Ethereum Price Forecast: ETH ETF investors face huge unrealized losses following price slump

Ethereum price today: $1,920

- Ethereum ETF investors are sitting on about $5.15 billion in unrealized losses following a 60% price decline over the past four months.

- Net inflows only dropped from about $15 billion to slightly under $12 billion during the period.

- ETH continued its downtrend, eyeing the $1,740 support level.

US spot Ethereum (ETH) exchange-traded funds (ETFs) flipped negative again on Wednesday after recording net outflows of $129.1 million, reversing mild inflows seen at the beginning of the week, per SoSoValue data. Fidelity's FETH was responsible for more than half of withdrawals, posting outflows of $67 million.

Following the broader crypto market's downturn over the past few months, ETH has plunged about 60% from October levels, trading below $2,000 as of the time of publication on Thursday.

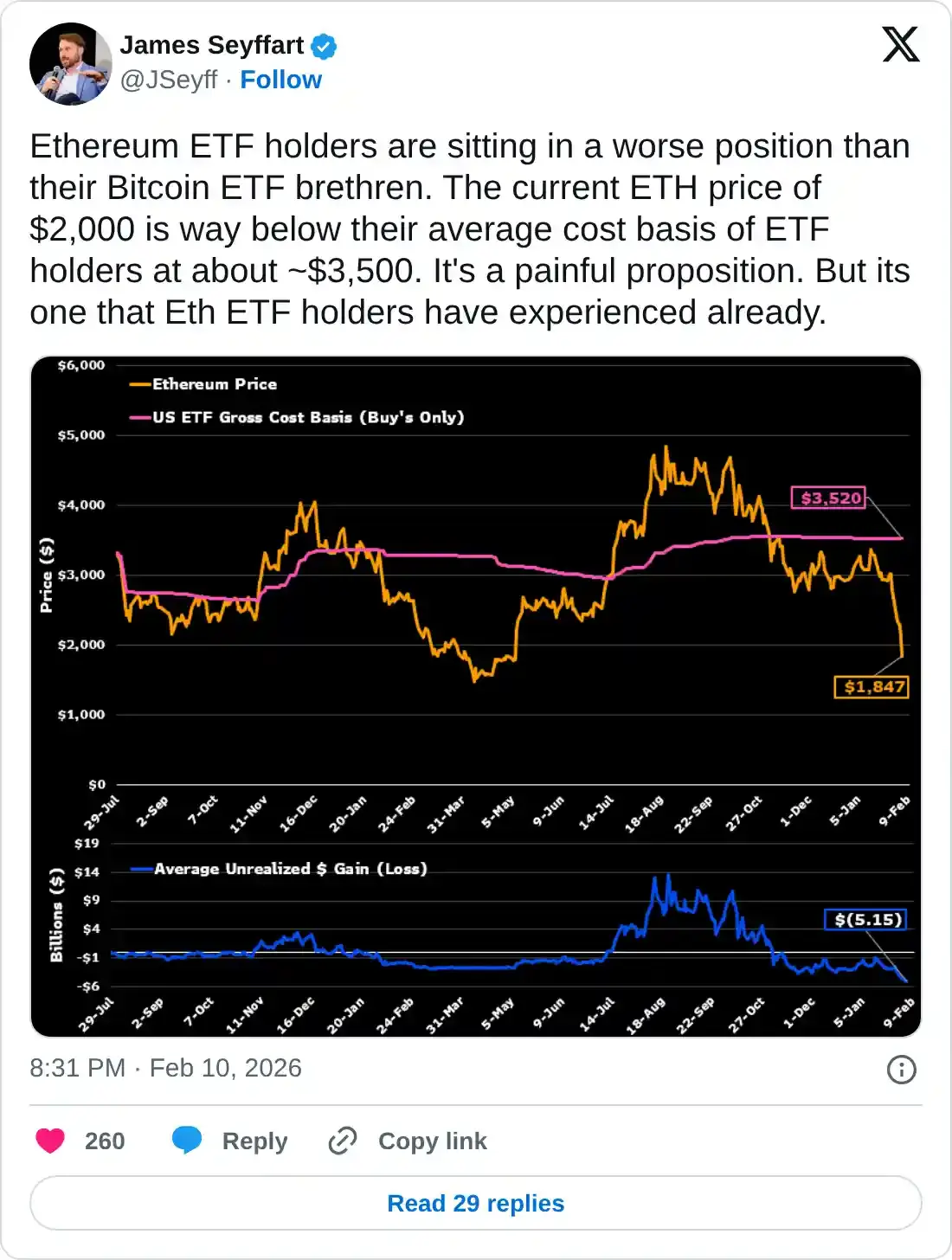

The move has put ETH ETF investors under pressure, with an average purchase cost of around $3,500, leaving them with about $5.15 billion in unrealized losses, according to data cited by Bloomberg ETF analyst James Seyffart in a Tuesday X post. However, such levels of drawdown aren't new to ETH ETF holders as ETH declined by about 60% in a similar four-month stretch that bottomed in April 2025.

