Bitcoin Price Forecast: BTC slides below $88,000 as Fed holds rates, geopolitical risks cap recovery

- Bitcoin is trading below $88,000 on Thursday after a rejection at the upper boundary of a horizontal channel.

- Fed’s decision to hold rates steady and the lack of dovish guidance limit BTC’s near-term upside.

- Rising geopolitical tensions between the US and Iran, along with concerns about the Fed’s independence, continue to weigh on risk sentiment.

Bitcoin (BTC) price slips below $88,000 at the time of writing on Thursday, after being rejected at a key level the previous day. The price correction followed the Federal Reserve’s (Fed) decision to keep interest rates steady on Wednesday, and the Fed Chair Jerome Powell's cautious tone capped BTC’s upside. In addition, rising geopolitical tensions between the US and Iran and lingering concerns over the Fed’s independence continue to dampen risk appetite, limiting Crypto King’s recovery.

Fed’s lack of dovish guidance limits BTC recovery

The Fed decided to leave rates unchanged in the 3.50%-3.75% range at the end of its two-day meeting on Wednesday. However, two Fed Governors – Stephen Miran and Christopher Waller – dissented in favor of a 25 basis-point (bps) interest rate cut. This move by the central bank was anticipated by traders, which kept riskier assets such as Bitcoin in a wait-and-see mode.

However, the lack of dovish guidance following the post-meeting press conference, in which Federal Reserve Chair Powell stated that inflation was still well above the 2% target, capped Bitcoin’s near-term recovery.

In addition, investors remain concerned about threats to the Federal Reserve’s independence. A criminal investigation of Powell by the Department of Justice and an evolving effort to remove Fed Governor Lisa Cook have focused attention on the independence of monetary authorities from direct political interference in policy formulation.

Meanwhile, traders seem convinced that the Fed will maintain the status quo through the end of this quarter and possibly until Chair Jerome Powell’s tenure ends in May, although they still price in two more rate cuts in 2026, which could provide longer-term support for BTC.

Rising geopolitical tensions weigh on BTC

Reuters reported on Thursday that US President Donald Trump is weighing options against Iran that include targeted strikes on security forces and leaders to inspire protesters.

“The arrival of a US aircraft carrier and supporting warships in the Middle East this week has expanded Trump’s capabilities to potentially take military action, after he repeatedly threatened intervention over Iran’s crackdown,” said the report.

On Wednesday, Trump urged Iran to come to the table and make a deal on nuclear weapons, warning that any future US attack would be more severe than a June bombing campaign. Iran responded with a threat to strike back against the US, Israel and those who support them.

These growing geopolitical tensions have triggered a risk-off sentiment among investors, prompting them to move toward safe-haven assets such as Gold (XAU) and Silver (XAG), whose prices reach new all-time highs. In contrast, riskier assets, such as Bitcoin, have remained under pressure since midweek.

