Bitcoin Whitepaper's 17th Anniversary: 17 key events in Bitcoin's path to a $2 trillion asset

- Bitcoin celebrates its 17th anniversary of the release of its whitepaper on October 31, 2008.

- In 2025, Bitcoin's market capitalization stands at $2 trillion as adoption increases among corporations, governments, and retail and institutional investors.

- FXStreet has listed 17 key events that shaped Bitcoin’s history and made it 'Digital Gold.'

The Bitcoin (BTC) whitepaper, the bible of the cryptocurrency market, was released by Satoshi Nakamoto exactly 17 years ago, on October 31, 2008. Bitcoin’s journey from “A Peer-to-Peer Electronic Cash System” to a $2 trillion digital asset gave birth to the cryptocurrency industry, which is now worth almost $4 trillion. This report lists the 17 key events in Bitcoin's history that have defined its growth as 'Digital Gold.'

Bitcoin’s 17 pivotal moments in the past 17 years

Bitcoin has traded above $100,000 for most of the second half of 2025 so far. However, Bitcoin’s path to the six-digit milestone has been marked by ups and downs. Here are the 17 defining moments from the history of Bitcoin.

1. Bitcoin’s whitepaper

Satoshi Nakamoto released the “Bitcoin: A Peer-to-Peer Electronic Cash System” whitepaper on Halloween 2008 on Bitcoin.org. Nakamoto envisioned non-reversible electronic cash transactions to bypass the trust-based models of financial institutions. In the nine-pager, Nakamoto shared the blueprint for a Proof-of-Work (PoW)-driven, trustless money system utilizing SHA-256 encryption on a public ledger.

2. Genesis block

Two months later, Satoshi set up Bitcoin’s Distributed Ledger, or Blockchain, with the first block, called the “Genesis Block,” on January 3, 2009. Satoshi embedded the block’s raw data with “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” after the 2008 financial crisis, for which he was rewarded with 50 BTC, which, unlike other rewards, can never be spent.

