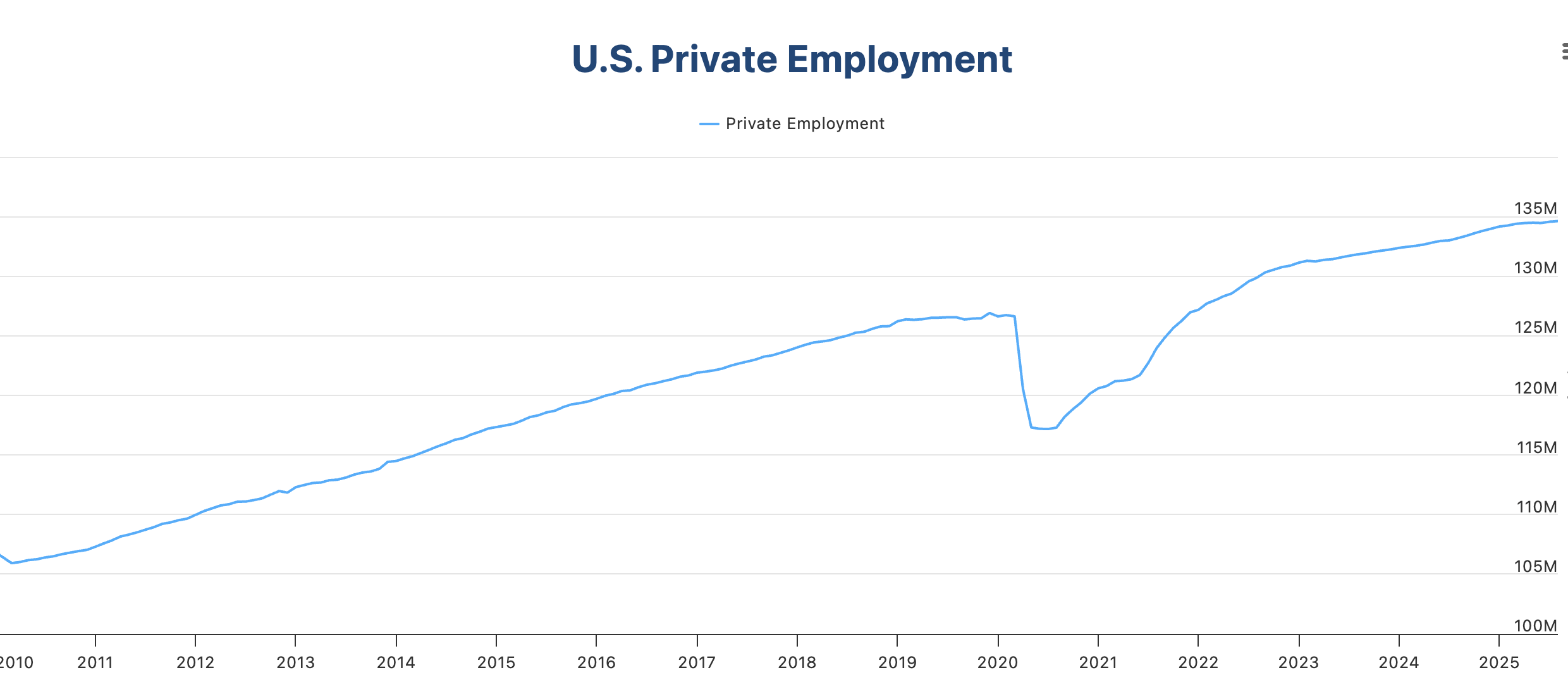

ADP Employment Change is set to show that payroll growth remained weak in September

- September’s ADP figures are expected to confirm that employment growth has stalled in the US.

- The US private sector is expected to have added 50K new payrolls in August.

- The US Dollar remains vulnerable as investors anticipate a series of Fed rate cuts.

Heading into the first week of the month, the focus shifts to US employment figures, looking for further clues of the Federal Reserve’s (Fed) interest rate path. On Wednesday, at 12:15 GMT, Automatic Data Processing Inc. (ADP), the largest payroll processor in the US, is set to release the ADP Employment Change report for September, measuring the change in the number of people privately employed in the US.

Recent employment reports have raised the alarm bell, pointing to an economic slowdown and putting into question the theory of US economic exceptionalism. In that sense, Wednesday’s figures, except for a surprise performance, are unlikely to calm those fears.

The ADP report is likely to gather particular interest. A highly likely shutdown of the US Government is threatening to delay the release of Friday’s all-important Nonfarm Payrolls (NFP) report, leaving Wednesday’s data as the last employment gauge ahead of the Fed’s monetary policy meeting in late October.

Labour market figures are likely to support further easing in October

Employment is a key element of the Fed’s dual mandate, in conjunction with price stability. Recent data revealed that price pressures remained at relatively moderate levels in August, in contrast with employment growth, which has plummeted in the second half of the year.

US Nonfarm Payrolls disappointed in August with a mere 22K increase, against market expectations of a 75K increment. Beyond that, the Unemployment Rate increased to 4.3%, its highest level in four years, confirming a significant deterioration of the labour market.

On Tuesday, US JOLTS Job openings were slightly better than expected; however, September’s ADP Employment Change report is expected to add to evidence of a weakening labour market. This will likely provide further arguments for Fed doves, as well as from US President Donald Trump, who has been pushing for a more aggressive monetary easing cycle for months.

The US central bank cut rates by 25 basis points in September for the first time this year and hinted at further interest rate cuts in the near term. Fed Chairman Jerome Powell and other policymakers have reiterated the need to tread cautiously amid the upside risks to inflation, but further evidence of a loosening labour market might put pressure on the bank to ease its monetary policy further.

Financial markets are nearly fully pricing a rate cut in late October. The CME Group’s Fed Watch tool is pricing in a 90% chance of a quarter-point easing move in October, although the odds for another such cut in December have eased to 70% from 75% a week ago. September’s ADP report might give a further boost to those hopes.

When will the ADP report be released, and how could it affect the US Dollar Index

The ADP Employment Change report for September is set to be released on Wednesday at 12:15 GMT. The market consensus points to 50K new jobs following a 54K increase in July. All in all, numbers are well below the above-100K average seen last year and in the first half of 2025.

The US Dollar Index (DXY), which measures the value of the Greenback against a basket of major currencies, has depreciated nearly 1% since the release of a moderate US Personal Consumption Expenditures (PCE) Price Index on Friday, and amid investors' concerns about the consequences of a US government shutdown.

With this in mind, the US Dollar is likely to be more vulnerable to a weak ADP employment report, adding to evidence that the US economy needs a further boost from lower borrowing costs. A positive surprise, on the other hand, might ease bearish pressure on the Greenback, but a significant recovery seems unlikely given the uncertain political context.

US Dollar Index 4-Hour Chart

From a technical perspective, Guillermo Alcalá, FX analyst at FXStreet.com, sees the US Dollar Index (DXY) under growing bearish pressure after breaking and confirming below the trendline support from mid-September lows, with the 4-hour Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), both dipping further into negative territory.

According to Alcalá, “The area between the September 19 and 22 highs and September 25 lows, near 97.70, is holding bears for now ahead of the September 23 lows, at around 97.15, and the key support area, the four-year low, at 96.22, hit on September 17.”

To the upside, Alcalá sees immediate resistance at a reverse broken trendline “now around 98.15, that needs to be breached to ease bearish pressure and shift the focus towards the September 25 high, at 98.60, and higher.”

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 01, 2025 12:15

Frequency: Monthly

Consensus: 50K

Previous: 54K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.