If You'd Invested $1,000 in Oklo 5 Years Ago, Here's How Much You'd Have Today

Key Points

Oklo hopes to build small nuclear reactors to produce clean, affordable energy.

The U.S. Department of Energy has selected the company for several projects under its Reactor Pilot Program.

- 10 stocks we like better than Oklo ›

For many years now, the foremost experts and the world's most innovative companies have been seeking alternative sources of power for multiple reasons. The effects of global warming are real and pose significant threats, and there are also concerns about whether power from traditional sources like fossil fuels can continue to meet future demand.

One alternative being explored is nuclear power. This concept has made Oklo (NYSE: OKLO) an exciting bet for investors. The company is attempting to build and deploy small modular reactors that can leverage nuclear technology to produce clean, affordable energy.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Through its Reactor Pilot Program (RPP), the U.S. Department of Energy has awarded Oklo three of its 11 RPP projects. The company has broken ground on one of its projects at the Idaho National Laboratory facility in Aurora. Oklo also hopes to have its Atomic Alchemy site, a research and development program intended to address supply chain shortages, begin operations in July of this year.

If you'd invested $1,000 in Oklo five years ago, here's how much you'd have today.

A big bet that has paid off for shareholders

Companies like Oklo are bets on new markets panning out and on first movers capturing significant market share immediately. However, Oklo is risky at this point because it is pre-revenue, and there are still many obstacles between now and commercialization. However, shareholders who bought in five years ago have done well.

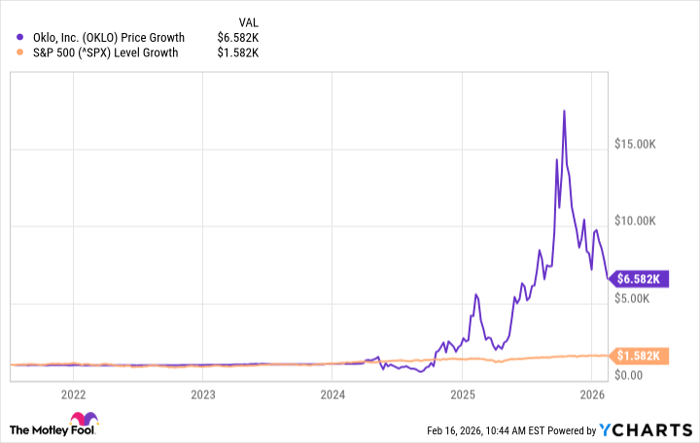

OKLO data by YCharts

As you can see in the chart above, while Oklo has undoubtedly been a volatile stock to own, a $1,000 bet five years ago would be worth over $6,500 today, a total return of 558%. This performance has widely outperformed the broader market, despite what's largely been a bull market in recent years.

Should you buy stock in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 18, 2026.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.