Gold slips below $5,000 as US Dollar rebounds in thin trade

- Gold drops nearly 1% as the US Dollar index climbs back above 97.00.

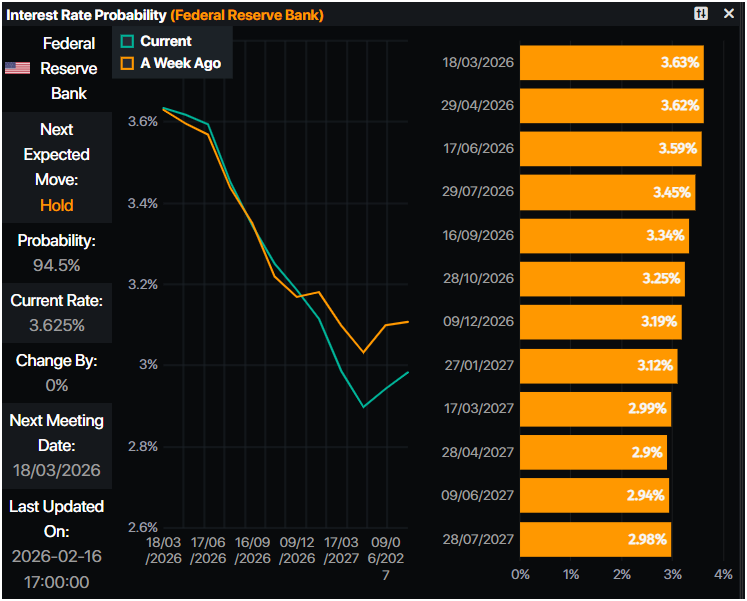

- Markets still price 60 bps of easing by the Federal Reserve despite strong NFP last week.

- Rising tensions in the Middle East and upcoming FOMC Minutes keep geopolitical risk in focus.

Gold price dives nearly 1% on a thin liquidity trading session on Monday as US markets are closed in observance of Presidents' Day, while China’s new year celebration will keep the markets closed for over a week. At the time of writing, XAU/USD trades at $4,992 after reaching a daily high of $5,054.

XAU/USD retreats on holiday-thinned liquidity as firmer Dollar offsets rising Fed cut expectations

Market sentiment remains positive, fueled by growing speculation that the Federal Reserve (Fed) will reduce interest rates at least twice this year. Factors like last week’s solid Nonfarm Payrolls report in the US and benign inflation data prompted investors to price in 60 basis points of easing towards the year’s end.

The Greenback's comeback is pushing Bullion prices lower. The US Dollar Index (DXY), which measures the buck’s value against a basket of six currencies, is up 0.22% above the 97.00 threshold.

On Friday, US Treasury yields plummeted sharply as investors seemed confident of lower rates in the US. The US 10-year Treasury note yield plunged five basis points, to 4.05%, after reaching a high of 4.125%.

Meanwhile, Chicago Fed President Austan Goolsbee was hawkish, saying that he is still seeing pretty high services inflation, and added that he hopes we’ve seen the peak impact of tariffs.

Goolsbee commented that rates can still go down, but he needs to see progress on inflation.

Money markets anticipated that the Federal Reserve will keep rates steady at the March 18 meeting, according to Prime Market Terminal data.

IRGC increases tensions in the Middle East

Aside from this, Russia and Ukraine will hold talks in Geneva on February 17. The Kremlin said that the territory is one of the main issues to be discussed.

The Financial Times reported that Iran launched naval drills as tensions with the US rise. Iran’s Revolutionary Guards exercises in the Strait of Hormuz come a day before talks between Tehran and Washington begin.

US economic calendar for February 16 — 20

The US economic calendar will be packed this week, featuring Durable Goods Orders, housing data, remarks from Federal Reserve officials, and the release of the Federal Open Market Committee (FOMC) Minutes.

Later, attention will shift to Initial Jobless Claims, the second estimate of fourth-quarter 2025 GDP, and the Fed’s preferred inflation measure, the Core Personal Consumption Expenditures (PCE) Price Index.

XAU/USD Price Forecast: Gold tumbles below $5,000 eyes on crucial $4,900

The technical picture shows that Gold buyers are losing momentum after three consecutive sessions of lower highs than the February 11 peak of $5,119, a signal that sellers are defending the $5,100 level, driving prices lower.

The Relative Strength Index (RSI) also depicts that bulls are surrendering, and if XAU/USD finishes Monday’s session below $5,000, it could pave the way for lower prices.

The first key support would be the 20-day EMA ahead of $4,900. Once surpassed, the next floor would be $4,800 ahead of the 50-day EMA at $4,634 as the next demand zone.

Conversely, if Gold finishes above $5,000, the first resistance would be $5,050, followed by the February 11 high of $5,119.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.