Merck to Acquire Verona Pharma for $10 Billion in Bid to Cushion "Patent Cliff" Impact

TradingKey - U.S. pharmaceutical giant Merck (MRK.US) has announced a roughly $10 billion deal to acquire U.K.-based biopharma firm Verona Pharma (VRNA.US), marking a major move into the respiratory disease treatment space.

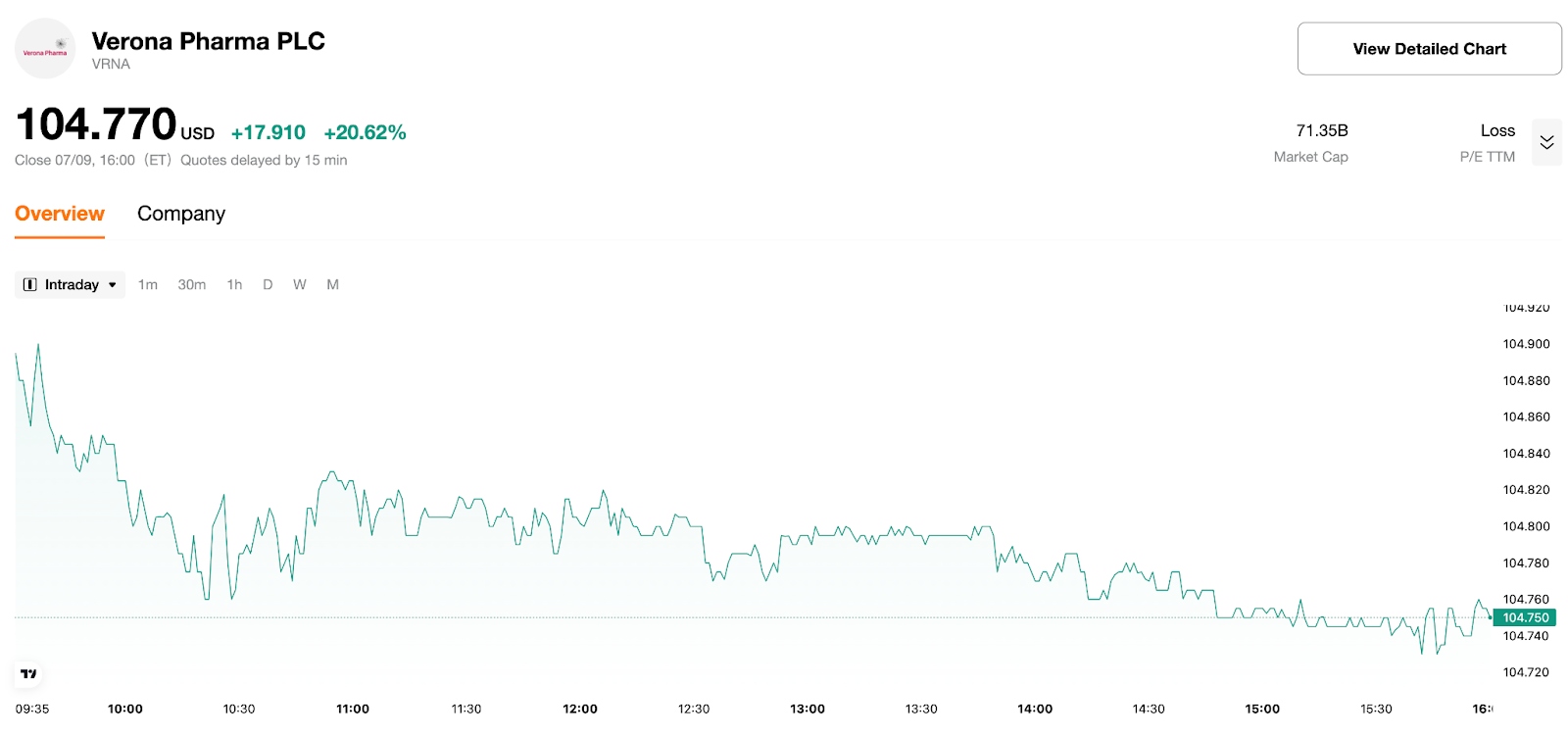

Under the agreement, Merck will pay $107 per American Depositary Receipt (ADR) for Verona Pharma — a 23% premium over its previous closing price. Following the news, Verona’s shares surged 21% in pre-market trading to $104.70, Merck's stock price rose 3% at the close of trading.

This acquisition ranks as Merck’s third-largest in nearly three decades and comes as the company prepares for the looming patent expiration of its blockbuster cancer drug, Keytruda. With annual sales nearing $30 billion — accounting for nearly half of Merck’s total revenue — the drug’s impending “patent cliff” in 2028 has created urgent need for new revenue sources.

The deal is expected to close by the fourth quarter of 2025. Investors are now watching closely to see whether Merck can effectively plug future revenue gaps through strategic acquisitions and establish a strong foothold in the highly competitive respiratory disease market.