Solana ETF approval, PayPal stablecoin supply and rising transactions fuel hopes for rally

- Brazil officials approve a Spot Solana ETF, a key milestone for the Ethereum-competitor token.

- PayPal stablecoin supply on Solana exceeds that of Ethereum and the network sees a rise in transactions.

- SOL hovers around $145, and could extend gains by 20% to hit the $175 target in a bullish scenario.

Solana (SOL) has been a victim of the recent decline in crypto asset prices, but several fundamental and on-chain factors seem to support an optimistic outlook for the Ethereum competitor. The approval of a spot Solana Exchange-Traded Fund (ETF) by Brazil’s Securities and Exchange Commission, rising PayPal stablecoin (PYUSD) supply on the Solana chain and interest from traders are the three key market movers to consider.

SOL trades at $144.32 at the time of writing.

Solana developments could catalyze gains

- Solana has climbed over 30% from the August 5 low of $110, but it is still well below the $194 high seen on July 29. The Ethereum-killer cryptocurrency has three key market movers that could influence the price this week.

- Solana Spot ETF was approved by Brazil’s Securities and Exchange Commission, a key milestone for Solana as it could pave the way for a similar investment product in the US and UK markets in the future. Asset manager VanEck predicted a Solana ETF in the US market, British bank Standard Chartered predicted SOL ETF arrival is likely in 2025.

- PayPal stablecoin supply (PYUSD) crossed $377 million on Solana, exceeding the asset’s supply on Ethereum, according to DeFiLlama data. Meanwhile on Ethereum, PYUSD crossed the $356 million mark, data shows.

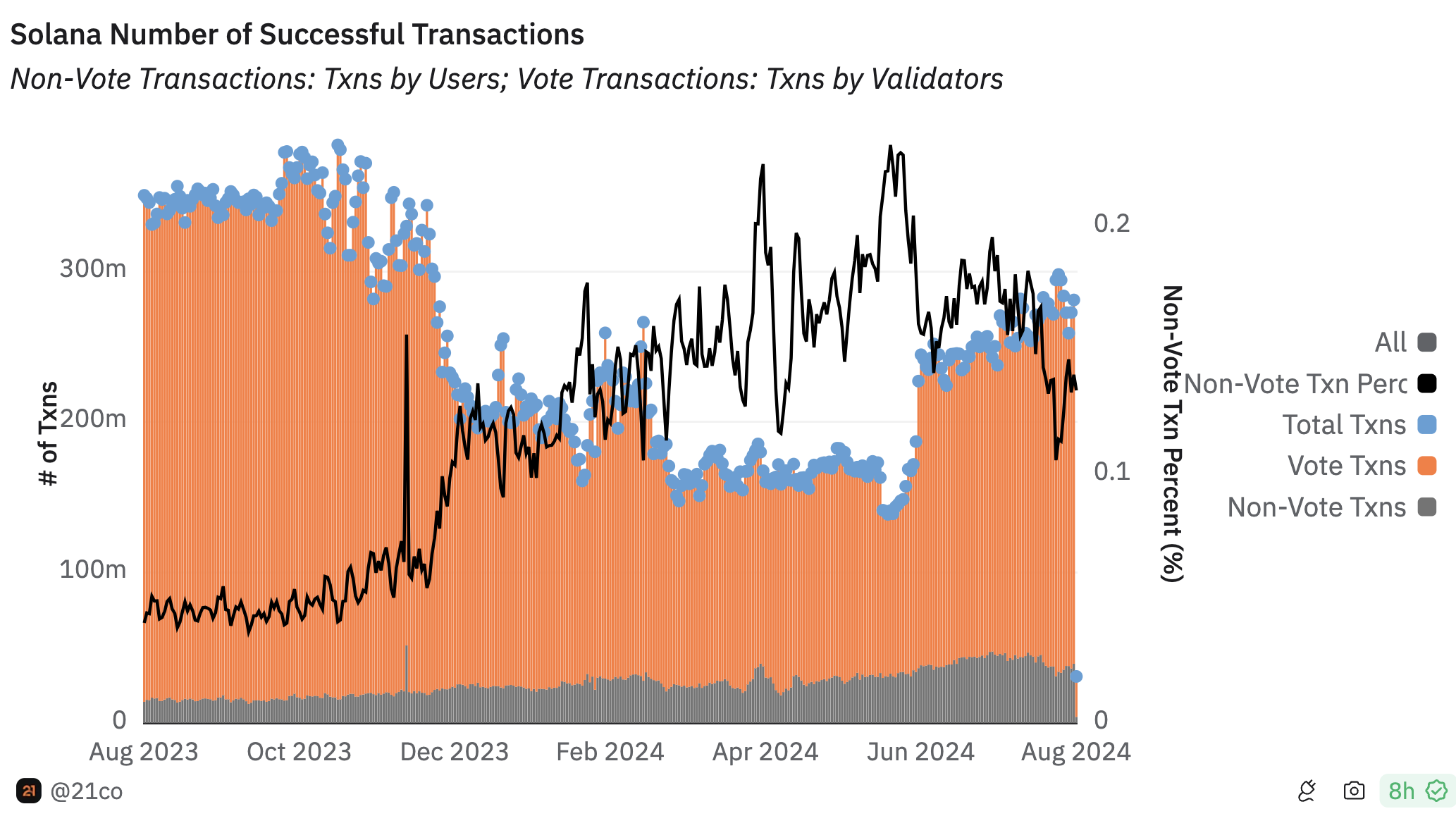

- Solana transactions have increased in the last sixty days, per Dune analytics data. This signals a rise in activity and interest from traders.