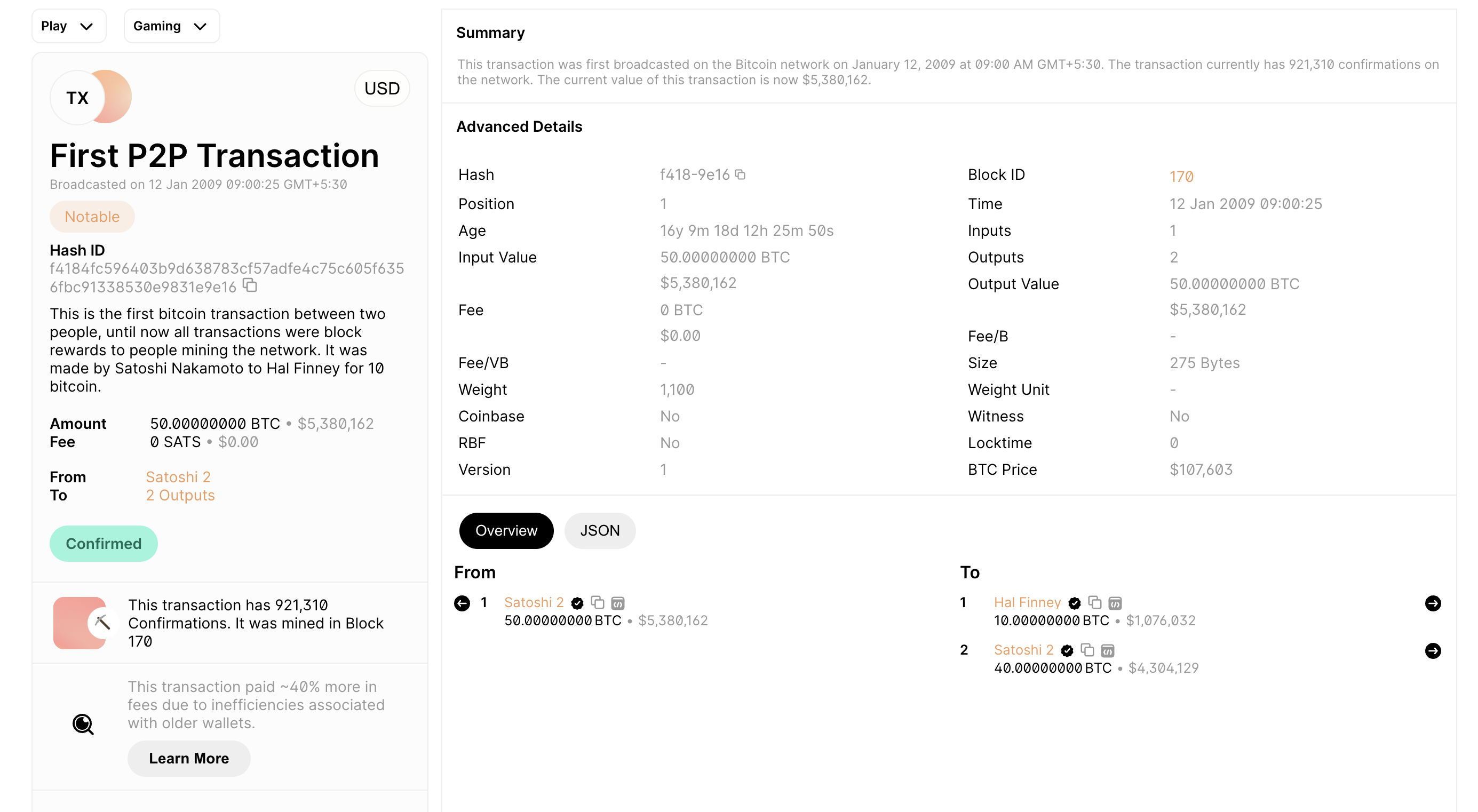

3. The first-ever Bitcoin transaction

Nine days after the Genesis block, Nakamoto transferred 10 BTC to Hal Finney, a Software Developer and an early contributor to Bitcoin. This marked the start of actual peer-to-peer electronic cash transactions without intermediaries.

First Bitcoin transaction details. Source: Blockchain.com

4. Bitcoin Pizza Day

More than a year after the first Bitcoin transaction, on May 22, 2010, Laszlo Hanyecz, an early Bitcoin developer, spent 10,000 BTC to buy two pizzas from Papa John's, making Bitcoin’s first known commercial transaction. At the all-time high of $126,199 earlier in October 2025, these two pizzas will be worth over $1.26 billion.

5. First Bitcoin rally and the flash crash

In June 2011, Bitcoin reached its then-record high of $31, up from $0.30 at the end of 2010, an 8,000% increase. In the same year, Mt. Gox, a Tokyo-based Bitcoin exchange, witnessed the BTC price drop to nearly $2.00. With the first-ever flash crash in crypto history, the industry's volatile nature was molded.

6. Bitcoin’s recovery to $1,000

In 2013, Bitcoin moved away from Satoshi’s niche cypherpunk money narrative to a financial market phenomenon. Bitcoin reached $100 for the first time in April 2013 and hit a market capitalization of over $1 billion. Later in November of the same year, BTC reached $1,000, with the market valuation rising to double-digit billions.

7. The Mt.Gox theft

In early 2014, Mt. Gox, after multiple security breaches and operational malfunctions, went offline and declared bankruptcy, during which 850,000 BTC were lost. Out of which 200,000 BTC were later recovered. However, investors received refunds in cash, cryptocurrency, or a combination, valued at what their BTC was worth at the time of the theft.

8. Bitcoin’s SegWit upgrade in 2017

After two years of a crypto winter, Bitcoin made a comeback with the Segregated Witness (SegWit) upgrade at block 481,824 in August 2017. The upgrade introduced changes by separating signature and transaction data, which helped increase block capacity and transaction speed while reducing fees. Furthermore, it helped enable the Lightning Network, a second layer built on top of Bitcoin.

9. Bitcoin’s most successful hard fork, Bitcoin Cash

Rejecting the SegWit upgrade, a hard fork of the original Bitcoin blockchain called Bitcoin Cash (BCH) was born on August 1, 2017 which favored on-chain scaling by increasing the block size. As of October 30, Bitcoin Cash has a market capitalization of $11.27 billion, ranking it among the top 15 cryptocurrencies.

Apart from BCH, Bitcoin Gold (BTG) was launched in October 2017 by modifying the PoW consensus mechanism to the Equihash design, which prioritized GPU mining and addressed ASIC dominance.

10. First-ever Bitcoin Futures on CME

The Chicago Mercantile Exchange (CME) launched cash-settled Bitcoin futures in December 2017, enabling BTC to serve as an institutional hedge or speculative asset. This launch pushed Bitcoin deeper into the macro and derivatives markets.