Cautious stance among institutional investors

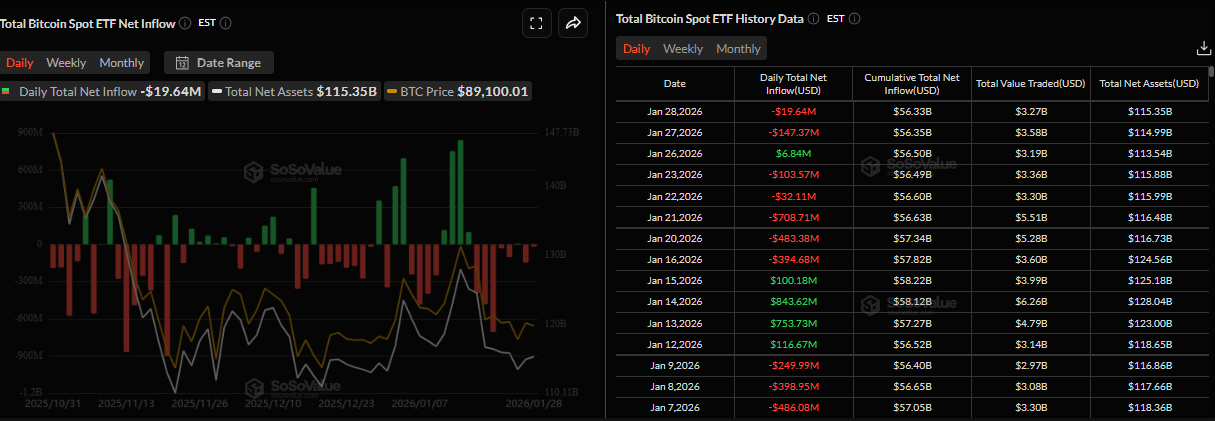

Institutional demand for Bitcoin signals a cautious stance among investors. The SoSoValue data show that spot Bitcoin Exchange Traded Funds (ETFs) recorded a mild outflow of $19.64 million on Wednesday and $147.37 million on Tuesday. If this trend of outflows persists, it could signal hesitation among institutional investors and limit Bitcoin’s upside momentum.

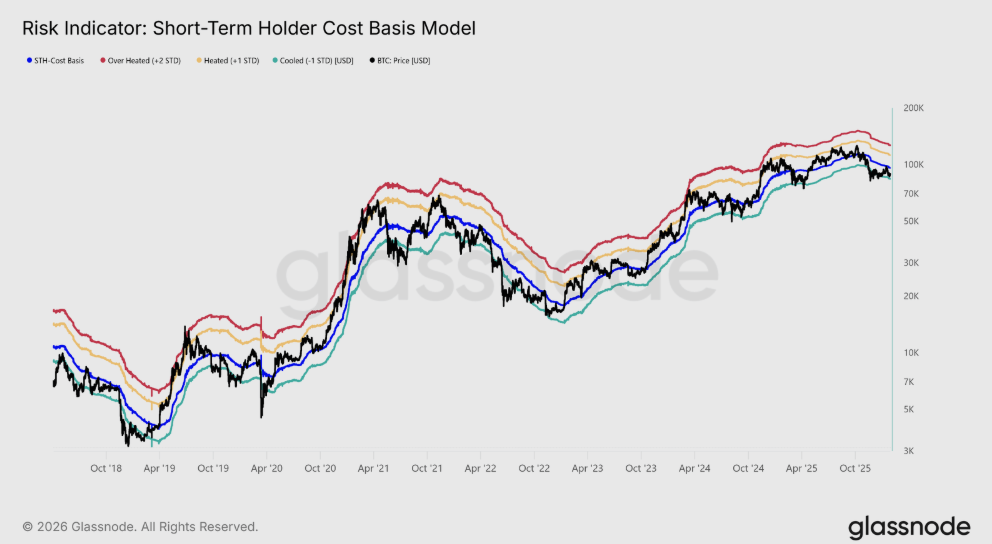

Additionally, Glassnode reported on Tuesday that BTC is slipping back into weakness.

“Following the spot price’s failure to sustain its advance toward the Short-Term Holder Cost Basis, the market has slipped back into a shallow pullback”, said Glassnode analyst.

The analyst continued, trading below this key bull–bear threshold, now at $96,500, once again closely resembles the market structures observed in Q1 2022 and Q2 2018. As shown in the chart below, the lower bound of the compressing range (−1 standard deviation) is currently $83,400. This level represents critical near-term support, and a failure to hold it could trigger a deeper correction toward the True Market Mean at $80,000.

Bitcoin Price Forecast: BTC faces rejection from $90,000 mark

Bitcoin started the week on a positive note. However, on mid-week, BTC failed to close above the upper boundary of a horizontal pattern at $90,000 and is correcting below $88,000 at the time of writing on Thursday.

If BTC continues its correction and closes below the midpoint of the horizontal parallel channel at $87,787 on a daily basis, it could extend the fall toward the lower consolidation boundary at $85,569, which coincides with the 78.6% Fibonacci retracement (drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199).

The Relative Strength Index (RSI) on the daily chart reads 41, below the neutral level of 50, and pointing downward, indicating bearish momentum gaining traction. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on January 20, which remains intact with rising red histogram bars below the neutral level, further supporting the negative outlook.

On the other hand, if $87,787 hold as support, BTC could extend the rally toward the upper boundary of the horizontal pattern at $90,000. A close above this level could extend gains toward the 50-day Exponential Moving Average (EMA) at $91,189.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.