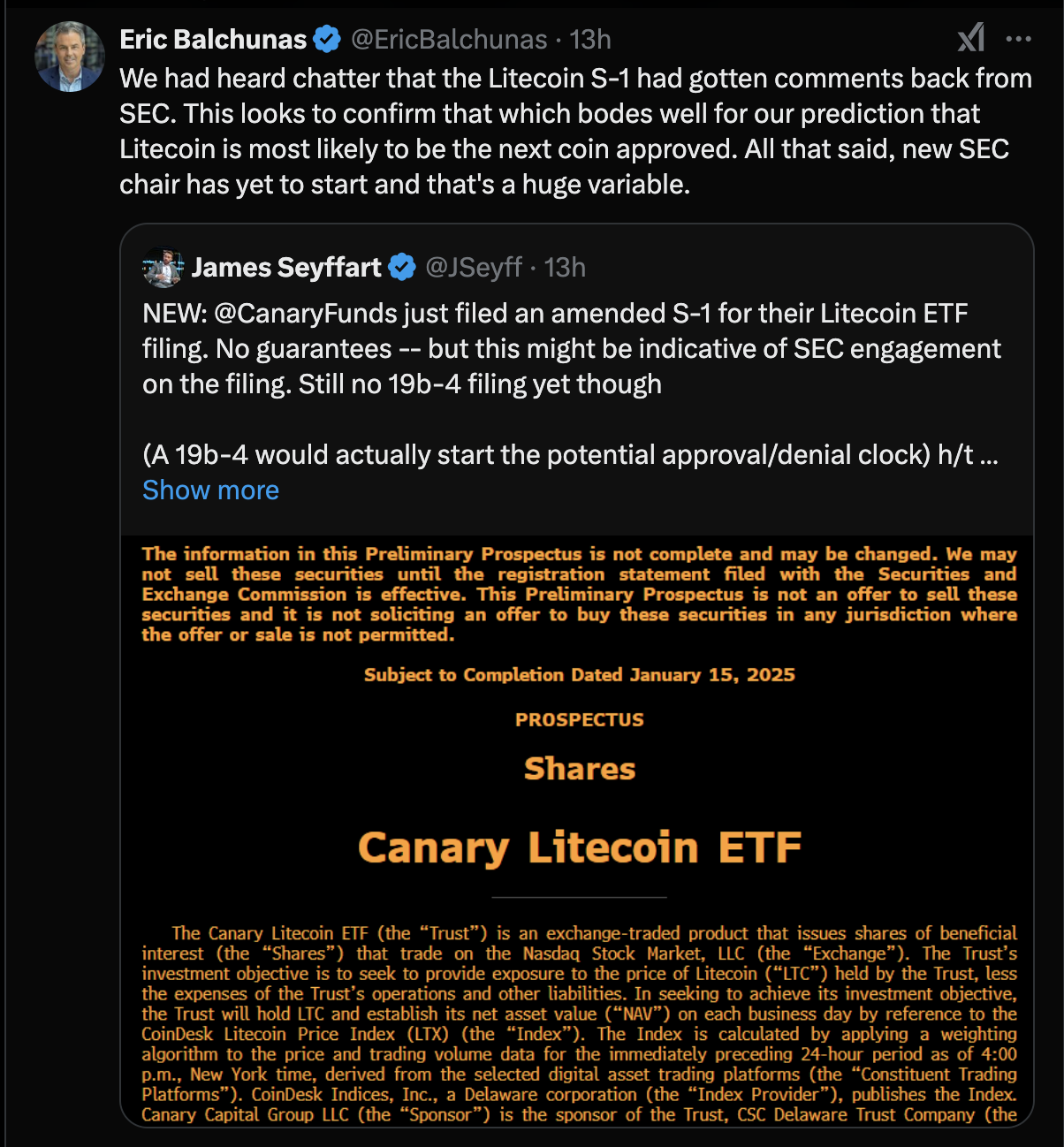

“A Litecoin ETF would most likely be the next spot crypto ETF approved in the U.S.,” Bloomberg senior ETF analyst Eric Balchunas posted on X Wednesday.

His statement comes after Canary Capital submitted an amended S-1 form, which is required for registering new securities with the SEC.

Bloomberg Analyst Eric Balchunas talks up Litecoin ETF Approval, January 2025 | Source: X.com

Bloomberg Analyst Eric Balchunas talks up Litecoin ETF Approval, January 2025 | Source: X.com

Balchunas highlighted that the amendment may indicate progress and engagement from the regulatory body.

James Seyffart, another Bloomberg analyst, also weighed in on the matter, suggesting that Canary’s recent filing is a promising development but not definitive proof of approval.

“The real signal would be a 19b-4 filing, which would indicate a proposed rule change from a self-regulatory organization like the NYSE,”

- James Seyffart explained.

With Gary Gensler stepping down next Monday, President-elect Trump has nominated Paul Atkins, a crypto-friendly former commissioner, further amplifying the positive speculation around potential approval verdicts for altcoin ETFs.

Whales ramp up Litecoin accumulation by 20% amid ETF approval speculation

Litecoin saw an 11% price surge on Thursday, driven largely by speculative demand following bullish commentary from Bloomberg analysts on Canary Capital's ongoing ETF application process. However, on-chain data reveals that whale investors were ahead of the curve, proactively accumulating unusually large volumes of LTC since the start of the week.

