This Artificial Intelligence (AI) Stock Could Be the Steal of 2026

Key Points

The booming investment in AI infrastructure has led to a significant improvement in this company's growth rate.

The key data center-related services it provides explain why its revenue is poised to grow significantly over the next three years.

Buying this stock is a no-brainer due to its attractive valuation.

- 10 stocks we like better than Vertiv ›

Artificial intelligence (AI) stocks have been on sticky ground lately due to concerns about the massive spending on infrastructure and the potential disruptions this technology could bring for software companies.

However, it cannot be denied that the proliferation of AI has driven meaningful growth for many companies. Vertiv Holdings (NYSE: VRT), a company that provides thermal management, power management, server racks, and services and software for managing data centers, is one such name that's seeing a substantial acceleration in growth due to AI.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Let's look at the reasons why this company could be one of the best ways to play the AI boom in 2026 and beyond.

Image source: Getty Images.

AI infrastructure investments have supercharged Vertiv's growth

Vertiv is in the business of selling critical infrastructure that helps AI data centers function optimally. Not surprisingly, the massive investments in AI data centers have been a tailwind for the company.

Vertiv released its fourth-quarter 2025 results on Feb. 11. The company's annual revenue jumped by 27.5% from the prior year to $10.2 billion. Its adjusted earnings grew at a stronger pace of 47% to $4.20 per share. Importantly, Vertiv is poised for another year of terrific growth in 2026, driven by its robust backlog.

The company's orders in the trailing 12 months increased by an impressive 81%, primarily driven by demand for AI infrastructure. In simple terms, Vertiv received more orders than it fulfilled last year, as evidenced by its book-to-bill ratio of 2.9. As a result, the company was sitting on a revenue backlog worth $15 billion at the end of Q4, up by 109% from the year-ago period.

This huge backlog explains why Vertiv anticipates accelerating revenue growth to 32% in 2026, with the midpoint of its guidance at $13.5 billion. Additionally, the midpoint of its earnings growth forecast of $6.02 per share would be a 43% improvement from 2025. However, this guidance seems conservative.

That's because capital spending by the top four hyperscalers in the U.S. is estimated at $700 billion this year, a 78% increase over 2025. That's higher than the 66% jump in the capex of the top four hyperscalers last year. Moreover, AI-focused companies such as OpenAI and Anthropic will continue to spend more to build out their infrastructure, while neocloud providers such as CoreWeave and Nebius Group are also rapidly building out their data centers.

So, Vertiv's order book could rise substantially in 2026, potentially paving the way for stronger growth in the company's top and bottom lines.

Vertiv stock is still a terrific buy

Vertiv stock has shot up by more than 117% in the past year. Its latest earnings report gave the stock a tremendous boost. The stock is trading at just 9 times sales, which isn't all that expensive compared to the U.S. technology sector's average sales multiple of 8.4.

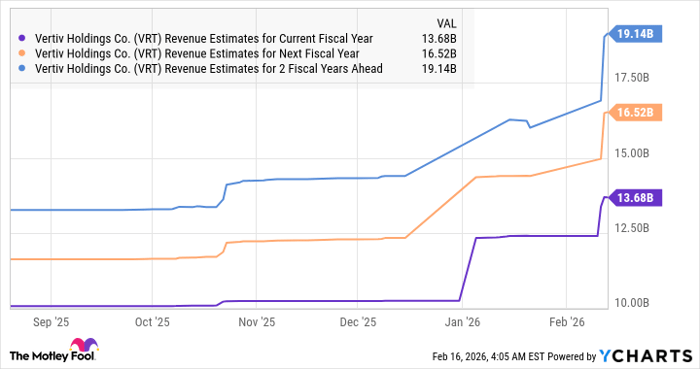

Don't be surprised if Vertiv trades at a premium valuation by the end of 2026, driven by accelerating growth. Analysts already expect it to deliver better-than-expected growth in 2026, followed by solid jumps in the next couple of years.

Data by YCharts.

All this makes Vertiv a top AI stock to buy right now, as it trades at a very attractive valuation that should pave the way for impressive upside in 2026 and beyond.

Should you buy stock in Vertiv right now?

Before you buy stock in Vertiv, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vertiv wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 18, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vertiv. The Motley Fool has a disclosure policy.