Ripple, Aptos Labs and Hedera to launch MiCA Crypto Alliance, XRP corrects slightly on Monday

- Ripple, Hedera and Aptos Labs, founding members of DLT Science Foundation, made a key announcement on Monday.

- The three firms launched the MiCA Crypto Alliance to enhance compliance with EU markets in crypto assets regulation.

- XRP hovers around $0.5600 on Monday.

Ripple (XRP) made a key announcement alongside other founding members of a crypto alliance. The DLT Science Foundation is behind the effort, Ripple partnered with Hedera and Aptos Labs.

XRP erased recent losses and held steady above $0.5600 on Monday.

Daily digest market movers: Ripple leads effort for crypto alliance launch

- Ripple partnered with crypto firm Aptos Labs and distributed ledger technology-based Hedera for the DLT Science Foundation. The DLT Science Foundation (DSF) is a non-profit organization that promotes blockchain technology adoption among firms.

- The foundation’s mission is to create an open ecosystem and work with industry, academia and developer communities.

- DSF announced the launch of the MiCA Crypto Alliance for better coordination among industry members and for navigating the regulatory landscape in the European Union (EU).

- The alliance aims to foster cooperation between firms navigating the EU’s regulation pertaining to innovation in blockchain technology.

- MiCA sets strict disclosures for Crypto-Asset Service Providers (CASPs) and expects centralized exchanges and crypto firms to disclose climate impact of operations, among other details, through white papers and online descriptions accessible to the public.

Technical analysis: XRP eyes double-digit gains

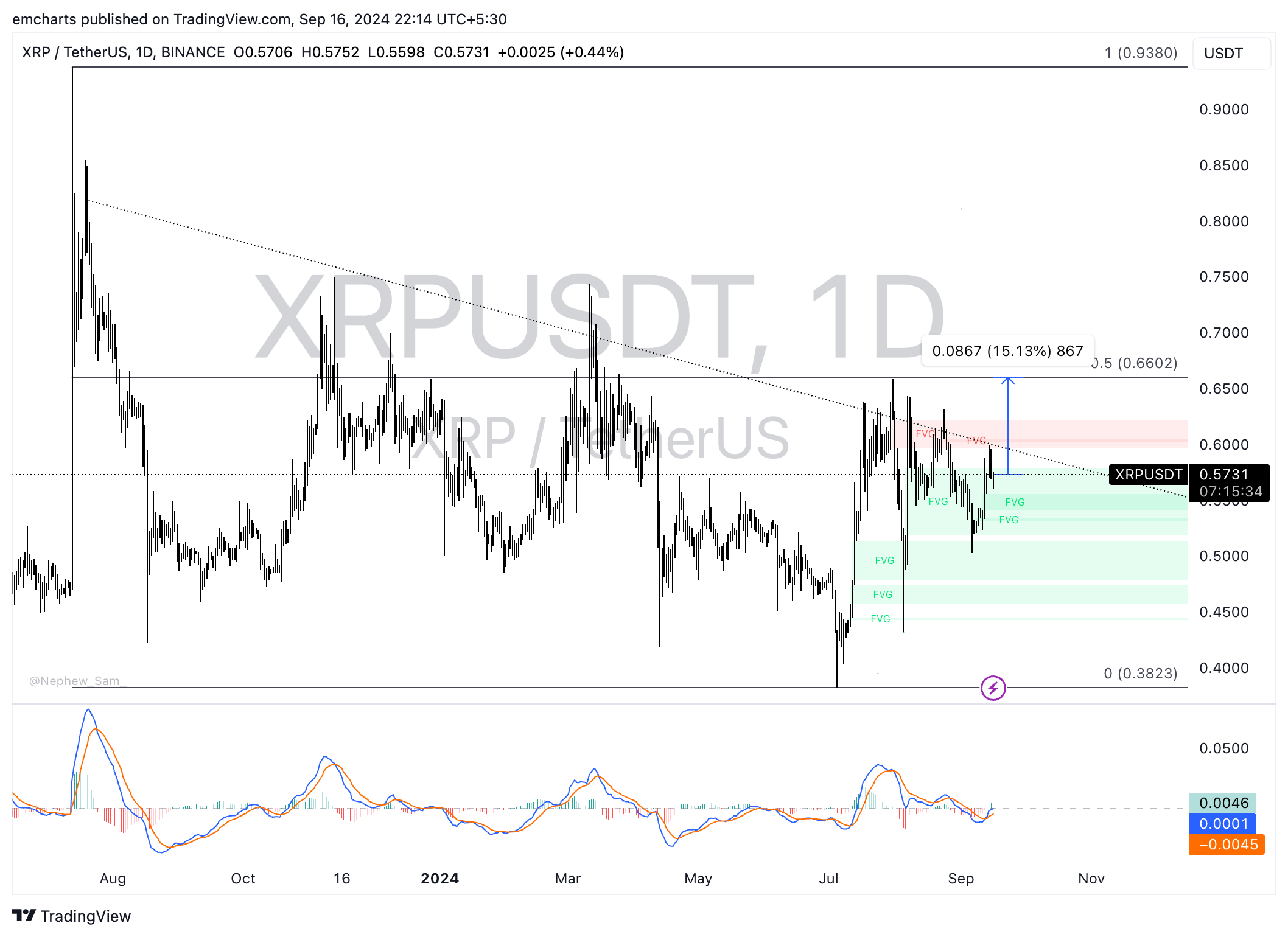

XRP has been in a multi-month downward trend since its July 2024 top of $0.9380. The native token of the XRP Ledger erased recent losses and trades at $0.5731, above support at $0.5600.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars above the neutral line, signaling underlying positive momentum in XRP price trend.

XRP could extend gains by 15% and rally to $0.6602, the 50% Fibonacci retracement of the decline from the July 2024 top of $0.9380 to the July 2024 low of $0.3823.

XRP/USDT daily chart

XRP could find support in the Fair Value Gap (FVG) between $0.5413 and $0.5556.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.