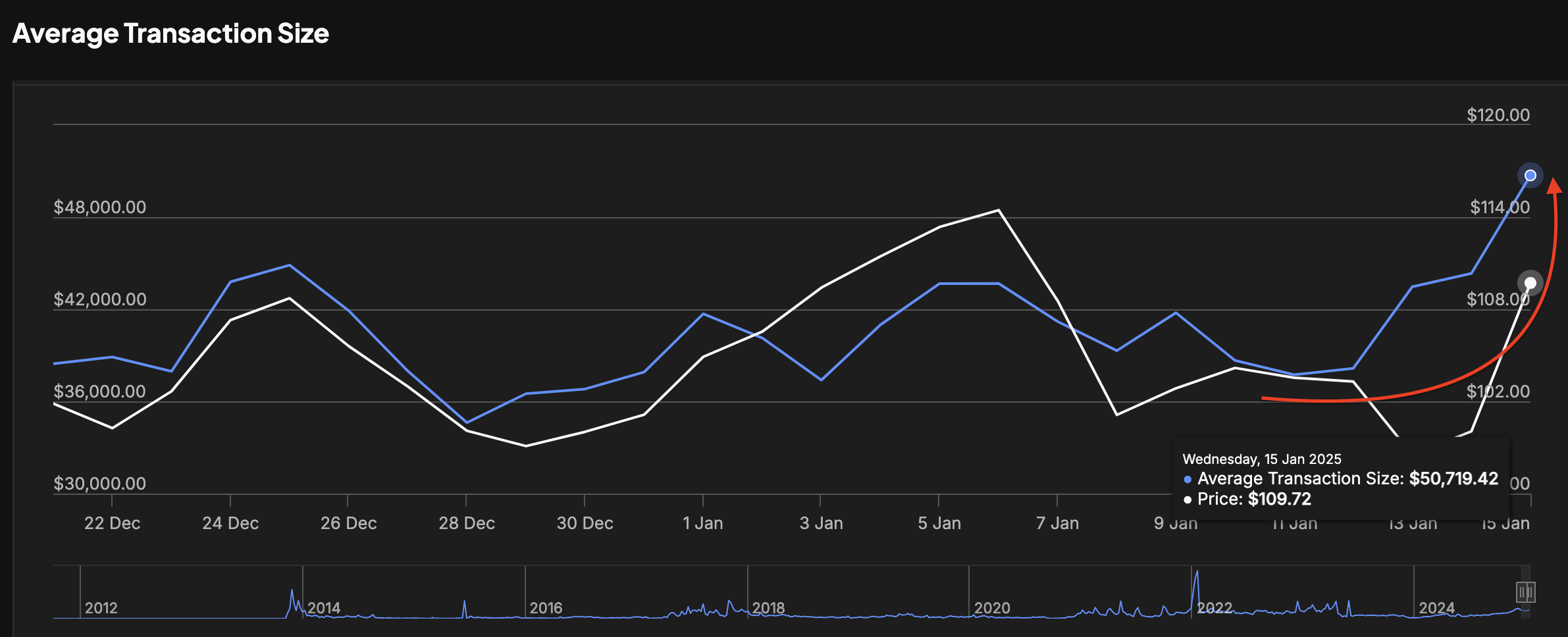

Further emphasizing this stance, IntoTheBlock’s Average Transaction Size chart below tracks real-time swings in whale activity by monitoring the rate at which current investors are placing large ticket bets.

Litecoin Average Transaction Size vs. LTC Price

Litecoin Average Transaction Size vs. LTC Price

The chart indicates that the average transaction size on Litecoin's network climbed from $38,100 on January 12 to $50,700 as of January 16 — a notable 25% increase within just a week.

Increased average transaction size is often a tell tale sign of active whale accumulation, and retail traders placing larger bets.

Bloomberg analysts’ positive about the potential approval of a Litecoin ETF further validated this outlook, fueling speculative buying.

With LTC prices breaking above $120, whales who began buying on Monday are now sitting on over 32% in unrealized profits.

This raises the risk of a potential “sell-the-news” event.

If whales opt to lock in profits during the Trump inauguration euphoria, Litecoin could face a sharp price reversal.

Alternatively, they may choose to hold out longer, potentially targeting further upside from an anticipated Litecoin ETF approval verdict.

Litecoin Price Forecast: $150 breakout ahead if certain conditions align

Litecoin surged to $130 on Thursday, gaining 11%, driven by bullish speculation and whale accumulation. The chart indicates a strong recovery over the past three days, with a 37.53% rise in price, backed by a significant increase in trading volume of 5.01M.

From a bullish perspective, the price action has convincingly broken above the Volume-Weighted Average Price (VWAP) of $124, signaling robust buying momentum.

Furthermore, Litecoin is trading in the upper range of the Keltner Channel (KC) at $125.83, suggesting an overbought condition that could still extend further.

The MACD indicator, with its histogram shifting into positive territory, supports this momentum, indicating that bullish strength may sustain in the short term. A close above the $130 psychological level could set the stage for a run toward $150.

Litecoin Price Forecast | LTCUSDT

Litecoin Price Forecast | LTCUSDT

Conversely, bearish risks persist. The price's proximity to the upper Keltner Channel boundary could trigger a reversal if buying momentum fades.

Additionally, the MACD line is only slightly above the signal line at 1.81 vs. 1.35, implying weak confirmation of an extended rally.

A break below the $124 VWAP could invalidate the bullish outlook, with $108 acting as immediate support.