Solana number of successful transactions

These positive developments and rising on-chain activity could catalyze gains in SOL in the coming months. Arthur Hayes, founder of BitMEX and crypto entrepreneur, set a target of $250 for the token in a recent blog post.

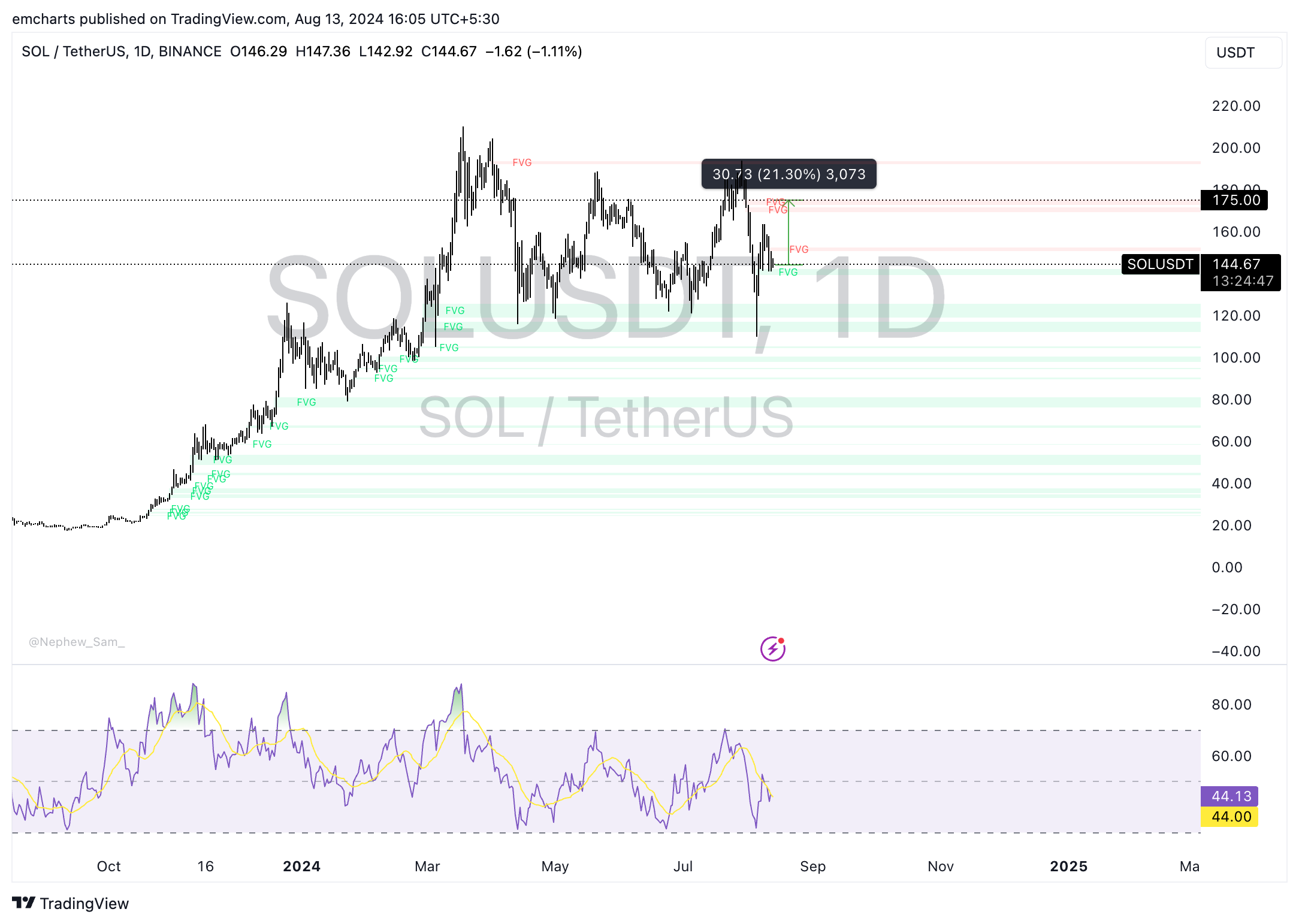

Solana could extend gains to $175

Solana has been trading sideways since its March 18 top of $210.18 as seen in the SOL/USDT daily chart. The altcoin could extend gains by 21.30% and rally towards its $175 target, the level that has acted as key resistance for Solana since mid April.

Before reaching it, SOL faces resistance at the psychological level of $150.

The Relative Strength Index (RSI), a momentum indicator, reads 44.13 on the daily chart, close to the neutral level. This suggests indecisiveness among traders.

SOL/USDT daily chart

In case of a decline, SOL could find support in the Fair Value Gap (FVG) between $139.37 and $142.21. A daily candlestick close under $142 could invalidate the bullish thesis. In this scenario, SOL could sweep liquidity in the imbalance zones under $142.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.