While demand for the products has dried up, withdrawals haven't accelerated yet, as net inflows only dropped from about $15 billion to slightly under $12 billion during the period, Seyffart noted.

Generally, all ETH investors on the spot market are in a similar situation, with prices also below their average cost basis of around $2,300.

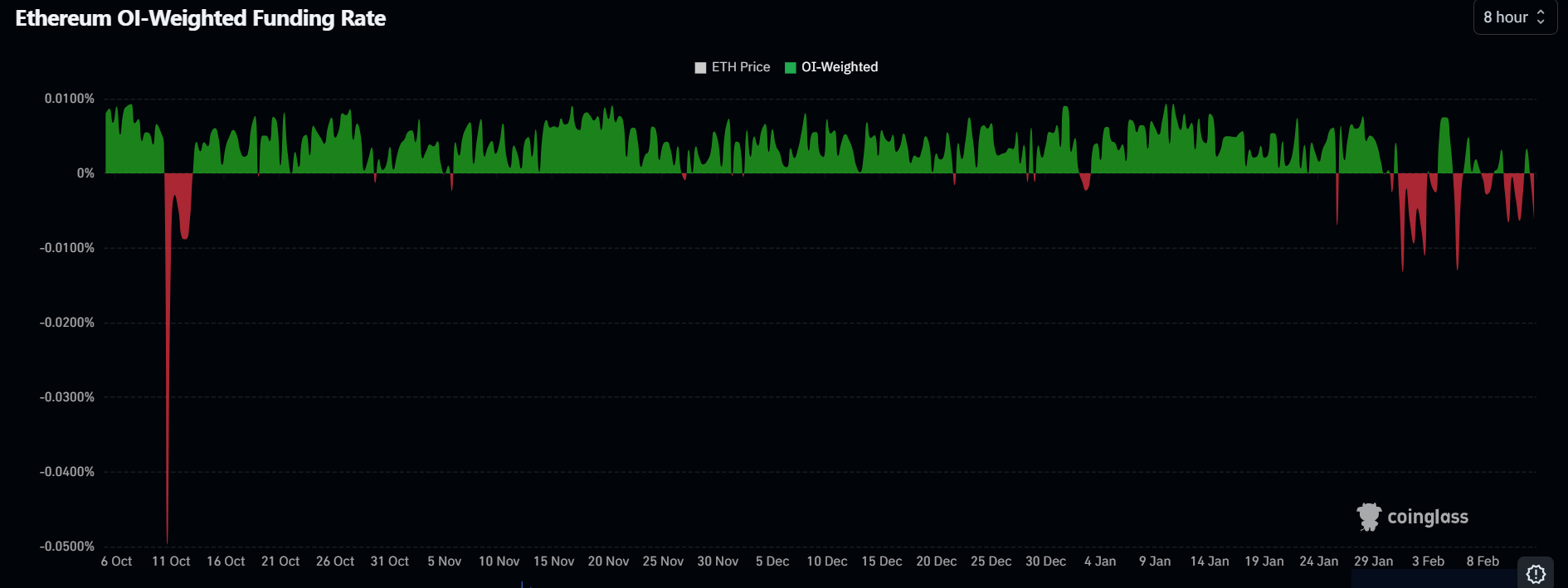

On the derivatives side, Ethereum funding rates have largely remained negative over the past few days, with bearish positioning dominating futures price action, according to Coinglass data.

Meanwhile, ETH liquidations reached $59.7 million over the past 24 hours, led by $35.3 million in long liquidations.

Ethereum Price Forecast: ETH continues bearish path, eyes $1,740

In the daily chart, ETH/USDT trades around $1,920. Price remains entrenched below a declining 20-day EMA at $2,323, reinforcing a bearish short-term tone. The downward slope of the average continues to cap rebounds.

The Relative Strength Index (RSI) at 27 and the Stochastic (Stoch) at 15 flags stretched downside conditions, though any reflex recovery would need confirmation.

Immediate resistance aligns at $2,107, followed by $2,388. Support is seen at $1,741, then at $1,524. A push beyond $2,388 would open room toward $2,746. On the downside, a break beneath $1,524 would expose $1,404 and risk an extension of the downtrend.

(The technical analysis of this story was written with the help of an AI tool.)