Billionaire Stanley Druckenmiller Still Isn't Buying Nvidia. But He Recently Picked Up Shares of This AI Stock That's Among the Cheapest of the Magnificent Seven.

Key Points

Druckenmiller is a former Nvidia shareholder -- he sold all of his shares in 2024.

At that time, he said he would consider returning to Nvidia at the right price.

- 10 stocks we like better than Alphabet ›

Stanley Druckenmiller, who oversees $4.4 billion at the Duquesne Family Office, owned Nvidia (NASDAQ: NVDA) stock, but sold all of his shares in 2024. At the time, he considered the AI giant richly valued, though he did express some regret about his move -- and said he would consider buying the stock again at a lower valuation.

Since that time, Nvidia's valuation has dropped considerably. It now trades for about 24x forward earnings estimates -- back in 2024, it traded for more than 48x estimates.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Still, Druckenmiller hasn't returned to Nvidia stock yet. Instead, showing a focus on value, the billionaire recently bought shares of the following player, one that's been among the cheapest of the Magnificent Seven tech stocks.

Image source: Getty Images.

Proven expertise

Investors keep a close eye on Druckenmiller's moves because he's proven his expertise over the long term. This top investor ran Duquesne Capital Management for three decades and delivered an average annual return of 30% without any years of losing money. After retiring, he went on to run the Duquesne Family Office -- as he files quarterly 13F filings with regulators, a requirement for all managers of more than $100 million, we continue to get frequent glimpses into this investing expert's strategy.

As mentioned, Druckenmiller benefited from part of Nvidia's growth story but sold the shares as they gained in valuation. Nvidia has been one of the most prominent AI companies since it's the designer of the world's most popular AI chips. Customers flock to them for their speed and efficiency, and that's resulted in explosive earnings growth for the AI giant. Nvidia's earnings reports show us that this demand and growth continue, and general forecasts for an AI market on track to reach into the trillions of dollars in a few years suggest Nvidia's strength may be long-lasting.

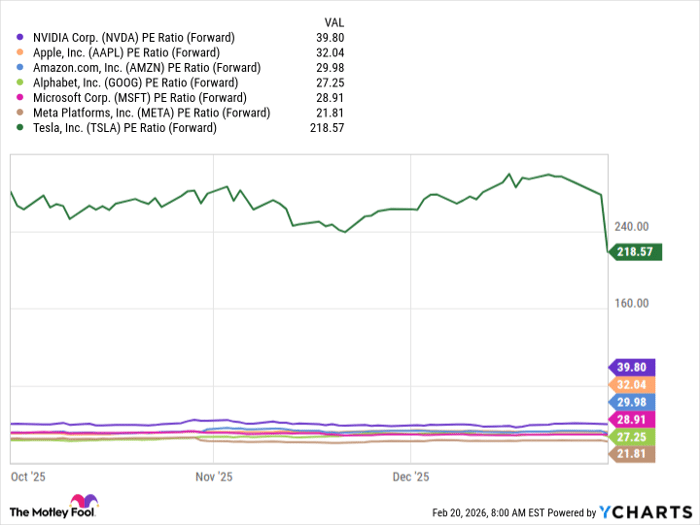

Still, Druckenmiller didn't purchase Nvidia stock in the fourth quarter of last year. It's important to remember that Nvidia shares weren't as cheap then as they are today. At that time, they traded for about 39x forward earnings estimates. Instead, he bought shares of Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), which at the time was the second-cheapest of the Magnificent Seven stocks.

NVDA PE Ratio (Forward) data by YCharts

Druckenmiller increases his holding

Druckenmiller already held Alphabet shares but increased his position by 276% and now owns 385,000 shares. This represents more than 2.6% of his portfolio.

Alphabet is also a key player in the AI revolution, and like Nvidia, already is generating revenue growth. The company offers AI products -- such as AI chips -- and services to customers through its Google Cloud business, and in the recent quarter, this unit saw revenue jump 48% to more than $17 billion. Google Cloud has been delivering solid growth quarter after quarter, driven by demand for AI infrastructure and solutions. And this is likely to continue as the AI boom unfolds.

We don't know the exact reason behind Druckenmiller's purchase of Alphabet, but it's fair to say that the move offered him a strong AI player at a bargain price.

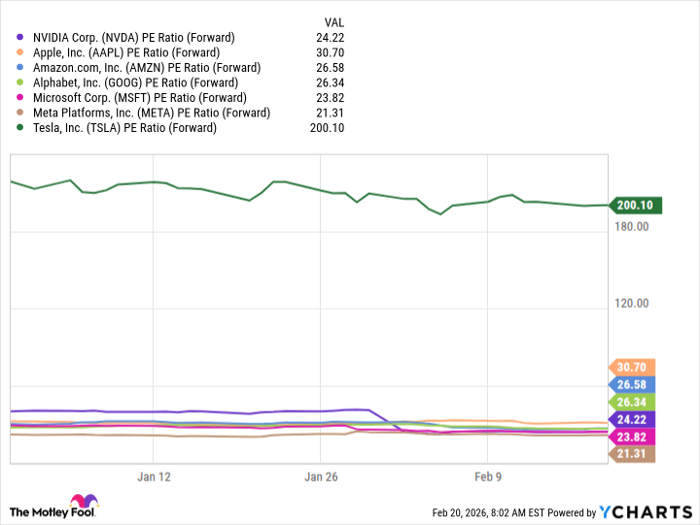

So, should you follow this famous investor and get in on Alphabet shares right now? The stock is about the same valuation levels today, but other Magnificent Seven stocks have become considerably cheaper. Today, for example, Nvidia is less expensive than Alphabet.

NVDA PE Ratio (Forward) data by YCharts

Your decision about which AI stocks to buy may depend on your risk tolerance. If you're a cautious investor, you might prefer buying shares of Alphabet or Amazon, for example, as they're less dependent on AI than a company like Nvidia. AI does come with some risk because, though it seems promising, we still don't know for sure to what extent it will be used several years down the road -- and which companies will benefit the most.

But, if you don't mind a bit of risk today, you might pick up a few shares of Nvidia at this dirt cheap price -- and keep an eye on Stanley Druckenmiller's moves in the coming quarters to see if he does the same.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $424,262!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,163,635!*

Now, it’s worth noting Stock Advisor’s total average return is 904% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 22, 2026.

Adria Cimino has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.