Merck to Acquire Verona for $10 Billion — A Major Move into Respiratory Care, Shares of VRNA Surge 20%

TradingKey - According to a report by the Financial Times, U.S. pharmaceutical giant Merck (MRK.US) is nearing a deal to acquire Verona Pharma (VRNA.US) for $10 billion, marking Merck’s largest biopharma acquisition since 2023.

The acquisition will expand Merck’s presence in the respiratory disease space, adding a key drug — Ohtuvayre — to its pipeline.

Ohtuvayre: A New Player in COPD Treatment

Ohtuvayre is an innovative inhaled therapy approved by the U.S. Food and Drug Administration (FDA) last year for the treatment of chronic obstructive pulmonary disease (COPD) — affecting approximately 8.6 million patients in the U.S. over the past two decades.

In Q1 2025, Ohtuvayre already achieved $71.3 million in sales, with over 25,000 prescriptions issued, exceeding market expectations.

Analysts project that Ohtuvayre could reach peak annual sales of around $4 billion by the mid-2030s.

Deal Details and Market Reaction

Sources indicated that the deal is in its final stage and may be announced as early as Wednesday. Under the proposed terms, Merck would pay $107 per American Depositary Share (ADS) — representing a 23% premium to Verona’s closing price on July 8.

Following the news, shares of Verona Pharma surged nearly 20% in after-hours trading on July 8. Year-to-date in 2025, VRNA has gained 80%, while Merck shares have fallen 18%.

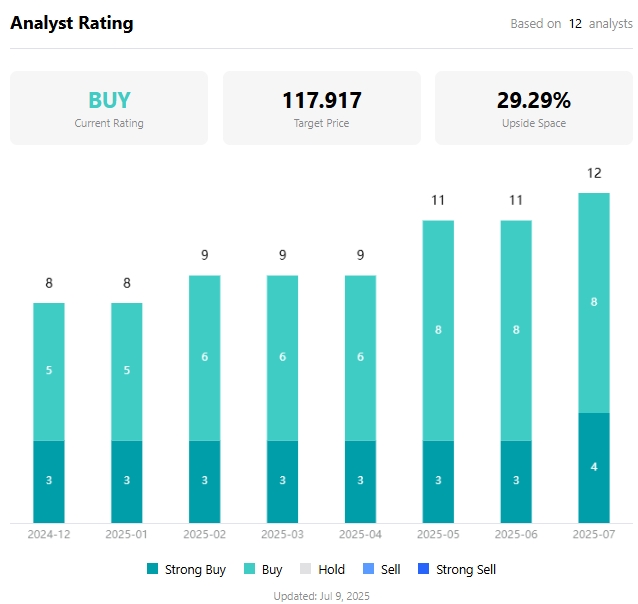

As of July 9, Wall Street analysts had set an average 12-month target price of $117.92 for Verona Pharma, implying about 30% upside potential from current levels.

Source:TradingKey