11. Taproot upgrade

The Taproot upgrade in November 2021 introduced a key technical shift in the Bitcoin blockchain, upgrading its core cryptography to Schnorr signatures from the previous Elliptic Curve Digital Signature Algorithm (ECDSA). This provides enhanced privacy, efficiency, and smart contract capabilities.

12. Bitcoin topped the $1 trillion market capitalization

In early 2021, Bitcoin rose above $53,000 and reached a market capitalization of $1 trillion, solidifying its position in the global financial market.

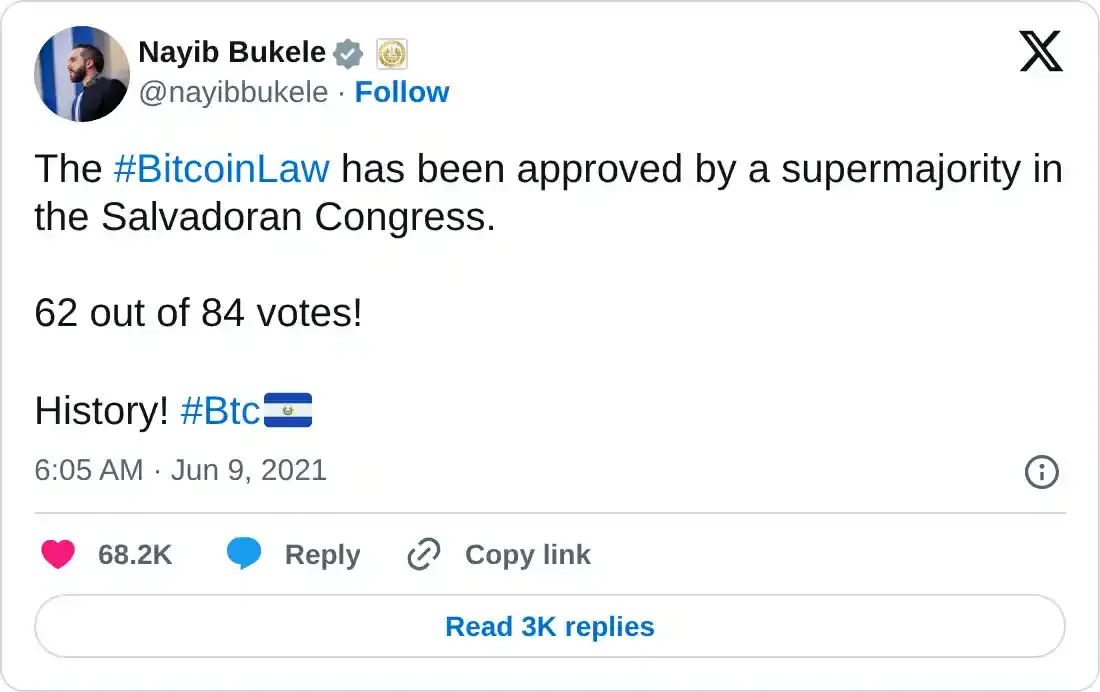

13. El Salvador approved Bitcoin as legal tender

Nayib Bukele, the President of El Salvador, approved Bitcoin as a legal tender alongside the US Dollar and initiated nationwide Lightning network pilots in September 2021. As of October 30, El Salvador holds 6,365 BTC worth $688.94 million.

14. Bitcoin Ordinals

In January 2023, Ordinals were launched by Casey Rodarmor on the Bitcoin mainnet, unlocking the world of Bitcoin-native Non-Fungible Tokens (NFTs). With Ordinals, users can inscribe various data types, such as images, text, or code, into the witness data of a block, resulting in on-chain permanence without the need for a smart contract.

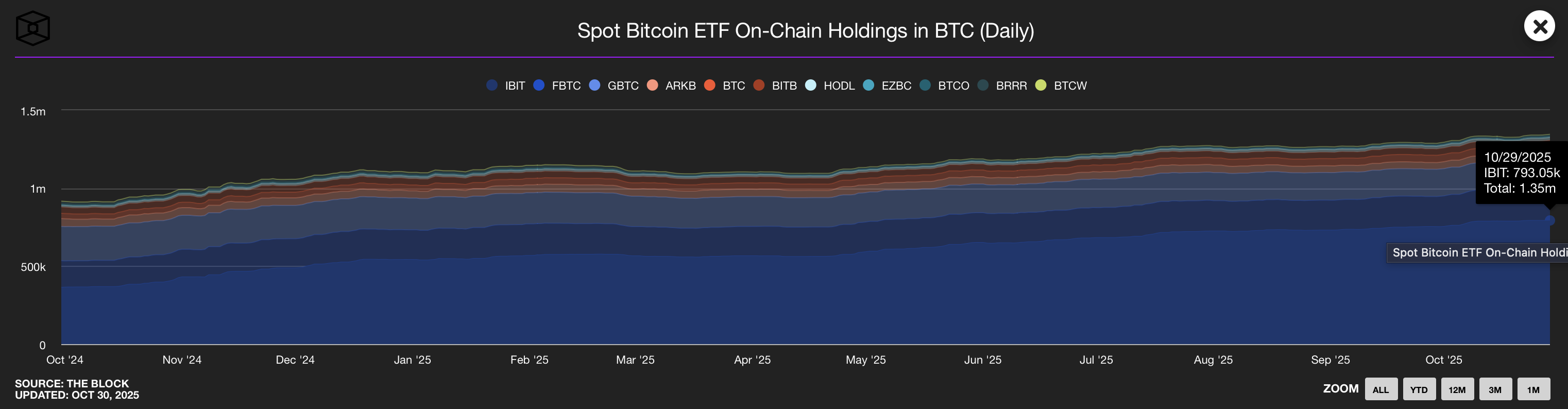

15. First-ever US spot Bitcoin ETF

After years of legal struggle and BlackRock’s initiative, 12 Bitcoin-linked spot Exchange Traded Funds (ETFs) were listed in January 2024. This provided an institutional flow into Bitcoin, which, as of October 30, holds 1.35 million BTC or nearly 6.5% of the total Bitcoin supply.

Bitcoin spot ETFs holdings in BTC. Source: The Block

16. Bitcoin hit the six-digit figure

Bitcoin broke the $100,000 milestone on December 5, 2024, within a year of the launch of the first US Bitcoin spot ETF. Following the recent breakout above $100,000 in May 2025, Bitcoin holds steady in the six-digit figure range.

17. Digital Asset Treasuries

In 2025, Bitcoin is solidifying its position as a haven, similar to Gold, as its demand and presence in institutional portfolios have increased significantly, underpinned by a debasement shift from the US Dollar and debt.

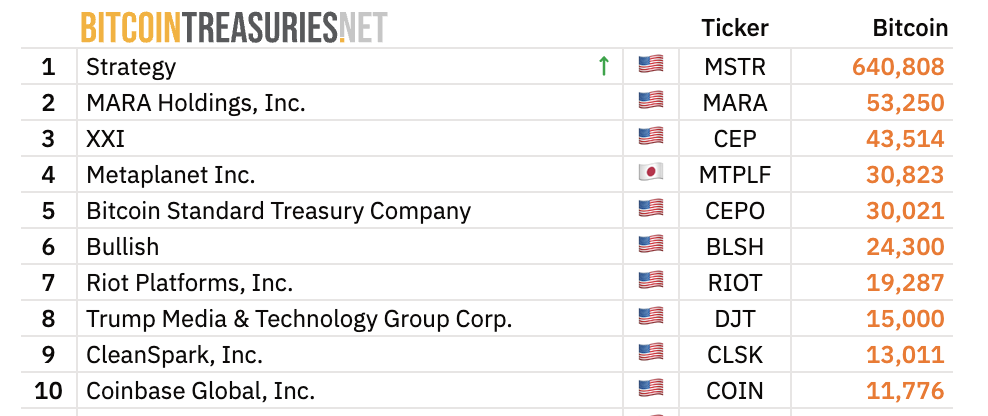

Digital Asset Treasuries are accumulating Bitcoin, as the Nasdaq-listed Strategy (MSTR) led by Michael Saylor holds 640,808 BTC worth $69.06 billion, as of October 30. At the same time, Marathon Holdings holds 53,250 BTC, worth approximately $5.73 billion, while Metaplanet has acquired 30,823 BTC, valued at $ 3.34 billion.

Bitcoin treasuries. Source: Bitcoin

Bitcoin and the broader cryptocurrency market have developed into a new financial instrument over the last decade. Something that Satoshi Nakamoto may or may not have predicted. Still, on the 17th anniversary of Bitcoin’s whitepaper release, we extend our gratitude to Satoshi Nakamoto for establishing the cryptocurrency industry.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.